From Home Care to Nursing Homes: Where Families in Cincinnati Turn When Aging Parents Need Support

Table of Contents

- What Long-Term Care Really Means

- What Extended Care Costs in Cincinnati

- Home Care: Most Preferred if Possible

- How Long-Term Care Insurance Expands Options

- Seven Cincinnati Communities Families Should Know

- How to Judge Quality Before You Decide

- Five First Steps When Time Comes

- Why Planning Now Protects Quality of Life

It is hard when you are facing the moment you had hoped would never come. You start to notice the little things first. A stumble at the top of the stairs. Medications left untouched on the kitchen counter. Bills forgotten on the table. Could it really be that your parents are not what they used to be?

Suddenly, the parent who once took care of you now needs help with life’s basics. It’s unsettling and emotional—and you may be asking: What happens now? Who pays for this care? Will I have to be a caregiver? How would I do that? Where do I even start?

If you live in the Cincinnati area, the choices for long-term care are many, but so are the questions. LTC News has the most comprehensive information on the internet about aging, caregiving, health, long-term care, and retirement planning.

No matter where your loved one lives, including in Cincinnati, we have clear facts on what long-term care means, what Medicare actually covers, how to find caregivers and facilities, and the cost of extended care services. The goal is always to keep your loved one safe and supported.

What Long-Term Care Really Means

Long-term care is not about hospitals or doctor visits. It’s daily help with eating, bathing, dressing, toileting, personal hygiene, moving safely, medication management, or supervision when memory loss makes independence dangerous.

The need for long-term care can arrive suddenly after a fall or stroke—or build gradually as health declines. Whether it’s caused by dementia, a chronic illness, an accident, or simply the effects of aging, you must act quickly to keep your loved one safe and protect their quality of life.

Long-term care isn’t just about nursing homes. Quality support can take place in the home, in assisted living, in a memory care community, or in a nursing facility—wherever your loved one’s needs are best met. Most of this care is custodial, not medical, and that’s why insurance coverage is limited unless your loved one has Long-Term Care Insurance or qualifies for Medicaid due to limited finances.

- Learn More: What is Long-Term Care Insurance? — What is Medicaid?

Medicare Covers Short-Term Skilled Care—Not Ongoing Help

Medicare does not pay for ongoing custodial long-term care, whether at home or in a facility. At most, it will cover short-term skilled nursing care—up to 100 days per benefit period— after a hospital stay, and only when strict criteria are met. Once therapy or skilled treatment is no longer needed, Medicare stops paying.

- Discover More: Medicare Falls Short on Long-Term Care

For your parent, this means that if the need is primarily for daily support or memory care, your loved one will have to pay out of pocket, called private pay, Long-Term Care Insurance, if they have an LTC policy already in place, or Medicaid, provided they have limited assets.

Of course, you or a sibling may have to become caregivers, but how would that work in your already busy life?

The Risk is Real—and It’s Higher Than You Think

Government research indicates that 56 percent of Americans turning 65 today will eventually require long-term services. For many, that means months or years of daily help—not just a brief recovery. Without planning, it is a family crisis. No matter what, quality and compassionate care are always the goals for someone you love.

What Extended Care Costs in Cincinnati

If you live in the Cincinnati metro area, you already know extended care is costly—and prices keep climbing. Across the country, demand for long-term care is surging, staffing remains tight, and too few families have the Long-Term Care Insurance coverage that could make a difference.

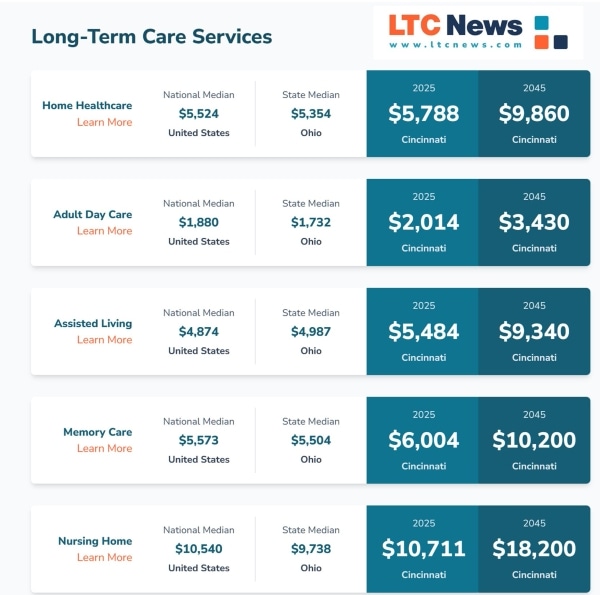

Before making decisions about your loved one’s care, review the current cost of long-term care services. Having accurate numbers provides a clear benchmark for comparing individual providers.

You need reliable information, and the LTC News Cost of Care Calculator is the most accurate tool for projecting current and future costs. Just type in a zip code or city, and you will find the median averages for all types of extended care services and the projected increases over the years.

Here is (as of August 2025) the current and projected future cost of extended care services in Cincinnati, Ohio:

You can use the calculator to see today’s rates and project five or ten years forward. Then compare those numbers against your loved one's income, assets, and any LTC Insurance benefits they have. You can also use the tool when you purchase LTC Insurance as part of your retirement planning to design an LTC policy to address the future costs and burdens of aging.

Home Care: Most Preferred if Possible

Most older adults prefer to stay at home, surrounded by familiar surroundings. Quality home care agencies in Cincinnati, including Amada Senior Care, will assist with meals, bathing, dressing, medication reminders, companionship, and so much more.

But when dementia advances, when falls become frequent, or when 24/7 supervision is needed, assisted living, memory care, or a nursing home may provide safer, more consistent support.

Tip: Start your search with the LTC News Caregiver Directory—it lists trusted home-care providers, assisted living, and nursing homes in the Cincinnati area and across the U.S.

How Long-Term Care Insurance Expands Options

If your parent has a Long-Term Care Insurance policy, coverage can pay for in-home aides, assisted living, memory care, or nursing homes—tax-free. Sharing this information early with a facility or agency often means faster placement and more flexibility. Without LTC Insurance, your loved one will pay out of pocket or rely on Medicaid once resources are depleted.

Need help filing a claim? LTC News partners with Amada Senior Care to provide free claim support with no cost or obligation. Their trained experts can walk you through the entire process and help you access benefits quickly and correctly — File a Long-Term Care Insurance Claim.

Seven Cincinnati Communities Families Should Know

Cincinnati is a city steeped in history, culture, and community, offering a range of senior living options. These seven are often on families’ shortlists:

- The Kenwood by Senior Star – Luxury setting with independent living, assisted living, and memory care; apartments, restaurant, fitness, and transportation.

- Bridgeway Pointe – Calm, social environment with chapel, library, gardens; assisted living and memory care.

- Marjorie P. Lee – Hyde Park Life Plan community with wellness programs, creative classes, and all levels of care.

- Evergreen Retirement Community – Full continuum of care with movie theater, café, crafts, and wellness activities.

- The Seasons – Resort-style independent and assisted living with dining, fitness, and cultural outings.

- Christian Village at Mt. Healthy – Faith-based Life Plan community with independent, assisted, memory care, and skilled nursing in a park-like setting.

- Ohio Living Llanfair – Long-standing Life Plan campus offering independent living, assisted living, memory care, rehab, and nursing care.

Share your thoughts and experiences about aging, caregiving, health, and long-term care with LTC News —Contact LTC News.

How to Judge Quality Before You Decide

Don’t just tour—observe. Visit the facility during mealtimes and observe the food, staff, and the cleanliness of the dining area. Also, take a look at the menu options. Drop in on evenings or weekends. Look for staff who know residents by name, activities that match abilities, and quick responses to call lights. Review inspection reports and star ratings on Medicare Care Compare for any facility offering nursing care, and on LTC News.

Five First Steps When Time Comes

When your loved one requires care, whether at home or in a facility, follow these steps:

- Define the need. List your parents’ daily struggles and safety issues.

- Price it locally. Use the LTC News Cost of Care Calculator for Cincinnati-specific average costs to compare the pricing of providers. Keep in mind, the better the facility, the more costly it will be - but that is not always the case. Understand that the cost of long-term care services will increase over time.

- Build a shortlist. Start with the LTC News Caregiver Directory and start narrowing down the options you wish to call and pursue. Schedule tours and assessments.

- Check coverage. Review any LTC Insurance policy that may exist, and if your loved one has a policy, be sure to tell the admissions director when visiting. Confirm whether Medicare will cover any short-term rehab that may be required. If there is no LTC policy, and your loved one has a life insurance policy, you could sell it for cash now to cover the costs of care.

- Involve the family. Assign roles for finances, appointments, and decision-making.

- Get professional movers. If your loved one is moving to a senior care community, make it easier on them and the rest of the family by using professionals. As they embark on this new chapter, the transition to a retirement community can be made easier with the help of professional senior movers in Cincinnati, or wherever you and your loved one live.

They can assist with the logistics of moving, making the process smoother and more manageable, allowing them to focus on settling into their new home and enjoying everything the community has to offer.

Why Planning Now Protects Quality of Life

The proper care shows up in the little things: a caregiver who is patient when helping with a shower, meals served on time, a friendly voice that eases confusion, and a clean, friendly, and safe environment.

Taking these steps will ensure your loved one maintains a good, quality life despite any health or aging issues. You can give your parent the best chance at safety, dignity, and social connection.

However, what steps have you taken now so your family can avoid the stress and burden of your future aging and health needs? By planning before a crisis, you can safeguard your income and assets, ensure access to quality care, and ease the burdens otherwise placed on those you love.

For many people, this means Long-Term Care Insurance. Most people acquire an LTC policy between the ages of 46 and 67. Seek help from a qualified LTC Insurance specialist to provide you with accurate quotes and professional recommendations.

- Learn more now: LTC News Long-Term Care Insurance Education Center