The Sandwich Generation Survival Guide: Planning for Your Future While Everyone Needs You Now

Table of Contents

- What It Means to Be in the Sandwich Generation

- Why the Sandwich Generation Faces Unique Financial Risk

- Seven Financial Survival Strategies for the Sandwich Generation

- Hidden Health Toll of Carrying Everyone Else

- How Long-Term Care Insurance Can Ease the Burden Right Now

- Get Help Managing the LTC Insurance Claim

- Let Experience Shape Your Own Retirement Planning

- Time May Be Your Most Valuable Resource

- Gratitude Exists Even in the Middle

You wake up already behind, before the day has even had a chance to begin. Your phone lights up with reminders and text messages. A parent needs help sorting medications, managing refills, or getting to a doctor's appointment they can no longer drive to on their own.

Your oldest child needs help with college tuition. Another needs a ride to practice, and the other needs help with homework. You juggle schedules, permission slips, and school calendars while trying not to fall behind at work.

Every decision feels urgent because someone is always waiting on you, and there is rarely space to ask what you need or how long you can keep this pace. Then your spouse is looking at you, wondering when you will have time to go out for dinner.

You move from one responsibility to the next without pausing, carrying the quiet weight of being the person everyone depends on. Somewhere in the middle of all that giving, your own retirement account sits untouched, your long-term plans postponed yet again.

The stress never fully shuts off. It hums in the background while you work, while you drive, and even when you try to sleep, because you know that if you stop moving, something important may fall apart.

If that sounds familiar, you are part of the sandwich generation. You are caring for older parents while still supporting children, sometimes even adult children, all at the same time. How can you handle it all?

What It Means to Be in the Sandwich Generation

The sandwich generation includes adults, typically in their 40s, 50s, and early 60s, who provide financial or hands-on support to aging parents while also supporting children. According to AARP, millions of Americans provide unpaid care to older relatives, often while working and managing households of their own.

That responsibility rarely fits neatly into a calendar or budget. It shows up as missed workdays, stalled careers, emotional exhaustion, declining health, and constant concern about what happens next.

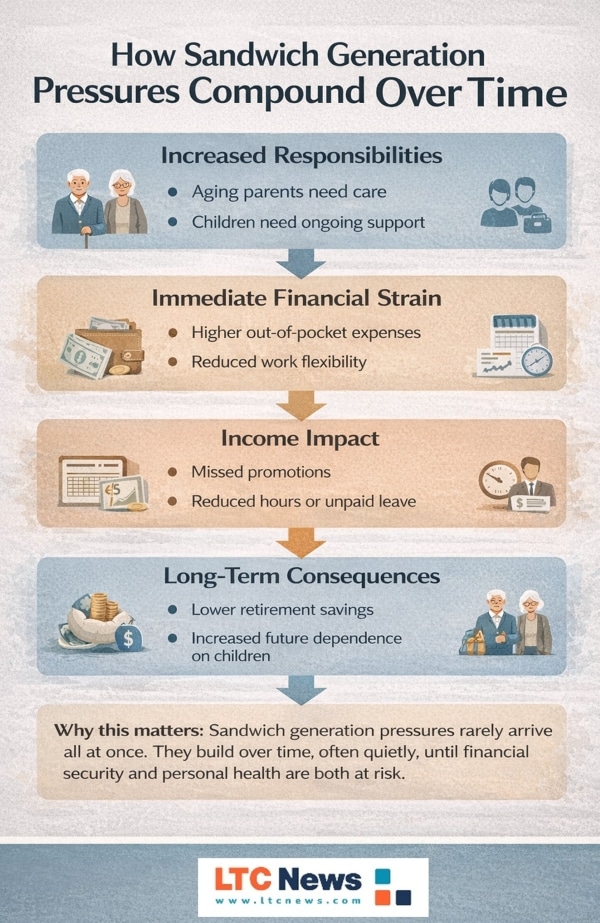

Why the Sandwich Generation Faces Unique Financial Risk

According to a November 2025 survey of American adults by Finance of America, approximately one-third of people aged 40 to 60 are considered in the sandwich generation.

Of those, 69% feel “financially exhausted” in addition to enduring the physical and emotional pressures of family caregiving. The situation drains finances through a perfect storm of factors.

Being caught in the middle creates pressure from both directions at once. Expenses rise. Income growth often slows. Savings suffer.

Rising Costs for Parents

- Medical bills not fully covered by Medicare

- In-home care or adult day services

- Assisted living or memory care expenses

- Home modifications when a parent moves in

Most long-term care costs are not covered by Medicare or traditional health insurance. Families often pay out of pocket until savings are strained.

Continued or Renewed Support for Children

Support for children rarely fits a neat timeline. You are paying for school tuition, fees, supplies, and extracurricular activities that seem to multiply every year. You are managing schedules, transportation, and after-school care while trying to stay productive at work.

In some families, there is also a child just starting out in adulthood who may need temporary help with rent, transportation, basic living expenses, or even childcare for your grandchild as they find their footing.

That ongoing support often competes directly with your career and your relationship with your spouse or partner. Late meetings are skipped. Travel is limited. Evenings meant for rest or connection turn into logistics and planning. All of this adds pressure at home and at work simultaneously.

- Turning down promotions that require travel or longer hours

- Shifting from full-time to part-time work

- Taking unpaid caregiving leave

Lost income today also affects future Social Security benefits and retirement savings.

- Reduced or paused 401(k) contributions

- Fewer emergency reserves

- Delayed long-term planning

When saving stops, time works against you.

Seven Financial Survival Strategies for the Sandwich Generation

The situation of juggling the role of caregiver and your family and work responsibilities can have a serious impact on you and those you love, but it is manageable with deliberate steps.

1. Build a Unified Family Budget

A standard household budget is no longer enough. You need to see the full picture of what flows out to parents and children.

Track:

- Direct financial support

- Care-related expenses

- Transportation and time costs

Clarity is the first form of control.

2. Have Honest Money Conversations

Silence creates stress. Clear conversations reduce it.

- Talk with parents about finances, benefits, and care preferences.

- Stay aligned with your spouse or partner.

- Set realistic expectations with adult children.

These discussions are uncomfortable but avoiding them often costs more.

3. Put Your Own Financial Stability First

Helping everyone else while neglecting yourself only pushes the burden onto your children later.

Experts recommend saving 15% of your annual pre-tax income for retirement, although this may vary depending on your circumstances. Even modest, consistent contributions matter. Protecting your future is one of the most responsible things you can do for your family.

4. Never Leave Employer-Matching Money on the Table

If your employer offers a 401(k) match, contribute enough to receive it. That match is essentially guaranteed compensation.

Skipping it is not a short-term fix. It is a permanent loss.

5. Use Dependent Care Flexible Spending Accounts

A Dependent Care Flexible Spending Account allows you to pay qualifying care expenses with pre-tax dollars.

Eligible expenses may include:

- Child care

- Adult day services for a dependent parent

- In-home aides for qualifying dependents

This strategy can reduce taxes and free up time.

6. Claim Available Tax Credits and Deductions

Many caregivers qualify for:

- The Credit for Other Dependents

- Medical expense deductions if they pay a parent's medical bills

Many people with an aging dependent parent will qualify for the credit for other dependents, which can reduce your tax bill by up to $500 per parent, but you won’t get it unless you claim it. Filing a tax return is often required to claim these benefits, even when income is limited.

7. Get Professional Guidance Early

A certified financial planner can help balance competing priorities with objectivity. A mental health counselor or therapist can help you deal with how you emotionally handle all these issues. That guidance often prevents costly mistakes and relieves stress.

Hidden Health Toll of Carrying Everyone Else

Juggling through the financial pressure, caregiving, parenting, marriage, and a career does not just strain your calendar. It strains your body and mind. Those trying to give time to parents and children simultaneously are almost twice as likely to experience severe psychological distress, potentially leading to time off work, which in turn may lead to lower income.

Many people in the sandwich generation live in a constant state of alert. You are always anticipating the next need. The next call. The next expense. Even when nothing is actively wrong, your nervous system rarely gets a break.

Over time, that chronic stress can show up as exhaustion, disrupted sleep, headaches, weight changes, irritability, anxiety, or a feeling that you are always running on empty.

Share your thoughts and experiences about aging, caregiving, health, retirement, and long-term care with LTC News —Contact LTC News.

Work performance can suffer, not because you care less, but because your attention is split in too many directions. Relationships feel the strain as well.

Conversations with your spouse or partner become transactional, focused on logistics rather than connection. There is little time left for exercise, preventive care, or even a quiet moment to reset.

Many caregivers minimize these effects and avoid regular check-ups because they feel responsible for holding everything together. That instinct is understandable. It is also dangerous. Ignoring your own health increases the risk that you will eventually be forced to step away from work or caregiving altogether, often at the worst possible time.

Protecting your health is not a luxury. It is part of your family's stability plan. Setting boundaries, accepting help, using available benefits, and occasionally paying for support are not signs of weakness. They are signs that you understand the long game.

Remember: If you burn out, everyone feels it. If you stay well, everyone benefits.

How Long-Term Care Insurance Can Ease the Burden Right Now

If an older family member already owns Long-Term Care Insurance, using it early can dramatically reduce pressure on the entire family. Many people delay filing a claim because they assume benefits are only for nursing homes or full-time care. That assumption is often wrong.

Know the Benefit Triggers and Use Them

Most Long-Term Care Insurance policies begin paying benefits when the insured person meets benefit triggers, commonly:

- Needing help with two or more activities of daily living, such as bathing, dressing, or eating

- Having cognitive impairment, including dementia

Once triggers are met, benefits may be available even if care is provided at home and only during part of the day. Waiting too long often means paying out of pocket for care the policy was designed to cover.

Use Benefits for In-Home and Daytime Care

Long-Term Care Insurance benefits can often pay for:

- Professional caregivers during working hours

- Adult day care centers

- Help with daily living activities or medication reminders

- Supervision for safety while family members work

Even a few hours of professional help can protect your health, your job, and your family stability. This type of help is called "respite care," providing you with relief. Using benefits from an LTC policy is not giving up. It is using a tool already in place.

Get Help Managing the LTC Insurance Claim

Long-Term Care Insurance claims can sometimes be complex. Getting professional help matters.

A care coordinator or experienced advisor can:

- Review the policy language

- Confirm eligibility

- Coordinate care providers

- Ensure benefits are used correctly and fully

Many families leave benefits unused simply because they do not understand the policy.

Get free professional help filing an LTC Insurance claim. LTC News partners with Amada Senior Care to provide free claim support with no cost or obligation. Their trained experts can walk you through the entire process and help you access benefits quickly and correctly — File a Long-Term Care Insurance Claim.

Let Experience Shape Your Own Retirement Planning

Watching a parent use Long-Term Care Insurance often changes the experience for the entire family. When benefits are available, care can begin earlier, stress eases, and decisions feel less desperate.

Without an LTC policy, the burden shifts quickly to you, smack in the middle of the sandwich generation. Costs rise, time slips away, and the emotional and financial pressure falls on everyone at once.

As part of your own retirement strategy, consider whether Long-Term Care Insurance belongs in your plan.

Coverage can help:

- Protect retirement savings

- Preserve independence and choice

- Prevent your children from becoming full-time caregivers

Long-term care planning is not pessimistic. It is responsible. You acquire an LTC policy typically before retirement. Premiums are much lower when you add an LTC policy in your 40s or 50s. Be sure to seek help from a qualified LTC Insurance specialist to get quotes from all the top companies offering long-term care solutions.

Time May Be Your Most Valuable Resource

Financial strain is only part of the sandwich generation story. Caregiving also consumes time and emotional energy.

Research summarized by the National Alliance for Caregiving shows that caregivers often experience higher stress levels that can affect work and health.

Sometimes the smartest decision is to trade money for time.

Whether your older family member has an LTC policy or not, professional caregivers and adult day care will be worth the cost to reduce the stress and burden on you, the primary unpaid family caregiver.

- Use the LTC News Caregiver Directory to search for qualified long-term care providers near you.

Use the LTC News Cost of Care Calculator to see the costs of long-term care services where you live.

Paying for quality extended care to help you as a caregiver will protect your health and give you the time you need to live your life.

Gratitude Exists Even in the Middle

Despite the pressure, many people in the sandwich generation report strong family bonds and a sense of purpose. Caring across generations can be exhausting and deeply meaningful at the same time.

When stress builds, remembering why you are doing this work matters.

Caring for parents and children is an act of love. Sacrificing your future is not required. Planning today helps ensure that when your needs arise, your family will not face crisis decisions.

The sandwich generation carries a heavy load. You do not have to carry it alone.