LONG-TERM CARE INSURANCE

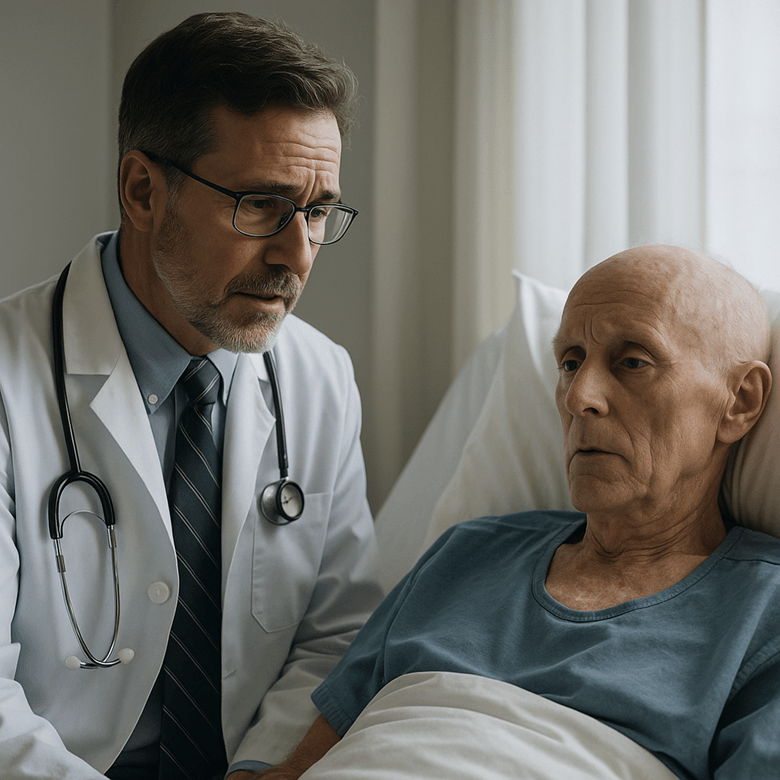

Illinois Legalizes Medical Aid in Dying — A New Era for End-of-Life Choice

Illinois becomes first Midwest state to allow terminally ill adults to access medical aid in dying, joining growing U.S. and international movement.

However, this might be a great opportunity to explore some of the most popular and fascinating topics we have to offer:

LONG-TERM CARE INSURANCE

Is Disability Insurance from an Employer the Same as Long-Term Care Insurance?

Looking for a way to share your knowledge with a wider audience? LTC News partners with industry voices to provide information and resources related to care and aging.

Step 1 of 4

Step 1 of 4

LTC News Trusted & Verified

Compare Insurers

+