Scammers Are Targeting Older Adults Online: What You Should Watch For

Scammers go where the money and trust are. Older adults often have retirement assets, answer unknown calls out of courtesy, and may not see the latest digital red flags. Being nice can lead to problems if they are not careful.

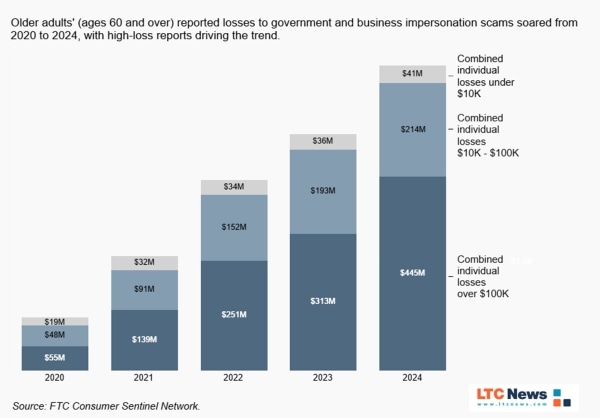

Impersonation scams are the fastest-rising threat for people 60 and over, with the FTC reporting steep multi-year growth and large-dollar losses, especially when fraudsters pose as government or well-known companies.

In late 2024, the FTC expanded the Telemarketing Sales Rule to cover tech-support schemes even when victims call in after seeing pop-ups or emails—closing a major loophole. That category alone accounted for about $175 million in reported consumer losses, age 60+ the prior year.

In 2024, then Samuel Levine, Director of the FTC’s Bureau of Consumer Protection, said the Commission will not sit idle as older consumers continue to report tech support scams as a leading driver of fraud losses.

The Scams You’re Most Likely to See

You don’t need to memorize every scheme. Learn the patterns.

- Government or business impersonation. You get a call, text, pop-up, or letter claiming there’s fraud on your account or a legal problem. The message pressures you to move money “to keep it safe,” share codes, or buy gift cards/crypto. That’s a hallmark of a coordinated imposter scam.

- Tech-support pop-ups. A screen alert says your computer is infected and gives a number to call. The “agent” asks for remote access and payment. These fake alerts commonly impersonate Microsoft or Apple.

- Romance approaches. A fast bond online followed by a money “emergency.” If money enters the chat, stop.

- Prizes and lotteries. “You’ve won—just pay taxes or fees.” Real prizes don’t ask you to pay first.

- SSA and law-enforcement look-alikes. The Social Security Administration continues to warn about messages using convincing badges or “official” letters to demand urgent payment.

What It’s Costing People Like You

The FBI’s Internet Crime Complaint Center (IC3) says Americans 60+ reported nearly $4.9 billion in losses in 2024, with average losses around $83,000, and thousands losing more than $100,000. The real toll is likely higher because many cases go unreported.

Criminals continue to launch calculated and deliberate attacks against a uniquely vulnerable population, our senior citizens. Threat actors systematically prey on their savings, their identity, and their sense of security. — Nicole Sinegar, Assistant Special Agent in Charge, Federal Bureau of Investigation, Philadelphia Division.

Five Defensive Moves to Put in Place Today

Start with the steps that cut the biggest risk quickly.

- Freeze your credit at all three bureaus. It’s free, reversible, and blocks new-account fraud. (You must contact each bureau directly for a freeze.)

- Use strong sign-in protection. Turn on multi-factor authentication (prefer app-based codes, passkeys, or hardware keys—avoid SMS when possible). NIST guidance favors phishing-resistant options like passkeys/FIDO2.

- Kill the pop-ups. If you see a “security alert,” don’t click or call. Close the browser or power down, then contact the company using a number from your statement or card. (The FTC has plain-English examples of these scams - Scams Against Older Adults.)

- Lock down money movement. Set daily transfer limits and alerts at your bank and brokerage. Require phone verification for wires above a threshold. (Institutional policies vary—ask your institution to enable them.)

- Make it a family plan. Choose a “second set of eyes” who agrees to sanity-check any large transfer, gift card request, or crypto purchase. Share a simple rule: no urgent money moves without a callback on a verified number.

Experts say the most effective fraud defense for older adults is a simple pause, verify independently before moving a dollar. Something all of us should be aware of, not just older people.

Identity Theft Protection

Identity theft is a serious threat that can appear even with the top precautions. So, what is identity theft protection?

Identity protection is a service that detects potential misuse of your identity. It gives alerts about suspicious activity. Also, it can help you recover personal information.

These services can scan credit activity and social security numbers to catch issues before they cause financial damage.

Red Flags That Mean “Stop and Verify”

- Urgent demands to move money “to protect it.”

- Requests to keep it secret from bank staff or family.

- Payment in gift cards, crypto, or wire only.

- Remote-access demands to “fix” your device.

- Threats from supposed government agencies like SSA, IRS, the court, or police.

If You Think You’ve Been Targeted (Or Hit)

Move fast; you can often limit the damage.

- Your bank/brokerage: Ask for a fraud hold and wire recall.

- Credit bureaus: Freeze your credit and add a fraud alert.

- Report it: File at ReportFraud.ftc.gov and IC3.gov (Elder Fraud). These reports help recover funds and stop serial offenders.

- Device check: Revoke any remote-access apps you didn’t install; run updates and reputable anti-malware.

- SSA/benefits impersonation: Ignore the message and check SSA’s scam guidance; contact SSA using a trusted phone number if you’re unsure.

Why This Matters

Fraud drains retirement assets you may need for your current or future retirement. A six-figure loss can change where—and how—you enjoy your retirement or even how you receive extended care later.

Build digital-security habits into your retirement plan and educate the person who holds your power of attorney.

Losing money or possessions to scams, fraud, and exploitation can be especially devastating to older adults, who may not be able to earn back what they’ve lost. — Consumer Financial Protection Bureau.

Millions of older Americans, especially those who are retired, have done well to save and those assets have been amassed after years of hard work. You or a loved one can be a target of these financial scams. Fraud wreaks havoc on your financial security and undo years of saving and planning.

Be sure to plan now and ensure your older loved ones understand how to protect themselves.