IRS Boosts 2026 LTC Insurance Tax Deductions — Business and HSA Benefits Add More Ways to Save

Table of Contents

- 2026 Deduction Limits: A Bigger Break on LTC Insurance Premiums

- Why Planning Early Matters

- Expanded Business Deductions for LTC Insurance

- Hybrid Policies and Tax Deductions: What You Need to Know

- HSA Rules for 2026: More Room to Plan

- Using HSA Funds for LTC Premiums

- Coordinating Deductions: How to Maximize Your Advantage

- Why This Matters for Your Family

- Trusted Planning Tools

- Take the Next Step

You probably don’t like to picture yourself needing care as you age, but most of us understand that more than half of Americans over 65 eventually do. When that day comes, the costs can be staggering, and the impact often goes beyond your wallet. Long-term care needs can change family dynamics, drain retirement savings, and place enormous pressure on loved ones.

That’s why many people purchase Long-Term Care Insurance while they’re still working or shortly before retirement. Premiums are lower when you’re younger and in good health. More importantly, getting coverage sooner rather than later helps make sure that when extended care is needed, you can rely on professional help so your loved ones don’t have to give up their own lives to take care of you.

Now, thanks to IRS adjustments for 2026, paying for that coverage is even more tax-efficient. New federal limits raise how much of your LTC Insurance premium may be deducted, and updated rules for business owners and Health Savings Accounts (HSAs) offer powerful ways to lower your tax burden while protecting you from the future costs and burdens of aging.

2026 Deduction Limits: A Bigger Break on LTC Insurance Premiums

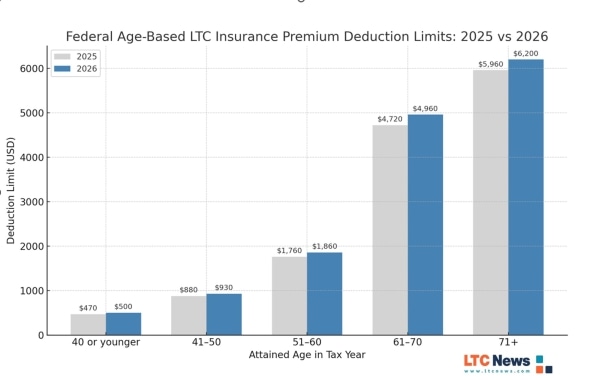

The IRS increased the 2026 age-based deduction amounts for tax-qualified LTC Insurance premiums by about 3%, reflecting inflation.

The maximum amount you can include as a medical expense depends on your age at the end of the tax year: $500 for those 40 or younger, $930 for ages 41–50, $1,860 for ages 51–60, $4,960 for ages 61–70, and $6,200 for age 71 and older. These age-based limits apply per person and can be used to reduce taxable income through itemized deductions, business deductions, or HSA distributions, making LTC Insurance more tax-efficient as you age.

Per diem benefit cap: The maximum tax-free daily amount from an indemnity-style LTC policy is now $430 per day in 2026.

These figures apply to tax-qualified policies under IRC § 7702B, which make up most traditional LTC Insurance plans.

Why Planning Early Matters

- Premiums are lower when you apply while you are younger.

- Insurability is stronger while you’re younger and healthier.

- Tax advantages grow as you age, allowing more of the premium to be deducted.

- Families avoid crisis care — you reduce the burden on loved ones to provide or coordinate care.

- You keep control of how and where you receive care, whether at home or in a facility.

Many families only face long-term care when a health or aging crisis hits — when it’s too late to buy coverage. Planning earlier gives you more choices, better protection, and greater financial leverage.

Expanded Business Deductions for LTC Insurance

If you’re self-employed or own a business, 2026 offers even more opportunities to deduct premiums.

Self-Employed Individuals

- You can deduct up to the IRS age-based limit (or the actual premium, whichever is lower) as an “above the line” self-employed health insurance deduction on Form 1040.

- This deduction is not subject to the 7.5% of AGI threshold for medical expenses on Schedule A.

- You may also deduct premiums for your spouse, dependents, and children under 27 if they’re covered.

Corporations and Employer Plans

- C corporations can treat LTC Insurance premiums for employees, spouses, or dependents as a tax-deductible business expense under IRC § 162.

- Premiums are typically excluded from the employee’s income, making it a tax-free benefit.

- Employers cannot offer LTC Insurance through a cafeteria plan, but they can pay the premiums directly as a benefit.

- For owner-employees, proper structuring ensures the benefit is treated as a legitimate business expense rather than disguised compensation. This can be especially powerful for small-business owners planning for retirement.

Owners of a C corporation can take advantage of the 100% deduction to pay the premium as a single premium or over a 10-year period. With proper timing, this allows the individual to have a fully paid LTC policy without ongoing premiums in retirement.

Experts say the tax code gives business owners one of the smartest and most flexible ways to pay for long-term care coverage while keeping more of their money working for them.

One unique advantage of Long-Term Care Insurance for business owners is the ability to legally select who’s covered. Unlike group health insurance, you don’t have to offer LTC Insurance to every employee. You can choose to cover just yourself, your spouse, or a few key people in the business. This flexibility allows owners to take full advantage of the significant tax benefits available without the cost or administrative burden of a broad employee plan.

Hybrid Policies and Tax Deductions: What You Need to Know

Many people today choose hybrid Long-Term Care policies, which combine a life insurance policy or annuity with a long-term care benefit. These policies can offer more flexibility and guarantee that the money you put in will be used one way or another — either for long-term care or as a death benefit — but often come at a higher cost.

However, IRS tax rules are different for hybrid policies compared with traditional Long-Term Care Insurance. Only the portion of the premium that specifically pays for qualified long-term care benefits (under IRC § 7702B) may be treated as a tax-deductible medical expense. The life insurance or annuity portion of the premium is not deductible.

This means:

- You can’t deduct the entire hybrid premium — just the long-term care component if it’s clearly identified by the insurer.

- The deductible amount is still subject to the IRS age-based limits listed above.

- If you pay through a business or an HSA, the same tax rules apply — you can only use tax-preferred dollars for the LTC portion.

Some hybrid policies are structured to make this allocation clear, while others are not. It’s important to confirm with your Long-Term Care Insurance specialist how much of your premium qualifies.

For some business owners or individuals with HSAs, pairing hybrid coverage with smart tax planning can still offer meaningful tax advantages — but only if you understand which part of your premium qualifies.

A knowledgeable Long-Term Care Insurance specialist or tax professional can help make sure you get the full benefit you’re entitled to.

HSA Rules for 2026: More Room to Plan

The IRS also raised Health Savings Account (HSA) contribution limits for 2026 (Rev. Proc. 2025-19), making HSAs an even stronger tool for LTC planning.

In addition to the regular HSA contribution limits of $4,400 for individuals and $8,750 for families in 2026, there’s also a catch-up contribution for people age 55 and older. You can contribute an extra $1,000 each year, allowing you to build your HSA balance more quickly as you approach retirement.

Many people who buy Long-Term Care Insurance in their 40s or 50s use this strategy intentionally. By maxing out their HSA contributions, they’re setting aside tax-free money they can later use to help pay for LTC premiums or other qualified care expenses. Over time, this creates a powerful, tax-advantaged way to ease the financial impact of care costs later in life.

To qualify, you must be covered by a High Deductible Health Plan (HDHP).

In 2026:

- Minimum deductible: $1,700 (self-only) or $3,400 (family)

- Maximum out-of-pocket (excluding premiums): $8,500 (self-only) or $17,000 (family)

Using HSA Funds for LTC Premiums

- HSA distributions can be used tax-free to pay for qualified LTC Insurance premiums, up to the IRS age-based limits.

- You can’t deduct the same premium twice (no “double-dipping”).

- After age 65, non-qualified withdrawals are taxed as income but not penalized.

- Contributions are deductible even if you don’t itemize.

This combination — deductible contributions and tax-free qualified distributions — can make HSAs one of the most tax-efficient ways to pay for LTC Insurance coverage.

Coordinating Deductions: How to Maximize Your Advantage

Here’s how individuals and business owners can combine strategies:

- Max out your HSA first. Use it to pay your LTC Insurance premium up to the allowable limit, tax-free.

- Leverage business deductions. If self-employed, deduct remaining eligible amounts above the line.

- Use itemized deductions last. If you still have unreimbursed medical expenses exceeding 7.5% of AGI, deduct them on Schedule A.

- Plan early. Buying coverage at a younger age means smaller premiums and more years to leverage these tax tools.

Why This Matters for Your Family

LTC Insurance isn’t just about protecting money — it’s about protecting people. When care is needed, families without a plan often face:

- Financial strain, draining retirement savings or home equity.

- Caregiver stress, as adult children balance jobs and caregiving.

- Fewer choices, forced to accept what’s affordable rather than what’s best.

When you plan ahead and use tax advantages wisely, you create financial breathing room — allowing loved ones to stay in their roles as family, not full-time caregivers.

Trusted Planning Tools

Use the LTC News Cost of Care Calculator to estimate current and future extended care costs in your area. Pair that with your tax strategy and LTC Insurance coverage to build a plan that fits your needs, ensures access to your choice of quality care, and eases the burden otherwise placed on your family.

Additional resources:

- IRS Rev. Proc. 2025-32 — 2026 LTC deduction limits

- IRS Rev. Proc. 2025-19 — 2026 HSA limits

- IRS Publication 502 — Medical expense deductions

- IRS Publication 969 — HSAs

- LTC News Caregiver Directory — Search for caregivers and long-term care facillities for someone you love

Take the Next Step

Most people purchase Long-Term Care Insurance between the ages of 47 and 67, although if you can take advantage of tax deductions, doing this at even younger ages makes sense.

The idea is to lock in coverage while it’s affordable and fully leverage tax benefits.

Ask yourself:

- How would a long-term care event affect my retirement plan?

- Would my family be able — or willing — to provide extended care themselves?

- How much tax savings could I capture by combining business and HSA deductions?

The earlier you plan, the more control you’ll have over your care, your costs, and your family’s future.

This article provides general information, not tax or legal advice. Consult a qualified tax for tax guidance specific to your situation.