Medicare Open Enrollment 2025: Dates, Deadlines, and Long-Term Care Coverage

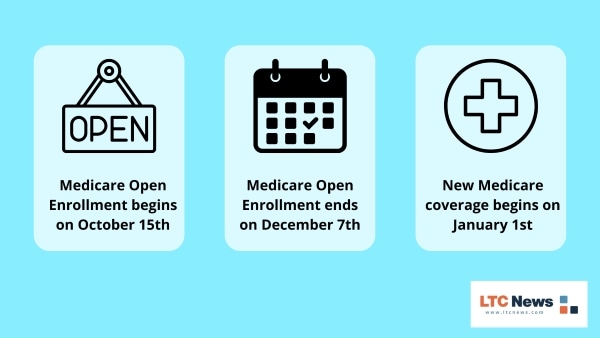

The 2025 Medicare Open Enrollment period is here, running from October 15th to December 7th. For millions of Americans aged 65 and older, this brief window presents an opportunity to discover new Medicare coverage options.

In this article, we’ll break down what Medicare Open Enrollment 2025 is, key deadlines, and answer common questions to help you make confident coverage decisions.

Understanding Medicare Open Enrollment

What Is the Medicare Open Enrollment Period?

The Medicare Open Enrollment period, also known as the Annual Enrollment Period (AEP), is an annual period that allows individuals on Medicare to make changes to their coverage.

What You Can Do During the Medicare Open Enrollment Period

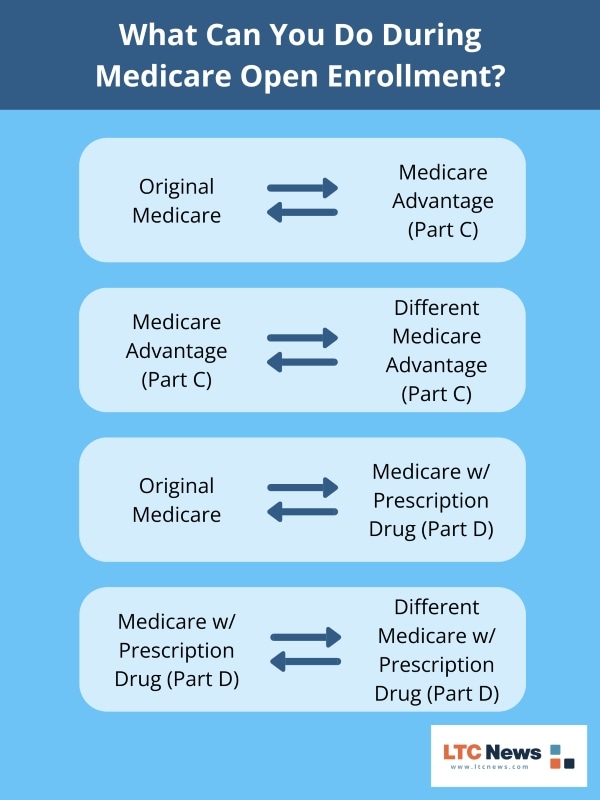

The Medicare Open Enrollment period allows you to make several types of changes to your Medicare coverage, including:

-

Switch from Original Medicare to Medicare Advantage (and vice versa).

-

Switch from one Medicare Advantage plan to a different Medicare Advantage plan, which may give you access to different provider networks.

-

Add, remove, or change prescription drug coverage.

Here’s a visual:

When Is Medicare Open Enrollment for 2025?

Medicare Open Enrollment 2025 runs from October 15th to December 7th.

Once the enrollment period ends on December 7th, you won’t be able to make changes until next year unless you qualify for a Special Enrollment Period (which we’ll discuss later in this article) or you are enrolled in a Medicare Advantage plan, which has its own enrollment window from January to March.

Any updates or new plans you select will take effect on January 1st, 2026.

If you don’t make any changes during this time, your current plan will automatically renew. However, please note that coverage details, such as premiums, copays, and covered services, are subject to annual changes.

To learn about any upcoming changes, review your Annual Notice of Change (ANOC), which should have been mailed to you in September. Any plan updates outlined there will also take effect on January 1st, 2026.

5-Step Guide on How To Prepare for Medicare Open Enrollment

Understanding the Medicare Open Enrollment period is only half the battle.

In this section, we’ll provide a step-by-step guide to help you make the most of this time and choose Medicare coverage that fits your needs and budget.

You’ll learn what steps to take before changing your plan, how to make those changes, and what to expect throughout the process.

Step 1: Evaluate Your Health and Coverage Needs

Medicare is supposed to support your health needs first and foremost. So finding the best plan for you starts with understanding your current and future healthcare needs.

Even if you're healthy, chronic conditions can develop with little to no warning. That's why it's essential to evaluate your health and risks:

-

Look at your personal health history and any ongoing conditions.

-

Consider family history of chronic illnesses such as heart disease, dementia, diabetes, or cancer.

-

Take note of lifestyle factors that may influence future care needs, such as weight, activity level, or smoking habits.

RELATED: Nutrition Tips for Older Adults: Wellness, Aging and Diet

Consider what specialized services or prescription drugs you may need:

-

If you take prescription medications regularly, make sure your plan covers them.

-

Consider whether you may need access to specialists or frequent doctor visits.

-

Consider the preventive care, screenings, and chronic condition management programs offered by health plans.

Ask yourself additional questions about coverage and healthcare values:

-

What healthcare services do I use most often?

-

Does this plan cover my prescriptions?

-

Will I need access to specialists, specialized services, or specific hospitals or care providers?

-

How likely is my health situation to change in the next year, and how would that affect my coverage needs?

-

Are there additional benefits that matter to me, such as dental, vision, or wellness programs?

By taking the time to review your health needs, potential risks, and the coverage each plan offers, you can make a more informed decision that protects both your health and your budget.

Step 2: Review Your Annual Notice of Change (ANOC)

Medicare plans are reviewed and updated annually. This means that even if you take no action during Medicare Open Enrollment, your plan could still change. Changes might include different copays, updated prescription drug coverage, or modifications to other benefits.

Each year, Medicare sends an Annual Notice of Change (ANOC) outlining any updates to your plan’s coverage or costs for the upcoming year. You should receive your ANOC by September 30. If you don’t receive it by that date, contact a Medicare representative.

Reviewing your ANOC is important to help you determine if your current plan still meets your healthcare needs and budget. Medicare plans can change in several areas, including:

-

Copays for doctor visits, specialists, or hospital stays may change.

-

Premiums may increase or decrease.

-

Provider networks can change, including doctors and pharmacies.

-

Prescription drug coverage may change or have different costs.

-

General coverage may change, such as coverage of emergency care, skilled nursing care, or facility care.

Even if your plan doesn’t change, you will still receive an ANOC summarizing your coverage for the year. Reviewing it ensures you’re fully informed and prepared to make any necessary adjustments during Medicare Open Enrollment.

Step 3: Compare Medicare Plans and Options

After reviewing your current plan, take time to compare Medicare plans. Medicare offers an official comparison tool that makes this process straightforward.

The tool will ask a few questions, including your location, the type of plan you’re seeking, and your preferred doctors or pharmacies. Based on your answers, it will show the plans available to you.

Comparing plans allows you to see if another Medicare Advantage or Part D prescription drug plan might better meet your health needs and budget for the upcoming year.

Step 4: Get Help from a Medicare Representative or SHIP Counselor

Medicare coverage options can be confusing. Sometimes the best way to get clarity is to speak directly with a Medicare representative or a State Health Insurance Assistance Program (SHIP) counselor.

These professionals can help you:

-

Understand the differences between Medicare plans and options.

-

Review your ANOC and explain any upcoming changes to your coverage.

-

Ensure you’re not overpaying for services or missing essential benefits.

Even if you feel confident managing your coverage on your own, speaking with a professional can provide peace of mind. This is especially true for individuals who prefer a more personalized approach or are less comfortable navigating coverage online.

Step 5: Submit Your Medicare Enrollment Changes

Once you've decided on a Medicare plan that works best for you, it's time to enroll. You can change your Medicare plan in a few ways:

-

Visit Medicare's official website and complete the forms online.

-

Call (800) 633-4227 to complete your changes over the phone with a qualified Medicare representative.

-

Contact a State Health Insurance Assistance Program (SHIP) Counselor for free and personalized guidance on Medicare changes.

-

Fill out a paper form and mail it to your local Social Security office.

-

Contact your Medicare insurance provider directly.

The most important part of changing your Medicare plan is ensuring you make any changes by December 7th, 2025.

After this date, the Medicare Open Enrollment ends. This means you cannot make any changes after December 7th, 2025. New coverage changes start on January 1st, 2026.

Frequently Asked Questions (FAQs) About the Medicare Open Enrollment Period

Medicare Open Enrollment can be confusing. In this section, we'll answer some frequently asked questions about the enrollment period, requirements, and what to do if you miss the Medicare Open Enrollment period.

Is Medicare Open Enrollment Affected by the Government Shutdown?

No, Medicare Open Enrollment is not affected by the government shutdown.

Although Medicare is a federally funded program, it is considered a mandatory spending program. This means it’s not a part of the regular budget that’s up for debate during the most recent government shutdown in October and November 2025.

However, Medicare may still be affected by the government shutdown. The Medicare help number may experience some delays due to staffing shortages. This could make it more difficult to compare options or get answers to specific questions over the phone.

When Can I First Apply for Medicare?

You can first apply for Medicare during your Initial Enrollment Period (IEP). This is a seven-month window that begins three months before you turn 65, includes your birthday month, and continues for three months after.

During this time, you can sign up for Medicare Part A (Hospital Insurance), Part B (Medical Insurance), or a Medicare Advantage (Part C) plan. Enrolling early ensures your coverage starts on time and helps you avoid potential late penalties.

What Is the Medicare Initial Enrollment Period (IEP)?

The Initial Enrollment Period (IEP) is your first opportunity to enroll in Medicare.

This period lasts for seven months, starting three months before you turn 65 and ending three months after your 65th birthday month.

If you’re still working and have health insurance through your employer, you may choose to delay enrollment without facing a penalty. Once your employer coverage ends, you’ll qualify for a Special Enrollment Period (SEP) to sign up for Medicare.

What Is a Special Enrollment Period (SEP)?

A Special Enrollment Period (SEP) allows you to make changes to your Medicare coverage outside of the regular Medicare Open Enrollment period.

To qualify, you must experience certain life events or changes in circumstances, such as:

-

Moving to a new area

-

Losing your current coverage

-

Becoming eligible for new coverage options

-

Your plan is changing its contract with Medicare

-

Other special situations, such as qualifying for Medicaid

Who Can Apply During Medicare Open Enrollment?

The Medicare Open Enrollment period is open to any individual who is already enrolled in Medicare. This includes any section of Medicare.

Can I Change My Medicare Plan After Open Enrollment Ends?

The Medicare Open Enrollment Period begins on October 15th and ends on December 7th each year.

After December 7th, most people cannot make changes to their Medicare plans until the next Open Enrollment Period. However, some people qualify for a Special Enrollment Period (SEP), which we covered in a prior section.

There’s one other exception for those enrolled in Medicare Advantage (Part C). The Medicare Advantage Open Enrollment Period (MAOEP) runs from January 1st to March 31st. During this time, Medicare Advantage enrollees can make changes to their Part C coverage.

What Is the Medicare Advantage Open Enrollment Period (MAOEP)?

The Medicare Advantage Open Enrollment Period (MAOEP) happens from January 1st to March 31st each year.

During the Medicare Advantage Open Enrollment Period, individuals who are already enrolled in Medicare Advantage plans can:

-

Switch to a different Medicare Advantage plan.

-

Drop their Advantage plan and return to Original Medicare (or add a Part D plan).

This period is only for those who are already enrolled in Medicare Advantage plans.

What Is a 5-Star Special Enrollment Period?

The 5-Star Special Enrollment Period runs from December 8th through November 30th. During this time, Medicare enrollees can switch to a 5-star rated plan once per year as long as they meet all the requirements, such as living in a covered area.

This option allows you to move to any 5-star Medicare Advantage, Medicare Prescription Drug Plan, Medicare Cost Plan, or Medicare Advantage-Prescription Drug Plan. It’s designed to help beneficiaries transition to higher-quality plans based on Medicare’s performance ratings.

Does the Annual Medicare Open Enrollment Period Apply to Medigap Supplement Plans? (When Is the Medigap Open Enrollment Period?)

The Medicare Open Enrollment period does not apply to Medigap (Medicare Supplement) plans.

Medigap plans have a separate enrollment period called Medigap Open Enrollment. This period is unique to each person and is a one-time opportunity that begins the month someone turns 65 and is enrolled in Medicare Part B.

The Medigap Open Enrollment period lasts for six months. During this time, insurance companies cannot deny an applicant a Medigap policy as long as they meet the two requirements above. They are also required to offer policies at standard rates.

After the six-month window, you can still apply for Medigap policies, but you may be subject to medical underwriting, and standard rates may not be guaranteed. This means that pre-existing conditions could affect your ability to get coverage.

How Many Times Can You Change Your Medicare Plan During Open Enrollment?

You can change your Medicare plan as many times as you'd like during the Open Enrollment period.

After December 7th, you cannot make any further changes to your Medicare plan. The plan you selected last will go into effect on January 1st.

What Happens If You Don’t Make Any Changes During Medicare Open Enrollment?

If you don’t make any changes during Medicare Open Enrollment, then you’ll remain on the same plan. Every Medicare plan renews automatically annually. However, this does not necessarily mean you’ll keep the same coverage.

Medicare coverage is subject to change annually. Each September, you’ll receive an Annual Notice of Changes (ANOC) with any changes to coverage for the new year. This could include drastic changes to copays or drug coverage, or it could be no changes at all.

Regardless, staying on the same plan does not guarantee the same coverage year over year. You should review your ANOC annually to ensure you have coverage that suits your needs.

If you miss the Medicare Open Enrollment Period, you may not be able to change your Medicare plan until next year’s enrollment period in October. There are certain circumstances under which you may qualify for a Special Enrollment Period.

For more information, please read our section on other enrollment periods and options.

Does Medicare Cover Long-Term Care?

Many people assume Medicare will cover all their health needs. While Medicare helps with medical care, it does not pay for long-term care.

Long-term care refers to assistance with daily activities such as eating, dressing, or grooming. It also includes supervision for cognitive conditions, such as dementia.

About 56% of people age 65 or older will need some form of long-term care in their lifetimes, but Medicare won’t cover it.

Instead, Medicare only provides comprehensive coverage for medical care. Medicare does cover up to 100 days of short-term care provided in a skilled nursing facility (costs will depend on your plan). However, this is not the same as long-term care.

Long-Term Care (LTC) Insurance is the primary way to protect yourself against these costs. LTC insurance provides comprehensive coverage for home care, assisted living facilities, and nursing homes, often with stable premiums.

RELATED: Who Needs Long-Term Care Insurance?

As you review your healthcare needs during Medicare Open Enrollment, it’s also important to consider your long-term care needs. Aging can sneak up quickly, and you may need care for a variety of reasons, including falls, injuries, strokes, dementia, or recovery after a hospital stay.

Keep in mind: You can only purchase LTC Insurance before you actually need long-term care. Once you actively need long-term care, you won't be approved for a new policy.

RELATED: When Is The Best Time To Apply For Long-Term Care Insurance?

Plan Ahead for the Medicare Open Enrollment Period and Long-Term Care Coverage

Medicare Open Enrollment is an annual period when current Medicare enrollees can make changes to their coverage. The Medicare Open Enrollment period in 2025 begins on October 15th and ends on December 7th.

During this time, Medicare recipients can review their existing plan, switch to a different plan, add or remove certain parts of their coverage, or change their providers.

If you miss the open enrollment period, you may need to wait until the next open enrollment to update your coverage unless you qualify for a special enrollment period. That’s why it’s important to review your options and make any necessary changes before the deadline.

Along with knowing Medicare enrollment dates, it’s also essential to understand long-term care. Medicare does not cover long-term care, leaving individuals responsible for these costs.

LTC News can help you prepare for long-term care. We offer resources on caregiving, aging, retirement planning, and Long-Term Care Insurance to help you plan with confidence for the future. Here are a few helpful articles to explore:

-

Does Health Insurance, Medicare, or Medicaid Pay for Long-Term Care? – Many people don’t realize that health insurance and Medicare don’t cover long-term care. Medicaid covers care in limited circumstances, but the only way to guarantee coverage is through Long-Term Care Insurance. This article explains what each type of insurance includes and how LTC Insurance can help you cover long-term care services.

-

What Is Long-Term Care Insurance & What Does It Cover? – Long-Term Care Insurance provides comprehensive protection for long-term care needs, often at a more affordable cost than paying for care out-of-pocket. This article explores what LTC Insurance is, what it covers, how it works, and how to find a policy that fits your needs.