Avoid Family Conflict: How To Plan Meetings About Aging Parents’ Elder Care

Table of Contents

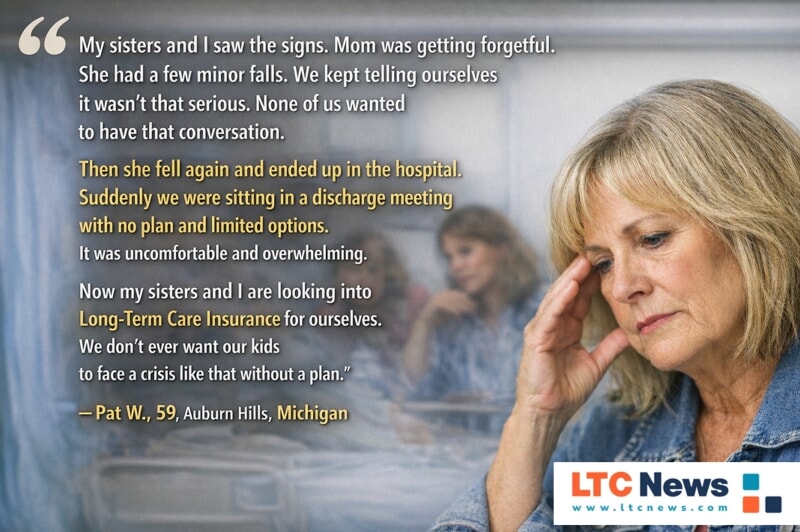

It is the conversation you know is coming. You start to notice it before anyone says it out loud. Your mom hesitates on the stairs. Your dad forgets to pay bills. A hospital discharge planner casually asks, “Who is handling your mother's care at home?”

Suddenly, you are no longer just a son or daughter. You are a decision-maker. Being a decision-maker on behalf of your parents is a role you may have never thought about before, and now it is front and center in your life.

Too often, families wait until a crisis to begin talking about care, and that’s when relationships are strained and emotions run high. Early conversations give adult children a chance to prepare emotionally, legally and financially before they suddenly find themselves making decisions they never anticipated. — Carolyn A. Brent, caregiver advocate. and author of "Why Wait? The Baby Boomers' Guide to Preparing Emotionally, Financially and Legally for a Parent's Death."

If you are over 45, this moment is either here or approaching. And without preparation, it often unfolds in a hospital hallway, during a holiday, or in the middle of a family argument.

That is the wrong time to start.

The problem is not unique and is playing out in families throughout the country and worldwide. According to the U.S. Department of Health and Human Services, about 56 percent of Americans turning 65 will need long-term services that meet the federal definition of needing help with at least two activities of daily living (ADLs) or having cognitive impairment.

At the same time, more than 63 million Americans provide unpaid caregiving, according to AARP and the National Alliance for Caregiving. These are not abstract statistics. They describe your family, your siblings, and your retirement timeline. The problem isn't going away; it's increasing.

Longevity is increasing, but the downside is an increased risk of chronic illness, accidents, dementia, or frailty. Since health insurance, including Medicare, only pays for short-term skilled care, the full responsibility of long-term care falls on you and your family.

Doing nothing creates a family crisis. Planning, no matter the age, starts with a conversation. A structured family meeting is not just a discussion. It is risk management for your parent’s safety and your family’s financial stability.

Handled poorly, it creates conflict. Handled well, it creates clarity, shared responsibility, and a plan.

Here is how to do it the right way.

Why Family Meetings Matter More Than Ever

Caregiving in America is expanding rapidly. Families are managing longer lifespans, higher rates of dementia, and rising long-term care costs.

When care decisions are delayed, families often face:

- Emergency hospital discharges

- Rushed assisted living placements

- Financial strain

- Sibling conflict

- Caregiver burnout

Early, structured conversations shift the dynamic from reactive to proactive.

Share your thoughts and experiences about aging, caregiving, health, retirement, and long-term care with LTC News —Contact LTC News.

The shift from family crisis to choice often begins with one well-planned family meeting.

Start With a Clear Agenda

Do not “wing it.” Create and circulate an agenda in advance.

Include:

- Current health status

- Safety concerns at home

- Financial resources

- Long-Term Care Insurance

- Legal documents such as a durable power of attorney and a health care directive

- Long-term care preferences

- Immediate and next-step action items

Sometimes, the only need is to make the home a safer environment. With a clear plan, family caregivers can create a safer home environment and provide consistent support.

Sharing the agenda beforehand gives siblings time to prepare and reduces emotional reactions. Keep the meeting focused. One or two core issues per session is often enough.

Choose the Right Setting

The environment shapes the outcome.

Avoid:

- Loud restaurants

- Holidays

- Times when someone is rushing to another commitment

Choose a neutral, quiet space where everyone feels heard. Schedule enough time so no one feels pressured.

A calm setting lowers defensiveness and improves listening.

Appoint a Neutral Facilitator

Every family has a history. Old grievances can surface quickly.

Designate a facilitator whose role is to:

- Keep the discussion on track

- Ensure each person has equal time

- Redirect unproductive arguments

- Summarize decisions and next steps

This person does not need to control decisions. They guide the process. In complex cases, families sometimes involve a geriatric care manager or elder law attorney for neutral guidance.

Bring Facts, Not Assumptions

Emotion fuels conflict. Information reduces it.

Bring documentation such as:

- Physician notes

- Medication lists

- Home safety concerns

- Insurance policies

- Income and asset summaries

Understanding financial realities is critical.

Use the LTC News Cost of Care Calculator to review current and projected costs for:

- In-home care

- Assisted living

- Memory care

- Nursing homes

Costs vary significantly by state and continue to rise.

It is also essential to clarify coverage realities:

- Medicare covers limited short-term skilled care, generally up to 100 days under strict conditions following hospitalization. It does not pay for ongoing custodial long-term care.

- Traditional health insurance does not cover extended assistance with daily living.

- Medicaid has strict income and asset eligibility requirements that vary by state.

Discuss whether your parent has Long-Term Care Insurance. Once their health starts to fail, obtaining new coverage may not be possible, but don't assume your parents don't have an LTC policy; they may not have shared it with you and your siblings.

Review:

- Daily or monthly benefit

- Inflation protection rider

- Elimination period

- Covered care settings

Concrete numbers reduce fear and improve decision-making. Be sure your parents are not afraid to use the policy benefits. Yes, sometimes some older adults want to save their policy for a rainy day, ignoring the rainy day is upon them now.

The LTC policy will help them maintain a better quality of life and reduce the stress and burden on the rest of the family.

When your loved one needs extended care, the last thing you want is paperwork, confusion, or delays. That is why LTC News partners with Amada Senior Care to offer free, no-obligation LTC Insurance claim support — File a Long-Term Care Insurance Claim.

Focus on Solutions, Not Blame

The meeting is not about who “should have” done more. It is about what happens next. Encourage open brainstorming. Then move toward structure.

Create:

- A list of responsibilities

- A timeline

- A communication plan

- A follow-up meeting date

If aging at home is the goal, discuss:

- Home modifications

- In-home care schedules

- Transportation planning

- Adult day services

If your loved one needs more comprehensive care or desires a more social atmosphere, an assisted living facility might be best. Those with memory issues or significant physical health issues may require memory care or a nursing home.

Start your search for quality caregivers and long-term care facilities with the LTC News Caregiver Directory. You can search from over 80,000 providers by zip code.

You can narrow down options and start making phone calls. When discussions stay solution-oriented, conflict decreases.

Address Legal and Financial Planning Early

Avoiding financial discussions does not protect your parent. It limits options.

Review:

- Durable power of attorney

- Health care directive

- Living will

- Estate planning documents

- Beneficiary designations

If no Long-Term Care Insurance exists, discuss how care would be funded. If your loved one owns a life insurance policy, you may be able to convert that life policy into cash through a life settlement. The funds can then be used to help cover the cost of care today. Sometimes a family will cancel a life insurance policy to save money when you can sell the policy, get the cash, and pay no premium.

Waiting until a crisis often forces families to liquidate assets under pressure. Proactive planning protects both dignity and financial stability.

Keep the Conversation Ongoing

One meeting is rarely enough. Health conditions evolve. Cognitive decline can progress gradually. Financial markets fluctuate.

Document decisions. Share summaries. Schedule follow-ups.

Most importantly, involve your parent as long as they have decision-making capacity. Preserving autonomy supports emotional well-being. Multiple national surveys consistently show older adults strongly prefer aging at home when possible. Planning allows you to honor that preference safely.

When Emotions Run High

Expect emotion. This is not just logistics. It is identity, independence, and mortality.

If tensions escalate:

- Pause the discussion

- Refocus on shared goals

- Return to documented facts

- Consider professional mediation

Ask yourself one grounding question: What outcome best protects our parent’s safety and dignity? That question often resets the conversation.

Control Preparation

Family meetings about elder care are not optional. They are a core part of retirement planning and risk management.

When handled thoughtfully, they:

- Prevent crisis decisions

- Reduce sibling conflict

- Protect assets

- Improve care outcomes

- Preserve independence longer

You cannot control aging. You can control preparation.

The conversation is coming. The only question is whether you will lead it—or let it lead you. Meanwhile, the best time to prepare for aging and future long-term care is before you retire. Most people add an LTC policy to their retirement plan between the ages of 47 and 67.

Seek a conversation with a qualified Long-Term Care Insurance specialist representing all the top-rated insurance companies offering long-term care solutions.