Aging, Frailty, and the Tipping Point for Long-Term Care

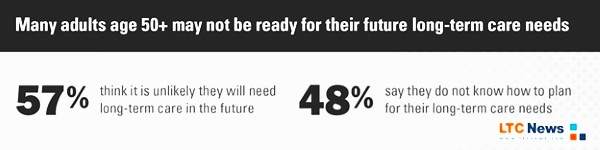

Interestingly enough, many people are unable to see themselves with declining health. According to a 2025 University of Michigan National Poll on Healthy Aging shows that many Americans over 50 are heading into older age unprepared, including lacking awareness of how their health may decline Yet, we all age and all experience our health, body, and mind decline, but usually not all at once.

For many people, it is a slow decline; you might notice stairs are harder to climb, your balance feels off, and simple illnesses take longer to bounce back from. You are not “suddenly old,” but something has clearly shifted.

Some people live with one or more chronic health problems or go through a major health event such as a heart attack. Modern medicine can often help you recover, but in many cases, you never get fully back to where you were before.

A new analysis of aging and frailty suggests that a shift in our health is real. Researchers modeling health data from tens of thousands of older adults found that the body hits a measurable tipping point in its ability to repair itself around age 75. After that, damage accumulates faster than the body can fix it, and the risk of disability and death rises quickly.

For many families, that tipping point is when everyday frailty turns into a real need for help with daily activities. It may begin with “standby assistance,” when someone stays close in case you lose your balance in the shower. Over time, it can progress to hands-on help with bathing, getting dressed, eating, or moving safely around the home.

All of this support, even simple standby assistance, is considered long-term care. And for many older adults, it is not a single diagnosis that triggers it. Often, aging and frailty alone are the cause.

There is no question that chronic illness, injuries, and dementia can lead to long-term care needs. But aging itself, and the frailty that often comes with it, can also be the reason you need extended care at some point in your life.

You can prepare for that possibility, yet the reality is clear: advances in medical science mean you will likely live longer, but that also means you will live long enough to face the challenges that come with growing older.

What Frailty Study Actually Found

The new work, led by researchers at Dalhousie University, used a “frailty index” built from more than 30 health deficits—things like difficulty walking, bathing, climbing stairs, chronic diseases, and past hospitalizations. They analyzed health trajectories of more than 47,000 adults in two major longitudinal studies: the U.S. Health and Retirement Study and the English Longitudinal Study of Aging.

Their key findings:

- Frailty accumulates over time. Small problems add up. As more deficits appear, people become more vulnerable to stressors such as infections, surgery, or a fall.

- The body’s “robustness” and “resilience” weaken with age. Robustness (resisting damage) and resilience (repairing damage) both fall steadily as people get older and frailer.

- There is a clear tipping point near age 75. The model shows that around age 75, damage and repair rates cross. After that, health deficits accumulate faster than the body can fix them, pushing people toward higher frailty and higher mortality risk.

In the authors’ words, “age 75 represents a tipping point in the aging process, after which robustness and resilience are insufficient to meet the demands of stressors.”

We infer that robustness and resilience mitigate environmental stressors only up to an age of 75, beyond which health deficits will increasingly accumulate, leading to death. — Kenneth Rockwood, MD, FRCPC, FRCP, Professor of Geriatric Medicine, Dalhousie University, Andrew D. Rutenberg, PhD, Professor of Physics, Dalhousie University, and Glen Pridham, MSc, Researcher and PhD Candidate (Physics), Dalhousie University.

Research reveals that aging isn't a steady process, as depicted here, but one with accelerations and tipping points. (Shinmura, The Keio Journal of Medicine, 2016)

Death is still the final outcome, but before death is long-term care, which can last several months to many, many years.

That does not mean everyone becomes frail overnight at 75, or that nothing can be done. It does mean that once you cross that age, your margin for error shrinks. A bad fall, a bout of pneumonia, or poorly controlled diabetes can push you into permanent disability much more easily than it did at 65.

From a long-term care perspective, the tipping point is when daily frailty, not a single dramatic event, begins to drive the need for help with ADLs.

Frailty And Disability: Who Ends Up Needing Long-Term Care?

Separate Research from the U.S. Department of Health and Human Services (HHS) shows how often this frailty turns into real-world long-term care needs.

Using national modeling, HHS estimates that over half (56%) of Americans turning 65 will develop a disability serious enough to require long-term services and supports (LTSS), which is help with daily living activities (ADLs) like bathing, dressing, or managing medications, etc.

The risk of needing extended climbs sharply increases with age. Large cohort studies also show that frailty itself—measured by a frailty index or similar scales—is a strong predictor of:

- Nursing home admission and institutionalization. Older adults with higher frailty scores are more likely to enter long-term care facilities, even after adjusting for specific diseases.

- Higher mortality. Frailty independently predicts death, beyond age alone.

- Cognitive decline and dementia. Frailty is associated with incident dementia in older adults. Some people with dementia can perform ADLs but require supervision.

In other words, it is often not one diagnosis that leads to long-term care. It is the overall frailty state, like slower walking, poor balance, muscle loss, multiple chronic conditions, cognitive slips, and difficulty with daily tasks, that pushes people over the edge into needing ongoing help.

How Frailty Shows Up in Daily Life

You might see that frailty emerging in yourself or a parent as:

- Leaving the house less because walking feels tiring or unsteady.

- Needing more time to recover from colds, surgery, or even a minor fall.

- Struggling with stairs, bathing, or getting in and out of a chair.

- Confusion around medications, bills, or new technology.

These are exactly the kinds of deficits that go into a frailty index, and they are the same early warning signs that someone may soon need home caregivers, assisted living, or nursing home care.

Frailty, Long-Term Care, And the Cost to Families

The HHS analysis of long-term services and supports found that an American turning 65 today will incur an average of about $120,900 (in today’s dollars) in future LTSS costs, with roughly 37 percent paid out of pocket by individuals and families. While in-home care is generally less, the actual cost of long-term care depends on the services you require, the setting, and where you live.

Since many people never plan for long-term care, most care ends up being provided by unpaid, untrained family members, often for years at a time.

A 2025 AARP/National Alliance for Caregiving report estimates 63 million Americans—nearly 1 in 4 adults—served as family caregivers in the past year, up 20 million since 2015.

Family caregiving often ramps up as frailty grows. Adult children start helping with transportation, groceries, and medications; spouses step in to try to manage bathing and toileting; siblings rotate overnight stays to prevent falls.

A large Japanese study of their national Long-Term Care Insurance program (a public system, distinct from U.S. private LTC Insurance) found that higher frailty scores were linked to higher long-term care costs and more intensive service use, reinforcing the connection between day-to-day frailty and expensive long-term care needs.

For U.S. families, that combination of high odds of needing extended care, fast-rising frailty after 75, and heavy reliance on unpaid help creates a difficult question: What happens if your health crosses the tipping point without a plan for the growing costs and burdens of long-term care?

Frailty is Not Just “Getting Old” - Why It Matters for Independence

Geriatricians often describe frailty as a state of “reduced physiologic reserve.” You might feel mostly fine on a normal day, but you no longer have the extra strength, balance, or organ capacity to bounce back quickly from stress.

Frailty matters because it:

- Turns short-term events into long-term disability. A hip fracture at 55 is often a months-long setback. At 85 with frailty, it can mean permanent dependence on a walker, a toilet aid, or facility care.

- Magnifies chronic conditions. Diabetes, heart failure, COPD, and arthritis are more likely to lead to falls, hospitalizations, and functional decline in people who are frail.

- Raises the stakes for every decision. Medication side effects, skipped vaccines, unsafe home environment, and missed rehab appointments all carry a higher risk once you are near or past the tipping point.

Since the research shows that once individuals pass the tipping point, everyday stressors “drive them towards a high frailty index and ultimately death” if those stressors are not reduced.

That is a sobering sentence. It is also a call to act earlier, and most people acquire Long-Term Care Insurance between the ages of 47 and 67.

You cannot change your age. You can change how vulnerable you are when you reach that tipping point. You can, however, be proactive now and plan for the consequences of aging.

Research on frailty and aging repeatedly points to a few practical steps:

- Build and maintain strength. Resistance and balance training reduce falls, improve walking speed, and help preserve independence. Even light weights or chair exercises help.

- Treat chronic conditions aggressively but safely. Good control of blood pressure, diabetes, heart disease, and lung disease reduces the risk that a minor episode turns into a major decline.

- Protect your brain. Managing hearing and vision, staying socially connected, and treating depression are all linked to lower dementia risk and better day-to-day function.

- Audit your home for safety. Grab bars, better lighting, railings, and removing trip hazards lower the odds that one fall will push you past your tipping point.

- Plan for help before you need it. Adding Long-Term Care Insurance to your retirement plan will give you guaranteed tax-free benefits to pay for quality extended care services, even at home. Older adults should understand who could step in and help, which home care agencies or facilities you would consider, and how you would pay for it, which is part of “frailty preparedness.”

The LTC News Caregiver Directory allows you to search for caregivers and facilities based on zip code.

Frailty is where the gap between what your body can do and what life demands gets dangerously narrow. The more you widen that gap with strength, support, and planning, the better your odds of staying independent.

Using The LTC News Cost of Care Calculator

To see how expensive long-term care services are where you or your parents live, you can explore the LTC News Cost of Care Calculator, which compiles the most comprehensive current data on:

- Home care hourly rates by state and metro area.

- Costs of adult day care centers.

- Assisted living and memory care monthly costs.

- Nursing home daily rates.

Seeing those numbers in black and white can help you decide whether you will lean on:

- Personal savings and retirement income for older adults who have limited options.

- Long-Term Care Insurance (traditional or hybrid policies).

- Home equity strategies.

- Selling life insurance to pay for extended care.

- Medicaid safety-net planning is available if you or a loved one has very limited income and assets.

Those tools do not remove the emotional weight of long-term care decisions. However, being prepared will reduce the stress and anxiety on those you love.

So, it is worth asking yourself now: When your health, or your parent’s health, hits the frailty tipping point five years earlier than you expect, would your family be ready?

If you start those conversations while you or your loved one still feels relatively robust, you are not being pessimistic. Consider adding LTC Insurance when you are younger and healthier. Be sure to speak with a qualified specialist to get accurate Long-Term Care Insurance quotes. You are giving your future self—and your family—more choices when frailty eventually arrives.