Table of Contents

- How Much Does Long-Term Care Cost in 2026? (National)

- Estimate Your Cost of Long-Term Care

- Long-Term Care Costs By State

- What Factors Affect Long-Term Care Costs?

- Why Is Long-Term Care So Expensive?

- Hidden Costs of Long-Term Care Most Families Overlook

- How Long Will You Need Long-Term Care?

- How To Plan for the Cost of Long-Term Care

- Frequently Asked Questions About Long-Term Care Costs in 2026

- Bottom Line: 2026 Long-Term Care Costs

In 2026, long-term care costs range from $22,997 to $128,834 per year, depending on the type of care, location, and level of assistance needed. Nursing homes cost the most, while adult day care costs the least.

On average, Americans aged 65 will spend about $135,000 on long-term care costs over their lifetimes. Of course, this is just an average; how much you’ll pay depends on your specific situation.

Most people aren't prepared for the financial impacts of long-term care prices. And here's the part that surprises most people: Medicare doesn't cover the cost of long-term care.

This guide covers the cost of long-term care by care type, explains why long-term care is so expensive, and what to expect as you plan for long-term care costs in 2026.

Note: This article focuses exclusively on long-term care prices. For information about Long-Term Care Insurance pricing, visit our dedicated Long-Term Care Insurance Cost Guide.

How Much Does Long-Term Care Cost in 2026? (National)

In the table below, we’ll break down the median daily, monthly, and yearly costs of long-term care based on service type.

It's important to note that the median cost isn't an average. The median is the middle value between the highest and lowest price points.

Please also keep in mind that these are the base costs of care.

The base cost is how much care costs without add-ons or specifications. If you have specialized needs, you may incur surcharges of up to $1,500 per month in addition to the base cost. This is especially true for assisted living facilities.

|

Median National Base Costs of Long-Term Care by Service Type in 2026 |

||||

|

Service Type |

Daily Cost |

Monthly Cost |

Annual Cost |

% Change from 2025 (Based on Annual) |

|

Adult Day Care Center |

$61 |

$1,930 |

$22,997 |

+9.4% increase |

|

Assisted Living Facilities |

$162 |

$5,005 |

$59,591 |

+8.1% increase |

|

Home Healthcare |

$185 |

$5,673 |

$67,532 |

+9.6% increase |

|

Memory Care |

$187 |

$5,723 |

$67,548 |

−1.8% decrease |

|

Nursing Homes |

$353 |

$10,824 |

$128,834 |

+12.1% increase |

(Cost data comes from the LTC News Cost of Care Calculator)

While national medians for full-time long-term care costs range from $22,997 to $128,834/year, this may not reflect how much you’ll pay for long-term care if you end up needing it.

The long-term care costs depend on where you live, how much care you need, and the service you choose.

Estimate Your Cost of Long-Term Care

You can use LTC News’s Cost of Care Calculator to get a better idea of what pricing looks like near you.

Calculate the Cost of Care

Near You in 2026

Living a fulfilling life into your senior years is about more than just medical care.

Explore resources for living your best life!

National Median

$4,570

United States

2026

$5,130

Chicago

Long-Term Care Costs By State

Long-term care costs vary dramatically by state. Factors like labor shortages, real estate costs, and state regulations can cause prices to differ by tens of thousands of dollars per year.

You can visit LTC News’s state pages for more information on costs, facilities, and insurance in each state.

Below, we’ve created two tables comparing the top 5 most expensive and the top 5 most affordable states for home healthcare, assisted living, and nursing home services. Each ranking is calculated by averaging home, assisted living, and nursing home costs.

Top 5 Most Expensive States for Home Healthcare, Assisted Living, and Nursing Homes

|

5 Most Expensive States for Long-Term Care (Annual Costs) |

|||

|

States |

Home Healthcare |

Assisted Living |

Nursing Home |

|

Alaska |

$78,829 |

$86,798 |

$349,114 |

|

Massachusetts |

$81,445 |

$84,827 |

$195,546 |

|

Connecticut |

$67,901 |

$77,023 |

$215,009 |

|

Hawaii |

$82,162 |

$78,211 |

$191,374 |

|

Vermont |

$85,652 |

$77,596 |

$164,851 |

Top 5 Most Affordable States for Home Healthcare, Assisted Living, and Nursing Homes

|

5 Most Affordable States for Long-Term Care (Annual Costs) |

|||

|

States |

Home Healthcare |

Assisted Living |

Nursing Home |

|

Louisiana |

$51,020 |

$48,977 |

$87,985 |

|

Missouri |

$58,931 |

$43,276 |

$90,553 |

|

Mississippi |

$51,435 |

$50,825 |

$102,163 |

|

Oklahoma |

$65,626 |

$51,419 |

$88,416 |

|

Arkansas |

$59,589 |

$52,996 |

$97,894 |

You may have noticed that long-term care costs don’t always move together.

For example, some states have lower home care costs but higher nursing home expenses. That’s because many factors influence pricing, so affordability in one care setting doesn’t necessarily translate into lower costs across all care settings.

What Factors Affect Long-Term Care Costs?

Long-term care costs vary widely based on several key factors. Understanding these variables can help you better estimate and plan for future care expenses.

Location and Regional Variations

Where you live is the single biggest driver of long-term care costs. The LTC News Cost of Care Calculator shows dramatic price differences between states and cities due to:

-

Cost of Living Differences: Areas with higher costs of living and higher wages have direct impacts on care pricing.

-

State Regulations and Licensing: Some states have stricter regulations for care facilities, resulting in higher administrative and compliance costs.

-

Real Estate and Operating Costs: Facility rent or mortgage payments, utilities, and property taxes vary significantly by region, affecting the overall cost of care.

Type and Duration of Care Needed

The amount and duration of care you need can significantly increase costs.

-

Level of care needed: Someone who needs round-the-clock skilled and custodial care in a nursing home will pay a lot more than someone who only needs part-time in-home care help with activities of daily living.

-

Duration of Care: The length of time you need care makes an enormous difference. A few months of care costs far less than several years.

Facility Quality and Amenities

Even within the same area, care costs can also depend on the facility you choose.

Here's how facilities can vary:

-

Standard vs. Premium Facilities: High-end facilities may offer luxurious amenities, expensive dining selections, and access to extracurricular activities. These amenities will cost more than a standard facility.

-

Facility Reputation: Facilities with great staff-to-resident ratios and good reviews may charge more than standard facilities. This often goes hand-in-hand with their quality staff, which they likely need to charge higher admission to retain.

-

Room Type: Private rooms are more expensive than semi-private or shared accommodations.

Why Is Long-Term Care So Expensive?

Why is long-term care so expensive in 2026? From wages to administrative costs to the costs of materials and supplies, providing high-quality long-term care costs a lot of money.

Rising Wages and Long-Term Care Facility Staffing Shortages

Long-term care facilities are struggling with rising wages and staff shortages, which are driving up operational costs.

According to a study by the American Health Care Association, 90% of nursing homes increased wages in 2024 to recruit and retain staff. In the same study, 46% of nursing homes reported having to limit admissions due to staffing shortages.

Inflation Increases Long-Term Care Facility Operating Costs

Since 2021, the United States has experienced volatile inflation, peaking at 9.1% in June 2022. While long-term care costs do not directly mirror inflation rates, rising labor, operational, and supply expenses can impact long-term care pricing.

Aging Population and Increased Demand for Long-Term Care Services

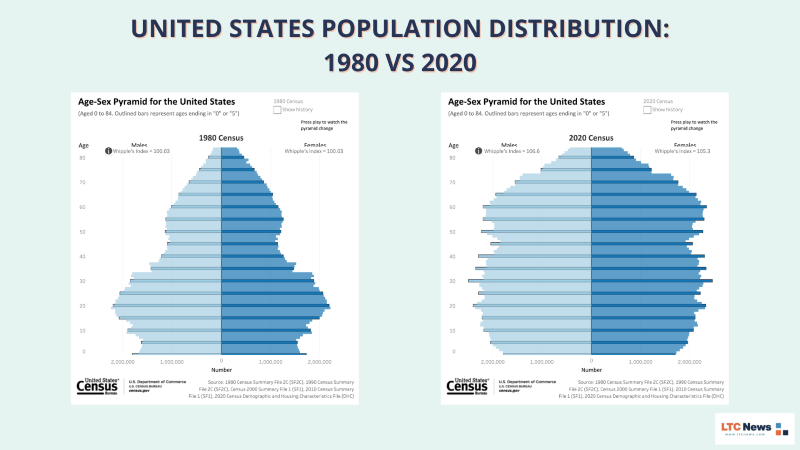

More people are entering retirement now than ever before. Historically, in the United States, the population has consisted of many young people and fewer elderly. Today, the graph has shifted, with many older people and fewer younger people to take care of them.

(Source: United States Census Bureau)

Hidden Costs of Long-Term Care Most Families Overlook

Median prices don't always equate to actual long-term care costs.

See, long-term care needs can happen for many reasons and in many ways.

Many families step in to help their loved ones long before considering professional help. At first, this could look like helping with groceries, housework, or yardwork, or driving their loved one to appointments.

Over time, these needs can develop and spiral out of control, leading to a need for professional caregiving services and assistance.

These costs are intangible, because how are families supposed to put a price on helping a loved one? Things that may not seem like much early on can lead to resentment and stress down the road.

This is what makes these costs so tricky to track. Here are a few hidden costs of long-term care to watch out for:

-

Medical Supplies: Families may need to buy medical equipment to help with caregiving. This could include handicap items like walkers or canes, or medical alert systems.

-

Transportation Expenses: Family members often drive their loved ones to and from appointments and spend time and money driving to and from their loved ones' homes to provide care. These costs add up over time.

-

Daily Living Expenses: When a loved one needs care, families may end up doing chores for them. This could include laundry, lawn care, home maintenance, and groceries.

-

Home Modifications: A majority of homes aren't conducive to senior care needs. As needs arise, families may need to install grab bars, improve lighting, or add handicap-accessible infrastructure to make their loved one's home a safer place to live.

-

Loss of Income: Most families step in to help their loved one before transitioning to professional care. This could mean losing wages or a job due to caregiving needs.

-

Loss of Time: When family members take on their loved one's care, they may lose time for themselves or time to spend with their children. This expense is intangible and can quickly lead to burnout.

-

Psychological Toll: Caring for a loved one can create emotional stress, which may lead to a need for respite care to recover from burnout, therapy, or for caregivers to seek support groups.

How Long Will You Need Long-Term Care?

You may be wondering, “Do I need long-term care? If so, how long will I need it for?”

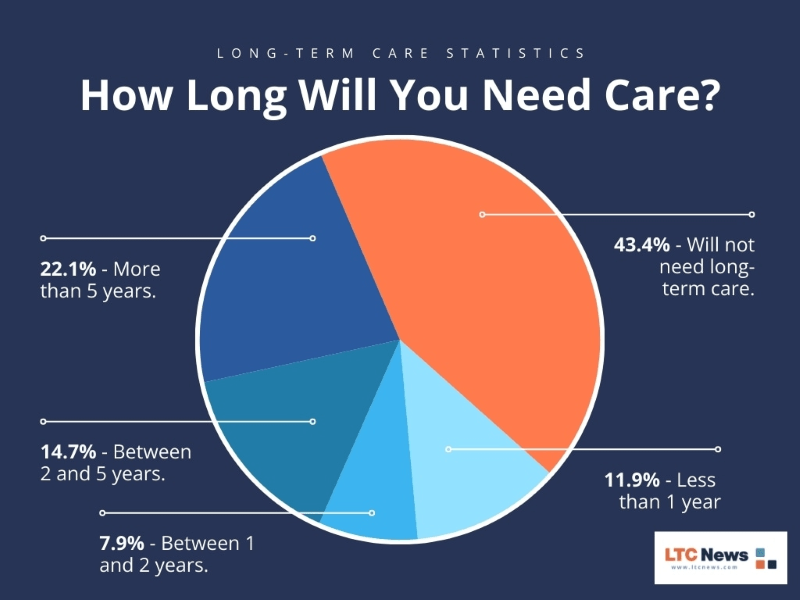

And that’s a tricky question to answer. See, everyone has different needs, backgrounds, and lifestyles. It’s impossible to predict with 100% certainty if you’ll need a month of care or 4 years.

But national data can help you estimate the amount of time that long-term care typically lasts for most Americans.

How Many People Will Need Long-Term Care?

Statistically speaking, over half of Americans, 56% to be exact, aged 65 or older, will need long-term care at some point in their lives.

Data from the 2025 Milliman Long-Term Care Index estimated that the average American aged 65 or older will need around $135,000 to cover lifetime long-term care costs.

How Long Does Long-Term Care Usually Last?

How long will you need long-term care?

For the 56% of people who will need long-term care:

-

11.9% will need care for less than one year.

-

7.9% will need care for 1 to 2 years.

-

14.7% will need care for 2 to 5 years.

-

22.1% will need long-term care for more than 5 years.

(Source: ASPE & HHS 2022 Long-Term Care Services and Support for Older Americans Study)

Risk Factors That Increase the Likelihood and Duration of Long-Term Care

So, who's at risk of needing long-term care?

-

Chronic conditions such as diabetes, Cardiovascular disease, arthritis, Alzheimer’s disease, dementia, Parkinson’s disease, multiple sclerosis, or osteoporosis.

-

Family health history of inheritable chronic conditions like dementia or autoimmune disorders.

-

Poor lifestyle choices, such as not getting enough exercise or sleep.

-

An unhealthy diet, such as not eating enough or overeating. This can also include eating overly processed or sugary food too often.

-

Recent injury or surgery may make you more likely to need help with recovery or follow-up care.

-

Socially isolated individuals may not have family or friends to rely on, leading to potential mental struggles, loneliness, and a need for paid long-term care services sooner.

-

Smoking and drinking increase the risk of developing cancers or other chronic conditions.

How To Plan for the Cost of Long-Term Care

So long-term care is expensive, but isn’t all health care expensive? You may be thinking:

My health insurance or Medicare will help pay for long-term care.

That’s where the problem lies: Medicare and regular health insurance don't cover long-term care.

Does Medicare Cover Long-Term Care Costs?

No, Medicare does not cover long-term care.

Why? Medicare is health insurance, and most health insurance policies focus on medical or skilled care. Medicare covers up to 100 days of skilled care, which includes services such as recovery, therapies, and IV treatments.

Neither Medicare nor health insurance covers long-term care, such as help with activities of daily living or long-term care needs, like getting dressed, using the bathroom, or bathing.

How Do Most People Pay for Long-Term Care?

There are three ways people cover long-term care costs:

-

Long-Term Care Insurance

-

Self-pay

-

Medicaid

To keep things brief, it’s not recommended to self-pay. Long-term care costs can quickly spiral out of control, and there’s no way to know exactly how much your care could cost you.

Relying on Medicaid isn’t a great idea either if you have assets, income, or savings you’d like to keep. You could lose everything when you spend down to meet Medicaid requirements.

However, Long-Term Care Insurance is a good solution for many people. It offers comprehensive coverage of long-term care needs, including home care, assisted living, memory care, and nursing homes. LTC insurance provides the resources to get professional care, protecting both family bonds and financial stability.

Frequently Asked Questions About Long-Term Care Costs in 2026

How Much Does Long-Term Care Cost Per Month?

In 2026, long-term care costs range from $1,930/month for adult day care to $10,824/month for nursing homes.

However, the cost of long-term care varies significantly depending on where you live, the level of care you need, and the type of facility or service you choose.

Use the LTC News Cost of Care Calculator tool to estimate how much long-term care could cost you.

Is Long-Term Care Cheaper at Home?

There isn't a simple yes-or-no answer to whether long-term care is cheaper at home vs in a facility.

The majority of long-term care begins in the home, often with help from family or informal caregivers such as spouses, adult children, relatives, or friends. Professional caregivers, like home health aides or nurses, may be added over time to support personal care and health needs.

In some situations, this can be more affordable than moving into a facility, especially if you only need part-time help or live in an area with lower caregiver rates.

However, as care needs increase to full-time or live-in support, home care costs can quickly add up. At this point, many find it more cost-effective to transition to community-based or facility care, usually starting with an assisted living facility.

But the financial comparison doesn't capture everything.

Family members who provide unpaid care face their own costs: lost wages, career setbacks, physical exhaustion, and the emotional strain of caring for someone they love. These burdens are real, even if they never appear on a bill.

Assisted living facilities offer a different value proposition: 24/7 staff availability, emergency response systems, and comprehensive daily care.

For families stretched thin by caregiving demands, this infrastructure can justify the expense and provide better outcomes for everyone involved.

So whether home care is cheaper for you and your loved ones depends entirely on how much care is needed and the burdens on your family.

What Is The Cheapest Type of Long-Term Care?

The cheapest option for long-term care is an adult day care center. These are kind of like senior centers, offering community, activities, and meals. The main difference is that adult day care also offers long-term care support services.

These facilities only operate during the day, so they make the most sense for people who need care only during the day or for those with family caregivers who can help in the evenings and weekends.

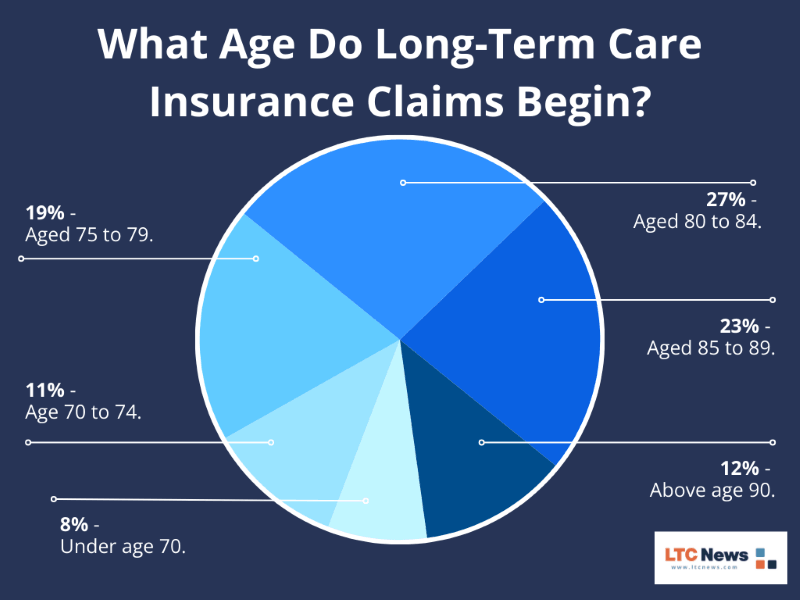

What Age Do People Usually Need Long-Term Care?

Long-term care needs are more likely to develop after age 65.

Long-Term Care Insurance claims data from the AALTCI show that:

-

19% of claims occur before age 75.

-

81% of claims occur after age 75.

-

62% of claims occur after age 80.

(Source: American Association for Long-Term Care Insurance)

Bottom Line: 2026 Long-Term Care Costs

It’s no secret that long-term care is expensive. Full-time care in 2026 ranges from $22,997 to $128,834 per year and can vary by thousands of dollars depending on where you live.

Over half of Americans turning 65 will need long-term care at some point in their lives, and nearly a quarter of those people will need care for more than 5 years, meaning long-term care could cost well into the hundreds of thousands.

Despite a lack of coverage from Medicare, long-term care costs aren’t all doom and gloom. With proper planning and education, you can protect yourself from the costs of long-term care.

LTC News is here to help. We hate to see people taken by surprise when they find out how much long-term care costs. That’s why we have tools like the Cost of Care Calculator and write pieces like this one: we want you to be prepared.

If you’d like to learn more, consider the following resources:

-

How Much Does Long-Term Care Insurance Cost? – When care costs are high, it’s natural to look for a more affordable alternative. This is where LTC Insurance comes in, providing comprehensive coverage of home care and assisted living at a price you can plan for.

-

The Long-Term Care Spectrum: From Independent Living to Skilled Nursing – This article covers the various types of long-term care services and facilities available, from adult day care to continuing care retirement communities to home care options.

-

Who Needs Long-Term Care? – This article dives deep into the risk factors associated with long-term care, helping you determine how likely you are to need help as you age and how to spot warning signs in your loved ones.