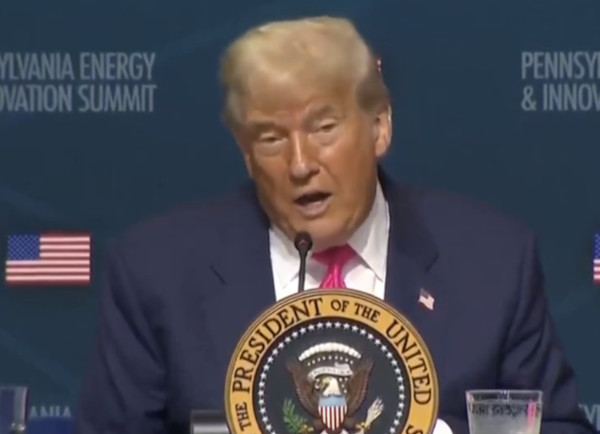

Trump’s Leg Swelling Diagnosis: White House Confirms Chronic Venous Insufficiency

Looking for a way to share your knowledge with a wider audience? LTC News partners with industry voices to provide information and resources related to care and aging.

Step 1 of 4

Step 1 of 4

LTC News Trusted & Verified

Compare Insurers

+