Michigan’s Graying Economy: How Long-Term Care Insurance Has Paid Billions to Ease the State's Aging Crisis

You might already be feeling it in your own family, a parent who’s slowing down, a spouse recovering from illness, a loved one who suddenly needs help with everyday tasks. If you are a Michigander, you are living in a state where aging is not a distant concern. It’s becoming a personal reality for millions of families just like yours.

If you’ve ever worried about how your parents will age, or what your own retirement will look like, you’re not alone. In Michigan, those questions are becoming urgent. Aging is reshaping our families, our finances, and our future — not someday, but right now.

The reality of an aging crisis in the Wolverine State means this conversation is no longer theoretical — it is here. Michigan is aging faster than the national average, a demographic shift that is already constraining the state's economic growth and placing profound strains on families.

Michigan is the 12th-oldest state in the United States, with an average age of 40.1 years. About a quarter of the state's population is 60 or older.

As the need for long-term care services grows, Long-Term Care Insurance has played a vital role, paying billions of dollars to help people afford quality care and ease the tremendous burdens on their loved ones.

The Looming Demographic and Economic Storm

Michigan’s aging crisis is a direct result of low birth rates and an aging population, trends that are fueling a steepening natural decrease (more deaths than births) across many regions.

A recent statewide demographic report highlights that Michigan continues to shift “from a young, higher-fertility population to an older, low-fertility population.”

As of 2024, approximately 19.6 percent of Michigan’s residents are age 65 or older, well above the national average of 18.0%, roughly 1 in 5 Michiganders. Some counties are seeing far higher concentrations of seniors.

At the same time, the under-18 population is shrinking, leading to a situation in which, by 2030, more households will be headed by older adults than by families with children.

This demographic shift has immediate economic consequences. As the labor force shrinks, with fewer young workers replacing retiring baby boomers, experts warn that Michigan may face a shortage of skilled and unskilled labor, making it harder to sustain economic growth and fill critical jobs.

At the same time, demand for long-term care services, both at-home and institutional, is set to surge, creating a significant burden on families, communities, and public systems if left unchecked and unprepared.

Growing Need for Extended Care Services — and Rising Costs

The personal risk of needing long-term care at some point in later life is high. Nationally, the Department of Health and Human Services reports that roughly 56% of people who survive to age 65 will need some form of long-term care services during their lifetime (home care, assisted living, or nursing home care).

For Michigan families, the financial pressure of accessing care is staggering. Recent data from LTC News shows the financial impact of long-term care in the state.

Most long-term care is provided at home, either by professional and semi-skilled caregivers or unskilled family members.

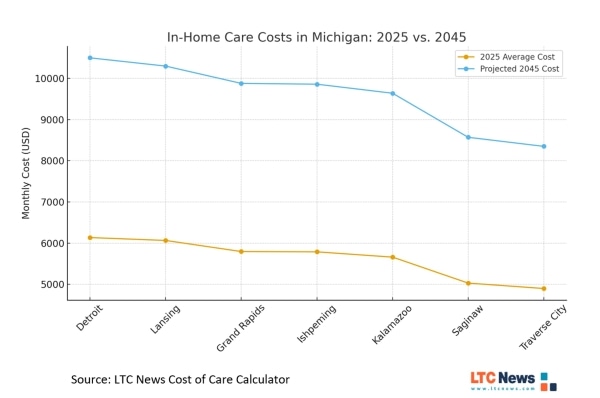

The average cost in Michigan for semi-skilled services, such as a home health aide for regular support with daily living activities or light supervision due to dementia, is $5728 a month. However, the cost of in-home care varies depending on where you live in Michigan. Plus, these costs are projected to increase significantly in the next 20 years.

The base cost of assisted living facilities statewide averages around $5,030 per month, with surcharges that can add another $2,000 per month.

Memory care and nursing homes will cost much more, according to the LTC News data. You can search for the current and projected cost of long-term care services by zip code in Michigan or anywhere in the United States here: Cost of Long-Term Care Services Calculator | LTC News.

These costs are more than many families expect — and far beyond what standard health insurance or Medicare will cover. As widely noted, Medicare does not pay for long-term custodial care, such as nursing home or in-home help, unless it’s short-term and medically necessary.

Leaving families to pay out-of-pocket often means depleting life savings, selling assets, or — for those without resources — relying on public assistance programs such as Medicaid, which requires seniors to “spend down” their assets to qualify.

The Crushing Burden on Family Caregivers

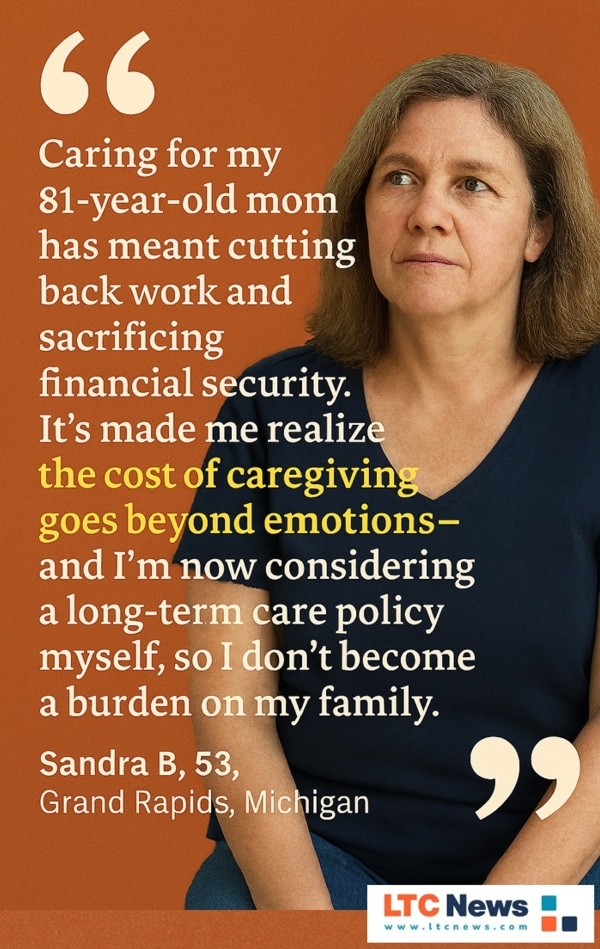

Beyond financial costs, there is a deeply human side to the aging crisis: the burden on family caregivers. Unpaid relatives, often adult children, step in to provide care, sometimes at significant personal sacrifice.

In Michigan, more than 1.5 million adults provide unpaid care to a family member or friend, supporting loved ones with chronic illness, disability, or age-related needs. That represents about one in five adults across the state, according to statewide data from both AARP Michigan (2025) and the Michigan Behavioral Risk Factor Surveillance System, published by the Michigan Department of Health and Human Services.

These individuals often juggle caregiving responsibilities with full-time (or part-time) jobs, raising children, or caring for other adults in the family.

The cost to caregivers is not just emotional, as their financial well-being, career prospects, and retirement security are at stake. Many caregivers find themselves reducing work hours, leaving the workforce entirely, or trading career advancement for caregiving duties.

Share your thoughts and experiences about aging, caregiving, health, retirement, and long-term care with LTC News —Contact LTC News.

The out-of-pocket costs for day-to-day care essentials like home modifications, medical supplies, respite care, etc., can easily run thousands of dollars per year. For many, this drains savings and pushes families to the brink. Emotional stress, burnout, and health impacts on caregivers are common.

In short: without a backup plan, caregiving becomes a balancing act fraught with risk — for both the senior and the caregiver. Long-Term Care Insurance alleviates that problem and is one of the reasons why so many people are pleased with how their LTC policy worked when they needed extended care.

LTC Insurance: Billions Paid, Assets Protected

Fortunately, a proven solution exists to help Michiganders navigate the costs of long-term care and alleviate the strain on families: Long-Term Care Insurance.

According to America’s Health Insurance Plans (AHIP)’s Long-Term Care Insurance Coverage: State-to-State 2025 report, LTC Insurance has provided a massive financial safety net for Michigan policyholders and their families:

- 2024 Benefits Paid: $303,555,800 — a six-statistic figure showing that in a single year, nearly a third of a billion dollars went to cover the extended care needs for Michiganders.

- Total Historical Benefits: Since LTC Insurance was first offered in the state, a cumulative $3,596,175,650 in benefits has been paid to Michigan policyholders and their families.

These tax-free funds directly help protect the savings and assets of policyholders, enabling them to choose where and how they receive care: whether at home with a professional aide, in assisted living, or in a nursing facility.

By covering the high costs of care, LTC Insurance allows family members to remain supportive loved ones rather than forced into the role of unpaid primary caregivers — freeing them to maintain their careers, their own finances, and quality of life.

Why This Matters for Michigan’s Future — and What You Should Do

The data is clear: Michigan faces an escalating need for long-term care services, and the cost of waiting to plan is too high for families to bear. LTC Insurance has a long-standing track record in the state of delivering on its promise: providing the financial resources necessary to safeguard assets and access the type of quality care policyholders prefer.

If you are a Michigander age 45 or older (or even younger), the time to plan is now. Ask yourself: have you reviewed how future long-term care costs will impact your family and finances in the decades ahead?

What you can — and should — do now

- Review Costs: Use the LTC News “Cost of Care Calculator” to estimate the real cost of nursing home care, assisted living, or in-home care in your region.

- Explore Options: Learn about different types of LTC Insurance policies — traditional, hybrid (life insurance + LTC), and partnership-qualified plans. Understand what they cover, how benefits are triggered, and what premiums you’ll pay - LTC News Long-Term Care Insurance Education Center.

- Compare Insurance Companies: Review and compare the major insurance companies that offer long-term care solutions - Compare LTC Insurance Providers.

- Have the Conversation: Talk with family members about your wishes for care; documenting preferences — e.g., “I’d rather receive care in-home if possible” — can guide decisions in a crisis.

- Plan Ahead: The earlier you buy LTC Insurance, the more affordable premiums tend to be, and the better chance you have of locking in coverage before health issues arise.

Final Word: LTC Insurance is Not Just Insurance — It’s Peace of Mind

Michigan’s aging population, shrinking workforce, and rising long-term care costs together form a demographic and economic storm that will impact millions of families. Without planning, many seniors and their families may struggle to access quality care or protect the assets they worked so hard to accumulate.

But the experience of nearly four decades of LTC Insurance in Michigan shows that it does what it promises: pay benefits when needed, preserve financial dignity, and give people the choice about how and where they receive care.

If you haven’t yet considered LTC Insurance — or if you bought a policy decades ago but never revisited your coverage — now is the time. The aging crisis in Michigan is not just coming. It’s already here.