Senior Housing Investment Surges in 2025 as U.S. Faces a Major Shortage by 2030

Table of Contents

- A Market Heating Up as Demand Surges

- Top Markets for Senior Housing Investment in 2025

- Why This Matters to You and Your Family

- The LTC News Caregiver Directory Helps You Navigate a Tightening Market

- What a Growing Senior Housing Gap Means for Aging Americans

- How You Can Prepare Today

- A Sector Strengthening, but a Shortage Still Looms

You may feel the pressure building inside your head even before you begin looking for extended care for a parent or even planning ahead for yourself. Senior housing communities are filling faster. Waitlists are longer. More and more people need long-term care, and it is becoming a crisis.

The cost for long-term care services is rising. New national data confirms what many older adults and families already sense. The U.S. is not building enough senior housing to keep pace with aging Americans, and the gap is widening.

A new NIC MAP report identifies the Top Markets for Senior Housing Transactions in 2025, showing a sector gaining strength, attracting capital, and signaling a coming shortage that will directly affect where and how you age.

NIC MAP is a data analytics platform built specifically for the senior housing and care industry. Founded in 2004, it offers market data, forecasting tools, and performance metrics that help operators, investors, developers, and healthcare providers make informed decisions.

A Market Heating Up as Demand Surges

The report shows that the U.S. will be short 550,000 senior living units by 2030, representing a $275 billion development gap. To meet demand from a fast-growing 80-plus population, developers would need to triple today’s construction pace.

Transaction activity reflects how investors interpret this challenge.

NIC MAP found that for the first three quarters of 2025:

- Total seniors housing and nursing care transaction volume reached $16.3 billion.

- Senior housing alone accounted for $10.3 billion.

- More than 1,000 properties changed hands over the past 12 months — a 7 percent increase from 2024.

- The average price per unit climbed to $175,000, a 43 percent year-over-year increase.

This data paints a clear picture of a market that’s regained its footing. Transaction activity, pricing momentum, and capital interest are all accelerating. — Arick Morton, CEO of NIC MAP.

For investors, these numbers signal opportunity. For older adults, it signals potential competition, higher costs, and limited availability unless planning begins early.

Top Markets for Senior Housing Investment in 2025

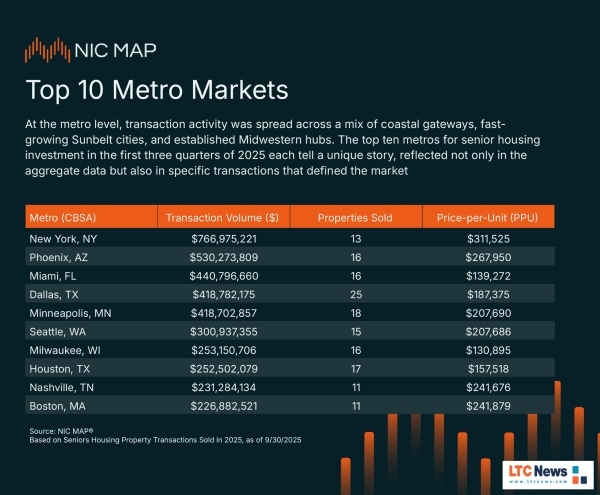

NIC MAP identified the metro areas with the strongest transaction volume and pricing activity during the first three quarters of the year:

“Investor activity is broad-based and strategically focused,” Morton said. “We’re seeing capital flow into both primary and secondary markets as investors pursue assets aligned with shifting demographics.”

For consumers, this means availability and pricing will vary dramatically by region. Markets like New York and Phoenix are seeing robust investment and rising valuations, while others lag behind in new development.

The LTC News Cost of Care survey shows that long-term care facility costs can vary dramatically from one community to the next.

Why This Matters to You and Your Family

You may not follow commercial real estate trends, but these numbers will eventually shape your long-term care decisions.

1. Rising prices will affect future care costs.

Higher price-per-unit transactions influence rental rates, monthly service fees, and care levels across assisted living, memory care, and independent living.

2. A national shortage means more competition for quality options.

NIC MAP warns of a 550,000-unit shortfall. That shortage can mean:

- Waitlists for desirable communities.

- Lower availability of specialized memory care.

- Fewer options for middle-income families.

- Those individuals with Long-Term Care Insurance will have an advantage in finding quality facilities of their choice.

3. Planning ahead will matter more than ever.

Planning early gives you the financial freedom to select top-quality care rather than settling for whatever is available during a crisis. Long-Term Care Insurance helps you pay for the care you want, at home or in a preferred facility. Policyholders are often prioritized for placement in high-demand communities.

The LTC News Caregiver Directory Helps You Navigate a Tightening Market

As communities fill and prices rise, you need fast access to local care options. The LTC News Caregiver Directory is the nation’s largest searchable database of:

- Home care agencies

- Adult day care centers

- Assisted living communities

- Memory care facilities

- Rehabilitation centers

- Nursing homes

You can search by ZIP code anywhere in the United States, from New York to Phoenix to Nashville.

Use the directory to compare providers, identify availability, and plan ahead before a crisis limits your choices.

Claim your free listing on the LTC News Caregiver Directory and/or upgrade the listing to enhance visibility and highlight your staff and services through the LTC News Directory Business Portal.

What a Growing Senior Housing Gap Means for Aging Americans

NIC MAP’s data shows investor confidence. But confidence doesn’t automatically translate into enough supply.

The U.S. will see record growth in adults aged 80 and older over the next decade. Without new development, seniors may encounter higher care costs and limited placement options, especially those living with chronic illness, mobility issues, or cognitive impairment.

Families often underestimate how quickly an unexpected fall, a stroke, or early dementia symptoms can shift care needs. And Medicare does not pay for most long-term care, outside of up to 100 days of skilled nursing under specific conditions.

That’s why planning matters now. According to the 2025 AHIP State-to-State Long-Term Care Insurance Report, the top insurers paid $16.8 billion in benefits in 2024 alone, supporting quality care for policyholders nationwide.

Since the inception of Long-Term Care Insurance, carriers have paid more than $193 billion in long-term care benefits.

Learn more about Long-Term Care Insurance with the LTC News Education Center.

How You Can Prepare Today

Aging well means preparing before needs arise. Consider these steps:

Evaluate long-term care options early

Review assisted living, memory care, and home care availability for a loved one in your area using the LTC News Caregiver Directory.

Review long-term care costs in your area

The LTC News Cost of Care Calculator provides the most current costs for every type of care and projects future expenses.

Be sure to use LTC Insurance benefits

If your loved one has an LTC policy, don't delay using the benefits. Be sure the admission director understands your loved one has an LTC policy.

Get free assistance in processing a Long-Term Care Insurance claim with any insurance company. LTC News partners with Amada Senior Care to provide free claim support with no cost or obligation — File a Long-Term Care Insurance Claim.

Consider Long-Term Care Insurance while you are still insurable

A tax-qualified LTC Insurance policy can help you:

- Protect retirement income and assets

- Ensure choice of high-quality care

- Reduce the emotional and financial burden on loved ones

- Get quotes from all the top-rated companies by using a qualified Long-Term Care Insurance specialist.

A Sector Strengthening, but a Shortage Still Looms

NIC MAP’s 2025 findings show a sector experiencing strong transactional momentum and growing investor attention. But even with billions flowing into acquisitions, the U.S. still has too little development to match the needs of older adults over the next five years.

For you, the takeaway is clear. Experts say that planning financially, medically, and logistically is the best way to maintain control over where and how you live as you age.