Best Long-Term Care Insurance Companies 2026 | Expert Rankings

Table of Contents

- How We Evaluate and Choose the Best Long-Term Care Insurance Companies

- Why Long-Term Care Insurance Matters

- Key Terms Used in This Guide

- Best Traditional Long-Term Care Insurance Companies in 2026

- Neutral Ratings: Other Long-Term Care Insurance Options

- Not Recommended Traditional Long-Term Care Insurance Companies

- Best Hybrid Long-Term Care Insurance in 2026

- Other Hybrid Long-Term Care Insurance Considerations

- Frequently Asked Questions

- Choosing the Best Long-Term Care Insurance Company in 2026

This comprehensive guide ranks the best Long-Term Care Insurance companies in 2026 based on financial strength, policy features, pricing, and real consumer value.

Each year, the staff at LTC News works with independent industry experts to review all major options for long-term care planning. Our goal at LTC News is to research for you so you can make informed decisions about long-term care with confidence.

Today, you have more choices than ever, and we'll cover each type of long-term care coverage in this review, including:

-

Traditional Long-Term Care Insurance (including partnership-certified policies).

-

Hybrid policies (life insurance or annuities combined with qualified long-term care benefits).

-

Short-term care insurance (also known as short-term cash indemnity plans and, in some cases, cash indemnity plans).

This guide will cover the best Long-Term Care Insurance companies for 2026 in each category, as well as companies we wouldn't recommend. We’ll discuss each company's offerings and financial stability, and answer frequently asked questions about Long-Term Care Insurance.

Quick Comparison: Best Long-Term Care Insurance Companies for 2026

Here’s a quick snapshot of our top Long-Term Care Insurance picks – detailed reviews follow below.

-

Best Long-Term Care Insurance Company (Traditional): Mutual of Omaha

-

Best Hybrid Long-Term Care Insurance Company: Nationwide Financial

-

Best Short-Term Care Insurance Company: Aetna

Long-term care planning is not one-size-fits-all. After reviewing your health, finances, family considerations, and retirement plans, a Long-Term Care Insurance specialist can make recommendations based on your specific situation.

How We Evaluate and Choose the Best Long-Term Care Insurance Companies

At LTC News, we keep our evaluations straightforward and independent. We don't accept payment from insurers to influence our reviews.

Our insights come straight from the source:

-

Insurance industry experts and financial professionals with decades of real-world experience.

-

Long-Term Care Insurance providers, who process claim data daily.

-

Independent insurance agents, who aren't tied to any specific insurance carrier.

An expert committee analyzes this data to rank companies on what matters most:

-

Financial strength & stability: Using A.M. Best, S&P, and Moody's rankings.

-

Policy flexibility & options: The ability to meet different care and family needs.

-

Underwriting criteria: How easy it is to qualify for a new policy.

-

Pricing & value: Long-term value and benefits going beyond just the initial premium.

-

Unique benefits & features: Exclusive or not widely available features and options that set companies apart.

-

Claims & customer experience: How easy is it to make a claim, and how have customers been treated?

This approach gives you the power to compare Long-Term Care Insurance companies on what truly matters to you.

How LTC Insurance Is Regulated & Why It’s Safe

Every traditional and hybrid Long-Term Care Insurance policy reviewed in this guide meets federal regulations under U.S. tax code Section 7702(b).

These regulations ensure consumer protections, tax advantages, and standardized benefit triggers. They control pricing, playing a crucial role in preventing premium increases.

In addition, Long-Term Care Insurance regulations ensure that your policy will pay for care as soon as you meet the benefit triggers (and complete your elimination period), providing you and your family with confidence that benefits are there when you need care.

Why Long-Term Care Insurance Matters

Long-term care costs are rising every year. In 2026, the median annual cost of an assisted living facility is $59,591 before surcharges based on additional services you will need.

What's worse is that Medicare does not cover long-term care, such as help with dressing, bathing, or other activities of daily living, often associated with a need for skilled short-term help.

Instead, Medicare only covers up to 100 days of skilled care. Medicare does not cover extended care in an assisted living, memory care, nursing home, or home setting.

So how are you supposed to pay for long-term care?

That’s where Long-Term Care Insurance comes in, offering comprehensive coverage for assisted living, home care, and any other extended care needs.

Long-Term Care Insurance protects your income and retirement assets and gives you a choice in where and how you receive care. But it's more than just asset protection; it helps your loved ones manage the burdens that come with caring for a loved one.

With such high stakes, choosing the right Long-Term Care Insurance policy has never been more critical.

That's why this guide exists: to help you make informed decisions about which company to work with to ensure the stability and longevity of your retirement plans.

Key Terms Used in This Guide

Before we get started, there are a few key terms you’ll need to know.

-

Maximum Lifetime Benefit: The maximum amount of benefits (money) within the LTC Insurance policy.

-

Daily/Monthly Maximum: The total amount that an LTC Insurance policy could pay out daily or monthly when you need long-term care services.

-

Benefit Period: The minimum length of time your policy would cover long-term care if you needed to use the maximum daily or monthly benefit.

-

Rider: An add-on feature or benefit for LTC Insurance policies, usually at an additional price. A common example is an inflation rider, which increases your policy benefits over time.

-

Elimination Period: A waiting period between when your Long-Term Care Insurance claim is approved and benefits begin. This period is usually between 0 and 90 days.

It’s also important to understand that companies use a process called underwriting to analyze the risk of insuring each applicant. Underwriting is based on many factors, but the most important one by far is your health.

Each company has different underwriting guidelines, so it's key to compare them before applying.

Best Traditional Long-Term Care Insurance Companies in 2026

Traditional Long-Term Care Insurance is what you probably think of first when you think about long-term care coverage options.

These are standalone, often private insurance policies that provide comprehensive coverage for long-term care, including home care, assisted living facilities, memory care, and nursing homes.

Below, we’ll break down the top 3 insurance companies for traditional Long-Term Care Insurance policies in 2026.

|

Rank |

Company |

Best for |

A.M. Best Rating |

Underwriting |

|

#1 |

Mutual of Omaha |

Overall Value |

A+ (Superior) |

Multiple underwriting classes, may be easier to qualify |

|

#2 |

Thrivent Financial |

Christians |

A++ (Superior) |

Lengthy process |

|

#3 |

National Guardian Life |

Couples and unlimited benefits |

A (Excellent) |

Conservative |

#1. Mutual of Omaha Long-Term Care Insurance – Best Overall Value

This year, Mutual of Omaha is LTC News' first choice for the best Long-Term Care Insurance companies.

Once again, it earns our top ranking for traditional Long-Term Care Insurance because of its balance of competitive pricing, strong benefits, and reliable claims performance.

Mutual of Omaha has been a long-time industry leader, serving families since 1987. The company has paid millions in long-term care claims, helping families access in-home care, assisted living, memory care, and nursing facilities of their choice.

In recent years, Mutual of Omaha has also improved its claims and service processes, making it easier for families to get help during stressful times.

Financial Strength & Ratings

Another major reason Mutual of Omaha remains a top choice is its financial strength. As a mutual insurance company, it is owned by its policyholders, not shareholders.

The company maintains strong ratings from major financial companies, reflecting its ability to meet long-term obligations:

-

A.M. Best: A+ (Superior)

-

S&P Global (Standard & Poor's): A+

-

Moody's: A1

Policy Options: MutualCare Custom Solution vs. MutualCare Secure Solution

Mutual of Omaha offers two Long-Term Care Insurance options:

-

MutualCare Custom Solution: Comprehensive coverage, highly customizable, and offers buy-up inflation options.

-

MutualCare Secure Solution: Comprehensive coverage, less flexible, no buy-up inflation option.

While both provide solid coverage, most long-term care planning specialists recommend MutualCare Custom Solution because it offers greater flexibility and more ways to customize benefits.

A knowledgeable Long-Term Care Insurance specialist who represents multiple leading insurers can help you compare the two and determine which design best fits your age, health, and planning goals.

Inflation Buy-Up Option

The MutualCare Custom Solution also stands out because it allows you to tailor your policy to your budget and future needs. It offers more inflation protection choices and benefit design options than the Secure Solution, making it easier to create affordable coverage that grows with you.

One of its most valuable features is the inflation buy-up option, which allows you to increase your inflation protection in the future without having to prove insurability, until age 74 or for 20 years, whichever comes first.

That flexibility is especially important because most people buy Long-Term Care Insurance between ages 47 and 67, when life and finances are still changing.

For younger buyers, this feature allows you to start with a lower inflation rate and a lower premium while paying for major expenses, such as a mortgage or college tuition. Later, when your financial obligations ease, you can raise your inflation protection so your benefits keep pace with rising care costs.

While there is an added cost when you increase your inflation benefit, Mutual of Omaha calculates it at a blended rate, which helps keep the increase affordable over time.

Key Features & Benefits

Mutual of Omaha's policies both include comprehensive coverage designed for flexibility and real-world care needs.

In recent years, Mutual of Omaha has increased the maximum monthly benefit available under both policies. New policyholders can now qualify for up to $15,000 per month in initial benefits, before adding inflation protection. This is especially important for people who live in areas where extended care costs are higher.

Mutual of Omaha has also streamlined its underwriting process, reducing approval times for some applicants.

Below, we'll list a few key features and benefits you can expect in a Long-Term Care Insurance policy with Mutual of Omaha.

Coverage Scope:

-

Up to $15,000 monthly maximum benefit (before inflation protection).

-

Separate benefit levels for nursing home, assisted living, and home care.

-

International coverage: Full benefits in the U.S., U.K., and Canada; up to 1 year anywhere else.

-

Respite care, hospice services, and adult day care are included.

Policy Design:

-

Monthly benefit structure (not daily) provides flexibility in how you use benefits.

-

Pool of money benefit: Unused monthly benefits roll over and can grow with inflation.

-

Inflation protection options: 1% to 5% compound in 0.25% increments.

-

Partnership-certified in most participating states.

Built-in Support:

-

Cash benefit alternatives: Additional money to pay for home modifications, medical alert systems, and even caregiver training to help you remain at home.

-

Care coordination and case management services.

-

Bed reservation benefit (holds your spot during hospital stays or any reason you are not in the facility).

-

Waiver of premium once benefits begin.

Options for Couples:

-

Shared care rider: Access your partner's unused benefits.

-

Preferred partner discounts available.

-

Spousal discount for couples purchasing together.

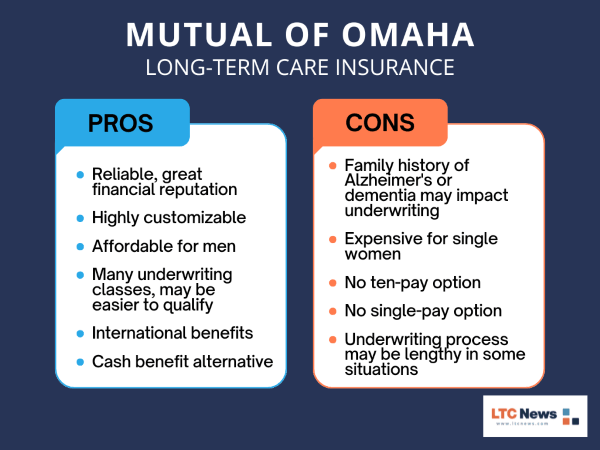

Pros and Cons of Mutual of Omaha

Overall, Mutual of Omaha is our #1 recommended insurance provider for traditional Long-Term Care Insurance. In this section, we’ll compare the pros and cons of Mutual of Omaha so you can decide whether the company is a good fit for you and your needs.

Why Mutual of Omaha is our top choice:

-

Superior financial strength for long-term security: A+ ratings from A.M. Best, S&P, and Moody's, plus a mutual company structure (owned by policyholders, not shareholders), reduce the risk of benefit cuts.

-

Monthly benefits look at your bills throughout the month, not just per day. This allows for easier scheduling of providers with less worry about exceeding a daily limit.

-

Easier qualification for some applicants: Multiple underwriting classes mean Mutual of Omaha will offer you the lowest possible premium based on your age and health, and even offer coverage for some who may otherwise not be eligible.

-

Affordable option for men.

-

Partnership certification provides additional dollar-for-dollar asset protection, shielding your estate from Medicaid spend-down if you exhaust policy benefits.

-

International flexibility: Mutual of Omaha is the only major insurer offering full benefits in the U.K. and Canada, and up to one year anywhere else in the world, which is valuable for snowbirds, expats, and travel enthusiasts.

What could be better:

-

Strict Alzheimer's family history rules: If two first-degree relatives (parents or siblings) are diagnosed before age 80, you will not be eligible to obtain a new policy.

-

Higher premiums for women.

-

No ten-pay option.

-

No single-pay option.

-

Longer underwriting process for complex health situations.

-

Shared spousal care restrictions: The return-of-premium rider is not available for those with shared spousal benefits.

Full Review: Learn more about Mutual of Omaha Long-Term Care Insurance coverage with LTC News’ comprehensive insurer review.

#2. Thrivent Financial – Best Long-Term Care Insurance for Christian Families

Again for 2026, Thrivent Financial maintained its position in our rankings at number two. Thrivent is a not-for-profit fraternal benefit organization and a Fortune 500 company that holds strong financial ratings.

Thrivent's membership is rooted in its Christian Common Bond. To be eligible for membership and its associated benefits, applicants must be Christians seeking to live out their faith or be the spouse of such an individual. This commitment to Christian values is integral to Thrivent's identity and operations.

This faith-based focus can be a good fit for people who share those values. However, it also means that individuals who are not Christians or not married to a Christian will not qualify for Thrivent’s products and services.

Thrivent's dedication to its Christian membership shapes its community-oriented approach, offering benefits and programs that align with these values.

Financial Strength & Ratings

Thrivent continues to be widely recognized for strong financial strength and stability, with top ratings from major independent agencies, all indicators of its ability to meet its financial obligations and pay claims.

-

A.M. Best: A++ (Superior financial strength and stable outlook)

-

S&P Global (Standard & Poor's): AA+ (Very Strong)

-

Moody's: Aa2 (Excellent)

Thrivent Financial also boasts a COMDEX rating of 100, the highest attainable rating. These ratings reflect Thrivent's financial strength and stability.

Key Features & Benefits

Thrivent offers a comprehensive LTC Insurance policy featuring a monthly benefit structure, partnership certification, shared spousal benefits, and multiple inflation protection options, allowing you to customize coverage to match your long-term care and financial goals.

Long-Term Care Insurance with Thrivent is a pool-of-money product, meaning any additional funds not used during a claim will remain in your account and grow with inflation if you choose.

Policy Design:

-

Monthly benefit structure as opposed to daily, giving you more flexibility and control over how you use your benefits and receive care.

-

Waiver of premium when receiving benefits.

-

Care coordination is available at the time of claim.

-

Offers a respite care benefit and a hospice benefit.

-

Ancillary benefits include equipment, home modification, and caregiver training.

Inflation Protection

Thrivent offers the following inflation benefit options:

-

1% compounded

-

2% compounded

-

3% compounded

-

5% compounded

The company also has a 5% flexible benefit option. Your maximum monthly benefit and total available benefit automatically increase 5% per year, compounded.

Each year, you’ll receive an offer to accept or decline the increase. Premiums rise each time you accept an increase. If you decline an increase, your benefits and premiums stay the same for that year.

If you decline three years in a row, Thrivent stops offering future increases.

Interestingly enough, once you start receiving benefits, the automatic benefit increases resume even if you previously declined offers. Remember, you do not pay the premium while receiving benefits.

Spousal Benefits

Shared spousal benefits are a popular option with several companies offering long-term care solutions. Thrivent’s shared spousal benefits are connected through a rider that allows one spouse to use the other spouse’s remaining benefits once their own are exhausted.

This means if one spouse dies, the surviving spouse retains 100% of the unused benefits. Premium payments for the deceased spouse end at that time.

Unique feature: Thrivent allows the surviving spouse to purchase additional coverage without evidence of insurability if one policyholder has used all benefits from both policies.

Like other insurance companies, single women typically pay higher premiums for coverage than single men. Thrivent offers spousal discounts even if only one spouse applies or gets approved.

Cash Benefits

Thrivent’s Long-Term Care Insurance policies also include a cash rider that provides additional funds when a claim is filed.

The cash benefit is additional money that is paid while you are already receiving regular long-term care benefits.

Cash benefits amounts are based on how and where you receive care:

-

15% of your maximum monthly benefit when you are receiving care at home.

-

10% of your maximum monthly benefit when you are receiving care in a facility.

To qualify, you must first satisfy the elimination period and receive care for at least five days during a calendar month. Once those conditions are met, the cash benefit becomes available to help cover extra care-related expenses.

Ten-Pay Option

If you like the idea of being done with premiums before retirement, Thrivent offers a 10-pay option that lets you fund the policy over ten years.

Once those payments are complete, the policy is fully paid up, and no further premiums are required.

Underwriting – How Easy Is It to Get Coverage with Thrivent Financial?

Compared to other insurers, Thrivent’s underwriting guidelines require longer periods of stability after a medical recovery.

As a result, applicants may experience longer waiting periods to become eligible following certain surgeries or health events. The underwriting process itself often takes longer than it does at other companies. This is because Thrivent orders medical records for each application.

If you’re concerned about your ability to qualify for coverage or navigate the underwriting process, reach out to a Long-Term Care specialist who works with all the major companies and will understand these circumstances.

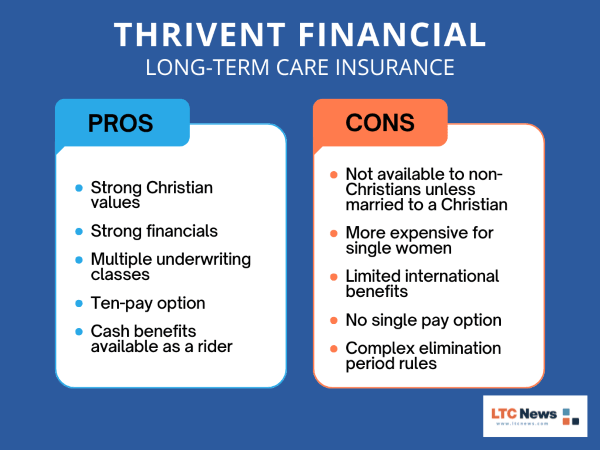

Pros and Cons of Thrivent Financial

Why Thrivent Financial is second on our list:

-

Very strong financially with an outstanding reputation.

-

Non-profit mutual company.

-

Christian-first company, which is great for those with strong Christian values.

-

Offers multiple inflation options.

-

Monthly benefits as opposed to daily benefits.

-

A pool of money product: if the policyholder does not use the entire monthly benefit at the time of claim, the remaining money stays in the benefit account and grows with inflation (if selected).

-

Shared spousal/partner benefits available.

-

Cash rider available at an extra charge.

-

Partnership-certified.

-

Limited payment options, such as the 10-pay option.

-

Return of premium option available.

-

Potential of dividends.

-

Will consider applicants as young as age 18.

-

Multiple underwriting classes.

Why it might not be for you:

-

You must state you have Christian faith to qualify, which eliminates those who do not.

-

More expensive for single women.

-

Elimination periods require at least one day of paid services in a calendar week to receive credit for seven calendar days (as opposed to calendar days that start on the first day of service).

-

Very limited international benefit.

-

No single premium option.

-

Lengthy underwriting process.

Full Review: Learn more about Thrivent Financial Long-Term Care Insurance with LTC News’ full insurance review.

#3. National Guardian Life (NGL)

There is no change in our top three from previous years, as National Guardian Life (NGL) continues to hold on to the number 3 position among our best traditional Long-Term Care Insurance options for 2026.

National Guardian Life Insurance Company (NGL) is a mutual insurance company founded in 1909. It continues to operate with a strong financial footing, with roughly $5.1 billion in total assets in the most recent reporting period.

The company's product is the same as in 2025; however, National Guardian Life is expected to release an updated version that builds on its already comprehensive product.

LTC News staff updates this article regularly. As soon as NGL officially releases its new product, we’ll update this review.

Financial Strength & Ratings

NGL is a financially stable company with a long history in the insurance industry, having been founded in 1909.

It holds an A (Excellent) Financial Strength Rating from A.M. Best, reaffirmed in July 2025, which reflects the company’s ongoing ability to meet its insurance obligations and pay claims.

This rating underscores National Guardian Life’s commitment to maintaining financial stability and delivering reliable insurance products to its policyholders.

Key Features & Benefits

National Guardian Life entered the Long-Term Care Insurance market in 2016 with its EssentialLTC product.

EssentialLTC is a standalone, traditional Long-Term Care Insurance policy designed with input from experienced industry professionals. NGL is set to release a new product, HonestLTC, in 2026.

HonestLTC updates key features in coverage, most notably offering monthly benefits instead of daily benefits and adding an alternative benefit feature that was missing in the EssentialLTC series.

Daily Benefits to Monthly Benefits

Traditionally, National Guardian Life has used a daily benefit structure rather than a monthly benefit approach.

In a daily benefit structure, companies review expenses one day at a time. Long-Term Care Insurance specialists have raised concerns about how restrictive this design can be.

For example, if you have multiple providers and services in one day, you might go over your daily limit, while the next day you might be under.

In 2026, NGL responded to these concerns, announcing an updated version of its policy, HonestLTC.

This new policy will use monthly benefits to support policyholders and offer greater control over care. Expenses are tracked by month, resulting in lower out-of-pocket costs and less stress about going over a daily benefit limit.

Anyone approved under the current daily-benefit version will be allowed to upgrade when the new monthly-benefit policy becomes available in their state.

Shared Third Pool for Couples

In 2026, NGL remains one of the leading Long-Term Care Insurance choices because of its distinctive third pool shared care feature.

The third pool design allows couples to share one policy that creates two separate benefit accounts. In addition, the couples also receive access to a third benefit account. Each of these accounts can grow with inflation if the option is selected.

This extra third pool becomes available to either partner if one person uses up their individual benefits.

The shared care design available with NGL delivers strong value, providing greater total coverage at a competitive cost, especially for applicants in good health and within favorable age ranges.

NGL’s third-pool shared spousal or partner benefit is the main reason many couples consider Long-Term Care Insurance with National Guardian Life.

1035 Exchange

NGL stands out in the traditional Long-Term Care Insurance market because it allows tax-free Section 1035 exchanges from life insurance or annuity cash values to fund premiums for a traditional LTC policy.

This feature is more commonly found in hybrid policies, but NGL makes it available for standalone coverage.

Conservative Underwriting

National Guardian Life has conservative underwriting guidelines. This means it may be more difficult to qualify for coverage if you have health conditions. In recent years, NGL has modestly expanded its guidelines.

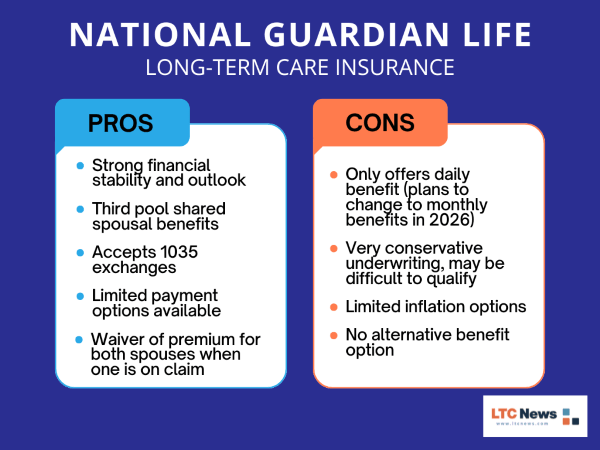

Pros and Cons of National Guardian Life

Why National Guardian Life is one of our top picks:

-

Partnership-certified.

- Availability of unlimited benefits.

-

Return of premium options let you recover part or all of your premiums if you surrender the policy or don't fully use its benefits.

-

Single-premium pay option. This may be 100% tax-deductible for C corporations (subject to IRS rules and the advice of a qualified tax professional).

-

10-pay premium option.

-

The third benefit account for couples provides outstanding value in many situations.

-

Accepts 1035 exchange of a life insurance policy or annuity.

-

Waiver of premium at the time of claim waives 100% of a couple's premium since it is one policy for two people.

-

Competitive pricing in some situations.

Why National Guardian Life may not be for you:

-

Very conservative underwriting.

-

Only offers a daily benefit right now with no monthly benefit available. (However, an update in 2026 is expected to offer monthly benefits.)

-

No alternative benefit option (However, the updated 2026 product is expected to offer alternative benefit options.)

-

The elimination period uses dates of service instead of calendar days. (However, the updated product is expected to use calendar days.)

-

No spousal discount when only one spouse applies for coverage.

-

More expensive for single applicants, especially women.

-

Limited available options and pricing structure can make NGL a higher-cost option in some situations.

Full Review: Learn more about National Guardian Life Long-Term Care Insurance with LTC News’ full insurance review.

Neutral Ratings: Other Long-Term Care Insurance Options

While LTC News’ top three Long-Term Care Insurance picks offer the strongest overall value, several other insurers also provide comprehensive policies that help address the physical, emotional, and financial challenges of long-term care.

As a result, LTC News has assigned these companies a neutral rating primarily based on pricing and, in some cases, features.

CareScout Insurance (Genworth)

Key Takeaways:

-

Excellent claims support (backed by Genworth)

-

Basic policy offerings

-

Expensive for what it offers

CareScout Insurance operates as a subsidiary of Genworth Financial, drawing on Genworth's more than 40 years of experience and extensive claim experience in the Long-Term Care Insurance industry.

Originally starting as a care management and quality review division, CareScout became the public face of Genworth's return to the Long-Term Care Insurance market with the launch of CareScout Care Assurance in 2025.

So why do we rate CareScout Long-Term Care Insurance as neutral?

The primary reason to consider CareScout policies is Genworth's claims expertise. However, CareScout's coverage is basic and among the more expensive options in the industry, leading to a neutral review.

Full Review: Learn more about CareScout Long-Term Care Insurance with LTC News’ full insurance review.

Knights of Columbus

Key Takeaways:

-

Strong financials and stable outlook

-

Exclusive to male Roman Catholics and their spouses

-

Not partnership-certified

-

Long-Term Care Insurance is not a primary company focus

The Knights of Columbus is a financially strong insurance provider with an A+ rating from A.M. Best.

Like Thrivent, the Knights of Columbus only sells Long-Term Care Insurance to its members, meaning eligibility is limited to male Roman Catholics and their female spouses.

Long-Term Care Insurance is not a main focus of the Knights of Columbus. While they do offer coverage compliant with regulations, their policies are not partnership-certified.

In addition, they sell policies exclusively through company agents. These agents typically focus on life insurance rather than LTC insurance, meaning long-term care planning expertise may be limited.

For most people seeking comprehensive long-term care planning, there are stronger and more flexible options available elsewhere.

Full Review: Learn more about Knights of Columbus Long-Term Care Insurance with LTC News’ full insurance review.

New York Life (Including AARP Endorsed Plan)

Key Takeaways:

-

Strong financials

-

Very expensive policies

-

Potentially high out-of-pocket costs

-

Substandard rate classes could make it easier to qualify for coverage with moderate health conditions

New York Life remains one of the financially strongest life insurance companies in the United States. However, New York Life Long-Term Care Insurance premiums are among the highest in the industry, often exceeding comparable options from other insurance companies.

There are a few reasons why New York Life received a neutral rating in 2026. Many of these concern the risk of high out-of-pocket costs resulting from policy design and misleading marketing strategies.

Because of the high out-of-pocket exposure, most Long-Term Care Insurance specialists do not recommend this product when other, more comprehensive options are available.

Here are a few examples:

-

Partnership with AARP: New York Life partners with AARP to offer a branded Long-Term Care Insurance policy. While the AARP name may inspire confidence, it is important to understand that this endorsement is a paid marketing relationship, not an independent evaluation of policy value or pricing.

-

High out-of-pocket exposure: The company also offers a product known as My Care, which includes cash deductibles and an 80/20 coinsurance structure. Under this design, policyholders are responsible for a significant share of care costs.

-

Dividend promises: Some New York Life agents illustrate scenarios suggesting that premiums could decline or disappear later in life due to dividends. However, most actuaries and industry experts caution that this outcome is highly unlikely. Dividends are not guaranteed and should not be relied upon to offset the company’s higher premiums compared with other insurers.

-

Inflation protection problems: New York Life agents also sometimes promote policies without inflation protection or with inflation purchase options that increase premiums over time. While these designs may start with lower initial costs, the ongoing increases often make them more expensive and less practical in the long run.

One advantage New York Life does offer is a substandard rate class, which can provide greater underwriting flexibility for applicants with moderate health conditions who may not qualify elsewhere.

While New York Life’s financial strength is unquestioned, its high premiums and reliance on non-guaranteed features mean that many people will find stronger value, flexibility, and long-term cost efficiency with other Long-Term Care Insurance providers.

Full Review: Learn more about New York Life Long-Term Care Insurance with LTC News’ full insurance review.

Northwestern Mutual

Key Takeaways:

-

Financially strong company with a great reputation

-

Very high premiums

-

High cost inflation protection

Northwestern Mutual is a financially strong insurance company with a long-standing reputation for stability.

However, Northwestern Mutual's Long-Term Care Insurance premiums are among the highest in the market. Their policies generally aren't competitive compared to other options.

Additionally, Northwestern Mutual agents often illustrate policies without inflation protection or with inflation purchase options that result in regular premium increases over time. While these designs may appear affordable at first, the ongoing increases can make coverage costly and difficult to sustain over the life of the policy.

Given the high premiums, most consumers are likely to find better overall value with other Long-Term Care Insurance companies.

Full Review: Learn more about Northwestern Mutual Long-Term Care Insurance with LTC News’ full insurance review.

LifeSecure (Dreamscape)

Key Takeaways:

-

Historically provided great Long-Term Care Insurance coverage

-

No longer sells individual policies (only employer-sponsored plans)

-

Worth considering employer-sponsored coverage

-

Less strict underwriting on employer-sponsored plans

LifeSecure was previously wholly owned by Blue Cross Blue Shield of Michigan. On October 3, 2025, Dreamscape Industries completed the acquisition of LifeSecure.

LifeSecure was once a significant provider of individual Long-Term Care Insurance. In recent years, however, the company shifted its focus to the employee benefits market and stopped selling individual LTC Insurance policies.

Its current long-term care offering is basic and generally not competitive when compared with other options available today.

That said, LifeSecure Long-Term Care Insurance may still be worth considering when offered through an employer-sponsored plan with more relaxed underwriting, which is why it receives a neutral rating.

Full Review: Learn more about LifeSecure Long-Term Care Insurance with LTC News’ full insurance review.

Not Recommended Traditional Long-Term Care Insurance Companies

While these companies offer products that meet federal requirements, they are not recommended in our 2026 review for a variety of reasons.

Banker’s Life

Key Takeaways:

-

Issues with claim delays and denials

-

A substantial number of complaints filed with the Better Business Bureau surrounding Long-Term Care Insurance

-

Lenient underwriting may be a last resort for those denied by higher-ranked companies

Financial Strength & Ratings

Bankers Life, the primary subsidiary of CNO Financial Group (formerly Conseco), has shown measurable improvement in its financial strength in recent years, given its history.

Following its 2003 emergence from Chapter 11 bankruptcy, CNO Financial Group Inc., formerly known as Conseco Inc., executed a series of strategic maneuvers to isolate and offload "legacy" long-term care and life insurance policies that threatened its financial stability.

The company, headquartered in Carmel, primarily used independent trusts, subsidiary sales, and reinsurance agreements to divest itself of volatile blocks of business sold during the 1980s and 1990s.

In 2008, CNO transferred Conseco Senior Health Insurance Co. into an independent, non-profit entity called the Senior Health Care Oversight Trust. Renamed the Senior Health Insurance Company of Pennsylvania (SHIP), the entity was separated from CNO’s balance sheet.

The spinoff was intended to protect CNO from rising long-term care claim costs. However, SHIP eventually faced its own insolvency and was placed into rehabilitation by the Pennsylvania Insurance Department in 2020.

Despite its past, A.M. Best most recently affirmed Bankers Life’s Financial Strength Rating of A (Excellent) with a stable outlook. Fitch Ratings has also affirmed an ‘A’ Insurer Financial Strength rating for CNO’s insurance subsidiaries, including Bankers Life.

Poor Customer Experience

Even with stronger financial ratings, customer experience remains a significant concern. Multiple consumer reviews and regulatory analyses continue to cite issues involving claim delays, claim denials, and sales practices, resulting in a higher-than-average complaint index relative to the company’s size.

Bankers Life has a higher-than-average customer complaint index specifically for Long-Term Care Insurance, according to data from the National Association of Insurance Commissioners (NAIC), many involving delays and claim denials.

The Better Business Bureau also lists a substantial number of complaints, many centered on claim handling and agent conduct. While online reviews are not definitive on their own, the consistency of these issues across multiple sources raises concern.

Bankers Life markets its policies exclusively through captive agents, meaning agents sell only Bankers Life products.

Lenient Underwriting

On the positive side, Bankers Life offers more lenient underwriting than many competitors and accepts applicants across a wide age range, roughly ages 18 to 84, which may appeal to individuals who have difficulty qualifying elsewhere.

Bottom Line

While Bankers Life has strengthened its financial position, ongoing customer service, claims handling, and distribution concerns outweigh those improvements.

Given the availability of more consumer-friendly, flexible, and competitively priced Long-Term Care Insurance options, Bankers Life is not recommended in our 2026 review.

Full Review: Learn more about Bankers Life Long-Term Care Insurance with LTC News’ full insurance review.

Federal Long-Term Care Insurance Program (FLTCIP)

Key Takeaways:

-

No longer offering new policies

-

Significant premium increases

-

No spousal benefits

-

Not partnership-certified

-

No state regulation

The Federal Long-Term Care Insurance Program (FLTCIP), administered by John Hancock Life & Health Insurance Company, has been closed to new enrollments since December 19, 2022.

The suspension, originally set for 24 months, was extended by the U.S. Office of Personnel Management (OPM) for an additional 24 months and is now scheduled to remain in effect through December 19, 2026.

New applications are not accepted, and current enrollees cannot increase coverage. Existing policyholders, however, will continue to receive benefits without interruption.

With a change in presidential administration in January 2025, additional administrative review could further affect the program’s timeline. However, no formal reopening plans have been announced.

Enrollees faced significant premium increases, with some rates rising by as much as 86% in 2024.

Unlike private insurers, the federal program does not require state approval for those increases. The plan also used a daily benefit structure rather than monthly benefits, limiting flexibility when care costs varied.

In addition, it did not offer spousal benefits. It was not partnership-certified, meaning policyholders were not protected from Medicaid if they used all the benefits in their policies. Partnership-certified policies are available through many private Long-Term Care Insurance policies.

Because of these issues, the program was not recommended prior to its suspension. Any new policy offerings will be reviewed if and when FLTCIP reopens after the suspension period ends.

Full Review: Learn more about the Federal Long-Term Care Insurance Program with LTC News’ full insurance review.

Best Hybrid Long-Term Care Insurance in 2026

Hybrid Long-Term Care Insurance policies, also known as asset-based policies, combine a life insurance policy or an annuity with qualified long-term care benefits.

These policies offer long-term care coverage and provide a death benefit to beneficiaries. Hybrid policies offer certainty; they guarantee a benefit no matter what happens and lock in a price, ensuring premiums will never increase.

The products discussed in this review are true hybrid Long-Term Care Insurance policies. Life insurance policies that include chronic illness riders or accelerate the death benefit are not true hybrid LTC Insurance and do not meet the requirements under Section 7702(b).

These regulations are essential to understand and play a crucial role in protecting everyday people from receiving unfair coverage.

Below, we’ll list the top 3 hybrid Long-Term Care Insurance companies in 2026.

|

Rank |

Company |

Best for |

A.M. Best Rating |

Underwriting |

|

#1 |

Nationwide Financial |

Best Overall Value |

A (Excellent) |

Lenient for annuity product |

|

#2 |

OneAmerica Financial |

Flexibility and Unlimited Benefits |

A+ (Superior) |

Accommodating |

|

#3 |

Brighthouse Financial |

Cash Benefits |

A (Excellent) |

Flexible |

#1. Nationwide Financial – Best Hybrid Long-Term Care Insurance for Overall Value

Nationwide Financial remains our top choice for hybrid Long-Term Care Insurance in 2026. The company offers great hybrid policy benefits, and its new annuity product, with lenient underwriting, can be valuable for those with pre-existing conditions

Nationwide Financial is one of the most recognizable insurance companies in the United States, known for its national brand presence, long operating history, and strong financial position.

Financial Strength

As of the most recent ratings heading into 2026, Nationwide continues to demonstrate solid financial strength, with ratings including:

-

A.M. Best: A (Excellent)

-

S&P Global (Standard & Poor's): A+

-

Moody's: A1

Policy Options: CareMatters vs. CareMatters Together

Nationwide offers a range of long-term care solutions, including riders attached to traditional life insurance policies.

Most notably, Nationwide offers two asset-based hybrid Long-Term Care Insurance products that have become leaders in this category:

-

CareMatters: Standard hybrid policy offering

-

CareMatters Together: Hybrid policy designed for couples.

CareMatters is a linked-benefit hybrid policy that combines long-term care coverage with a life insurance death benefit. While the benefits within CareMatters are great, the underwriting tends to be conservative.

Key features in CareMatters policies:

-

Monthly benefit amounts ranging from $2,500-$20,000

-

Benefit periods of 2-7 years

-

Cash benefits give families maximum flexibility

CareMatters Together is explicitly designed for couples and offers exceptional planning flexibility.

Key features in CareMatters Together policies:

-

Shared benefit pool equal to 48, 72, or 96 months of benefits.

-

Use your benefits for either or both insured in any combination.

-

Second-to-die death benefit, preserving value for beneficiaries if you never need care.

While both policies include a 90-day elimination period, Nationwide pays the full monthly benefit retroactively once day 91 is reached, effectively functioning as a zero-day deductible once eligibility is established.

New in 2026: CareMatters Annuity

As of 2026, Nationwide also offers CareMatters Annuity, an annuity-based linked-benefit solution that combines a fixed annuity with tax-qualified long-term care benefits.

CareMatters Annuity provides long-term care protection using a single lump-sum payment or a tax-free 1035 exchange from an existing non-qualified annuity or life insurance policy.

Because the policy is annuity-based, underwriting requirements are simplified, typically limited to a brief medical questionnaire and, for older applicants, a cognitive screening.

These lenient underwriting requirements make CareMatters Annuity accessible to some individuals who may not qualify for traditional or life-based hybrid LTC policies.

CareMatters Annuity provides tax-free cash-indemnity long-term care benefits, meaning that once a claim is approved and the elimination period is satisfied, the policy pays the full monthly LTC benefit in cash, without requiring bills or receipts.

If long-term care is never needed, any remaining contract value is paid to beneficiaries as a death benefit.

Full Review: Learn more about Nationwide Financial Hybrid Long-Term Care Insurance with LTC News’ full insurance review.

#2. OneAmerica Financial – Best Hybrid Long-Term Care Insurance for Unlimited Benefits

Although it is less well known than some competitors, OneAmerica Financial has a long track record of financial strength and stability and earns our No. 2 ranking for hybrid Long-Term Care Insurance solutions in 2026.

Financial Strength & Ratings

OneAmerica Financial is a financially strong company with a stable outlook. In 2025, they received an A+ (Superior) rating from A.M. Best.

Key Features & Benefits

OneAmerica offers two hybrid products that integrate qualified long-term care benefits with life insurance or annuity options.

In October 2024, OneAmerica launched Asset Care® 2024, an enhanced product offering more flexibility and designed to be more price-competitive.

The Asset Care® 2024 policy includes a cash benefit option, allowing you to receive up to 75% of your benefits in cash, enhancing flexibility in care choices.

Notably, OneAmerica also offers solutions that allow you to use qualified funds from 401(k) or IRA accounts to help fund your hybrid Long-Term Care Insurance policy, adding flexibility to retirement and tax planning.

OneAmerica is also a great option for couples, allowing joint long-term care benefits, individual monthly benefits, and a second-to-die death benefit. Plus, the only hybrid product offering unlimited long-term care benefits as an option.

Underwriting

OneAmerica offers relatively accommodating underwriting, making it somewhat easier for those with health conditions to qualify for its annuity-based product than with other companies.

Full Review: Learn more about OneAmerica Financial Hybrid Long-Term Care Insurance with LTC News’ full insurance review.

#3. Brighthouse Financial – Best Hybrid Long-Term Care Insurance with Full International Cash Benefits

Offering cash benefits, international flexibility, and solid financial strength, Brighthouse Financial earns our number 3 ranking for hybrid Long-Term Care Insurance in 2026.

Brighthouse Financial, which was spun off from MetLife several years ago, offers a hybrid Long-Term Care Insurance solution that stands out for its all-cash benefit design and broad international coverage.

On Nov. 6, 2025, Brighthouse Financial entered into a definitive merger agreement under which an Aquarian Capital affiliate will acquire the company for $70 per share in an all-cash transaction valued at about $4.1 billion.

The deal is expected to close in 2026, subject to stockholder and regulatory approvals. This change will not affect policies in force and is not expected to impact policyholders or future policyholders.

Financial Strength & Ratings

Brighthouse Financial continues to carry strong financial ratings, supporting its long-term ability to meet policy obligations. Recent ratings include:

-

A.M. Best: A

-

S&P Global (Standard & Poor's): A

-

Moody’s: A3

Key Features & Benefits

A key feature of Brighthouse’s hybrid policy is that long-term care benefits are paid entirely in cash, giving policyholders maximum flexibility.

Once a claim is approved, the full benefit amount is paid directly to the policyholder, allowing funds to be used for any qualified care arrangement without restrictions on providers or settings.

The policy also includes full international coverage, making it a practical option for individuals who plan to retire abroad, spend extended time outside the United States, or relocate internationally.

Flexible Underwriting

Brighthouse’s underwriting guidelines are generally more flexible than those of many competitors. This means some applicants with somewhat more complex health histories may be able to qualify.

As with any policy, eligibility depends on individual medical factors, so asking a qualified Long-Term Care Insurance specialist for guidance is an essential step in the application process.

Full Review: Learn more about Brighthouse Financial Hybrid Long-Term Care Insurance with LTC News’ full insurance review.

Other Hybrid Long-Term Care Insurance Considerations

Special Mentions

-

EquiTrust: This is a qualified hybrid that combines an indexed annuity with guaranteed tax-free long-term care benefits. Every applicant gets approved, but underwriting determines the size of the long-term care benefits, which are paid in cash once you qualify for benefits.

-

Securian Financial: SecureCare IV is the latest version of Securian Financial’s hybrid whole life insurance policy with long-term care benefits available in 2026. It’s designed to provide both a guaranteed death benefit and long-term care cash indemnity in a single policy. It also offers full international benefits.

Employer-Sponsored Hybrid Plans

In addition to LifeSecure, which offers employer-sponsored traditional Long-Term Care Insurance, several insurers offer employer-sponsored plans that combine life insurance with a long-term care benefit.

These plans are typically more expensive and provide limited long-term care coverage compared with individual Long-Term Care Insurance options.

Companies that offer these types of plans include:

-

Trustmark

-

Allstate

-

Chubb

For employees who work full-time and have significant health issues, these plans can be very appealing because they often feature guaranteed approval.

For individuals without major health concerns, however, it is usually possible to find more comprehensive long-term care coverage at a lower cost outside of the employer-sponsored market.

Companies Offering Cash Benefits

-

Brighthouse

-

EquiTrust

-

John Hancock

-

Nationwide

-

OneAmerica

-

Securian

Hybrid Plans with Shared Spousal Benefits

-

Nationwide

-

One America

Hybrid Long-Term Care Insurance with Full International Benefits

While most hybrid Long-Term Care Insurance policies offer limited international coverage, the following companies provide full overseas benefits:

-

Brighthouse

-

EquiTrust

-

John Hancock

-

Lincoln Financial

-

Securian Financial

Hybrid Annuity–Long-Term Care Policies with More Lenient Underwriting

-

EquiTrust

-

Nationwide

-

One America

-

Global Atlantic

Guaranteed-Issue Hybrid Annuity LTC Policy

EquiTrust offers an annuity-based hybrid long-term care policy with guaranteed issue, meaning coverage is available regardless of health history.

Best Short-Term Care Insurance (Cash Indemnity) Options

Short-term care insurance is a cash-indemnity plan designed to help offset some long-term care costs. These policies are not traditional Long-Term Care Insurance and should not be used in place of proper coverage.

Instead, short-term care insurance can help pay for care during gaps, such as elimination periods. These policies offer lenient underwriting, cash benefits, and up to 1-2 years of benefits, with some policies paying over $200,000 in total benefits.

While these policies may lack the comprehensive features of traditional LTC Insurance, they can serve as affordable alternatives for individuals who need flexible coverage or have health conditions that make traditional options unavailable.

In this section, we'll cover our top recommendations for short-term cash indemnity coverage.

|

Rank |

Company |

Best for |

A.M. Best Rating |

Underwriting |

|

#1 |

Aetna |

Best Overall Value |

A (Excellent) |

Very flexible, compared to LTC Insurance |

|

#2 |

Manhattan Life |

Inflation Protection and Drug Indemnity |

B++ (Good) |

Simplified, compared to LTC Insurance |

|

#3 |

Guaranteed Trust Life |

Flexibility and Inflation Protection |

A (Excellent) |

Broader guidelines, compared to LTC Insurance |

#1. Aetna Short-Term Care Insurance – Best Overall Value

Aetna offers two distinct short-term care insurance options, providing flexible underwriting and value-packed benefits.

Financial Strength & Ratings

Aetna is a financially stable company with a strong balance sheet and a stable outlook. A.M. Best rated Aetna A (Excellent).

Policy Options

Aetna offers two short-term care insurance products:

-

Recovery Care

-

Home Care Plus

Recovery Care is one of the most comprehensive cash indemnity policies available in 2026.

Once you qualify for benefits, the policy provides the full eligible benefit amount in cash, regardless of the actual cost of services. This flexibility allows you to use any provider you choose, including family members, for caregiving services.

Recovery Care offers a flexible, cash-based approach to addressing aging-related care needs. Features such as restoration of benefits and hospital indemnity coverage make it an even more attractive option.

As hospital visits become more common with age, Aetna's plan provides a financial safety net for post-hospital care, whether that care is delivered at home or in a facility. Its cash-benefit structure allows you to access funds immediately, even if you are not receiving formal long-term care services.

Aetna also offers Home Care Plus. This product eliminates the facility portion of the product above. Some people who are ineligible for Recovery Care may qualify for this product.

Key Features & Benefits

Facility-Based Care:

-

Pays the full benefit over 360 days in any long-term care facility, including: Nursing homes, memory care centers, rehabilitation facilities, and assisted living facilities.

-

Includes a restoration of benefits. (If you recover and go 180 consecutive days without requiring care, an additional 360 days of benefits are restored.)

-

Maximum daily benefit: $400 per day.

In-Home Care:

-

Pays the full benefit over a 52-week period for in-home care (51 weeks in some states).

-

Also includes a restoration of benefits in most states.

-

Maximum weekly benefit: $1,200 per week (higher limits in some states, with $1500 a week, and in Texas, up to $3,000 per week).

General Benefits:

-

Hospital Indemnity Benefit: Pays up to $400 per day for each night you are hospitalized, with no ties to health insurance or Medicare coverage.

-

Payments are made directly to you, not to providers, giving you the freedom to use the cash as needed.

-

No long-term care triggers. Your benefits activate after an overnight hospital stay.

Underwriting

Aetna’s underwriting is also far more flexible than traditional Long-Term Care Insurance, making the coverage accessible to a broader range of applicants.

Full Review: Learn more about Aetna short-term care insurance with LTC News’ full insurance review.

#2. Manhattan Life – Best Short-Term Care Insurance for Inflation Protection and Drug Indemnity

Manhattan Life's short-term care insurance stands out due to its inflation protection, prescription drug indemnity benefits, and flexible cash payouts.

These features make it an appealing, cost-effective option for those seeking coverage with broader underwriting eligibility and inflation benefits.

Financial Strength & Ratings

Manhattan Life has good financials with an A.M. Best Rating of B++ (Good).

Key Benefits & Features

OmniFlex by Manhattan Life is a versatile cash indemnity policy similar to Aetna's Recovery Care but with additional benefits that enhance flexibility and value.

Facility and In-Home Care Benefits:

-

Facility care benefit: Provides up to $400 per day for care received in a facility (nursing home, assisted living, memory care, or rehabilitation).

-

In-home care benefit: Provides up to $300 a day for in-home care services.

-

Includes a hospital indemnity benefit that pays cash directly for each day spent in the hospital, offering added financial support for recovery-related expenses.

-

The Fast-50™ Benefit eliminates the elimination period and provides an immediate cash payout equal to 50% of your accumulated daily benefit on the first day of care. This flexible benefit can be used for any purpose, making it especially valuable when spouses, family members, or friends assist with your care. It allows you to extend in-home care by using 50% of the facility benefit and receiving the remaining 50% in cash.

Inflation Protection:

-

Manhattan Life offers an optional 5% simple inflation benefit that increases your annual benefit amount until it doubles, without increasing your premium.

Prescription Drug Indemnity Benefit:

-

Pays $10 for generic and $25 for brand-name prescriptions, up to $300 per year.

-

Pays you a cash benefit directly, regardless of whether your health insurance fully covers the prescription.

-

If you regularly take multiple medications, this feature can effectively offset premiums, making the policy even more affordable.

Simplified Underwriting

Like other products in this category, underwriting is more lenient than traditional Long-Term Care Insurance.

Eligibility is typically based on a few knock-out health questions and a prescription drug review, making it accessible to individuals with some pre-existing health conditions.

Full Review: Learn more about Manhattan Life short-term care insurance with LTC News’ full insurance review.

#3. Guaranteed Trust Life – Best Short-Term Care Insurance for Flexibility and Inflation Protection

Guarantee Trust Life (GTL) is one of LTC News' top choices for short-term care insurance because of the flexibility and value its products offer.

GTL also offers relatively lenient underwriting, making it easier for some people with health issues to qualify for coverage.

Financial Strength & Ratings

Guarantee Trust Life is considered financially stable, with an A (Excellent) rating from A.M. Best.

Policy Options

Guaranteed Trust Life offers several insurance products designed to provide flexible care options.

Recovery Cash:

-

Features broader underwriting than traditional Long-Term Care Insurance but remains more conservative than GTL's other products.

-

Provides coverage for: nursing homes, assisted living facilities, and home care services

-

Ideal for individuals seeking comprehensive care benefits with less restrictive underwriting than standard LTC policies.

Home Health Care:

-

Offers limited home care benefits but has very broad underwriting, making it a viable option for individuals who may be unable to qualify for coverage through other insurers.

-

Includes a prescription drug indemnity benefit, which pays cash for medications and can significantly reduce premiums—especially for those who regularly take multiple prescriptions.

-

Designed as a last-resort option for those facing health challenges that disqualify them from traditional plans.

Home Care Secure:

-

A home care-only policy with underwriting requirements similar to Aetna's home care option.

-

Provides focused coverage for in-home care needs, making it another option for those with health issues who may have fewer options.

Full Review: Learn more about Guaranteed Trust Life short-term care insurance with LTC News’ full insurance review.

Frequently Asked Questions

How Much Does Long-Term Care Insurance Cost in 2026?

In 2026, Long-Term Care Insurance costs between $1,000 - $2,000 per year, depending on many factors like your age, health, and how many benefits are within your policy.

Hybrid Long-Term Care Insurance costs can be much higher because it combines life insurance with long-term care benefits.

Are Cheaper Long-Term Care Insurance Companies Riskier?

Cheaper Long-Term Care Insurance companies or policies are not inherently riskier.

All Long Term Care Insurance policies must meet federal requirements under Section 7702(b) of the tax code. These regulations ensure that policies provide comprehensive long-term care coverage, limit excessive premium increases, and require claims to be paid out once benefit triggers are met.

When a company offers Long Term Care Insurance at a lower price than another, it does not mean the policy is riskier. Each insurer independently calculates its costs and risk under strict regulatory oversight and prices its policies accordingly based on what it can sustainably support.

Rather than judging risk solely by price, it is more important to evaluate factors such as policy design, the company’s financial strength, and its track record of customer service and claims handling.

What Is the Best Age to Buy LTC Insurance?

In general, it's best to buy Long Term Care Insurance as young as you can and when it makes sense for you financially. Most people buy Long-Term Care Insurance between the ages of 47 and 67.

A majority of people find that their 50s make the most sense because you often have a good balance of financial stability, strong health, and enough proximity to retirement for long-term care planning to feel relevant.

The longer you wait, the greater the risk of developing health conditions that could disqualify you from coverage or increase your rates. This risk increases significantly with age.

While everyone has a different timeline, in general, the younger you are when you purchase coverage, the better off you will be.

Choosing the Best Long-Term Care Insurance Company in 2026

This overview of the best Long-Term Care Insurance companies underscores the importance of choosing coverage that will remain affordable, dependable, and comprehensive when you need it most.

In this review, we've analyzed traditional, hybrid, and short-term care insurance offerings from several providers. Our reviews are based on financial strength, policy offerings, pricing, and underwriting guidelines.

Choosing the best Long-Term Care Insurance company for you and your family is a very personal decision, and we hope this review has made it clearer.

Long-term care needs can arise out of nowhere, for a variety of reasons, including chronic illness, reduced mobility, cognitive decline, and the natural effects of aging.

While anyone can need extended care at any stage of life, the risk increases significantly as you age.

Neither health insurance nor Medicare covers senior care needs, making Long-Term Care Insurance a critical component of a well-designed retirement plan.

Long-term care planning is about more than protecting your assets. It is about ensuring access to quality care in the setting you prefer and easing the burden on loved ones, so they can remain family members rather than becoming full-time caregivers.

Work with a Qualified Specialist

It's normal to feel overwhelmed by the Long-Term Care Insurance options and details.

If you're looking for guidance, a qualified Long-Term Care Insurance specialist can make the process easier to understand.

Specialists are trained, licensed, and experienced specifically in long-term care planning, unlike most general insurance agents or financial advisors whose focus is broader.

Whether you are considering traditional Long-Term Care Insurance, hybrid solutions, or short-term cash-based options, planning provides peace of mind, financial protection, and access to quality care, helping you maintain independence and dignity throughout the later stages of life.

LTC News does not sell long-term care products (we do, however, sell advertising.) LTC News forwards requests for quotes and information to pre-screened specialists representing top-rated companies that offer long-term care solutions.

This means you'll work with a pre-screened LTC News Trusted Partner who:

-

Is licensed in your state.

-

Represents multiple top-rated Long-Term Care Insurance companies.

-

Holds the CLTC designation.

-

Endorsed by the American Association for Long-Term Care Insurance (AALTCI).

-

Highly recommended as Ramsey Trusted Pros by financial expert Dave Ramsey's organization (Ramsey Solutions).

Many of LTC News Trusted Partners are insurance specialists with strong affiliations with both Christian and Jewish organizations, reinforcing their commitment to ethical service and community values.

Help with Long-Term Care Insurance Claims

The most important part of Long-Term Care Insurance is knowing that your benefits will be there when you need them.

According to a November 2025 AHIP report, Long-Term Care Insurance policies have paid more than $193 billion in claims since the product's inception in the late 1970s.

LTC News works with Amada Senior Care, a trusted in-home care provider, to help you use your Long-Term Care Insurance benefits. This service is completely free and comes with no obligation.

Experience peace of mind knowing you can access quality care services when you need them most, when you file a Long-Term Care Insurance claim with the help of LTC News and Amada Senior Care.

LTC News – Your Hub for Everything Long-Term Care

LTC News offers a broad range of articles covering aging, caregiving, health, lifestyle, long-term care, and retirement planning.

LTC News also provides practical tools and resources to help you navigate everything from finding long-term care services for a loved one to healthy living, retirement planning, and preparing for your future long-term care needs.

If you have loved ones who may need care now or in the future, the LTC News Caregiver Directory is the nation's most comprehensive database of caregivers, home health agencies, senior communities, adult day care centers, assisted living, memory care, and nursing homes.

Our goal is to provide educational content and expert guidance to assist you in your journey toward comprehensive long-term care planning and to help you avoid a family crisis.