Prescription Data Reports Can Adversely Impact Long-Term Care Insurance Underwriting Decisions

Table of Contents

- What IntelliScript is and How Insurers Use It

- Why Adults Over 60 are Most Affected

- FCRA is One of Your Strongest Protections

- How These Errors Show Up in Real Life

- Your Rights Under the FCRA

- How to Check and Correct Your IntelliScript Report

- Why This Matters for Retirement and Long-Term Care Planning

- Where Long-Term Care Insurance Fits

- The Bottom Line

When you apply for insurance in your 50s, 60s, or 70s, you expect the decision to be based on your current health, medical records, and honest disclosures. Increasingly, insurers rely on something far less personal: a digital profile of your prescription history stored by outside companies.

One of the most widely used systems is Milliman IntelliScript, a prescription history database that insurers use to assess risk. Learning how this report works is now as important as checking a credit report before applying for a mortgage.

The challenge is simple. You may never see this file unless you ask for it. Yet, it can determine whether you qualify for Long-Term Care Insurance, for example, how much you pay, or whether an insurer requests additional medical underwriting.

What IntelliScript is and How Insurers Use It

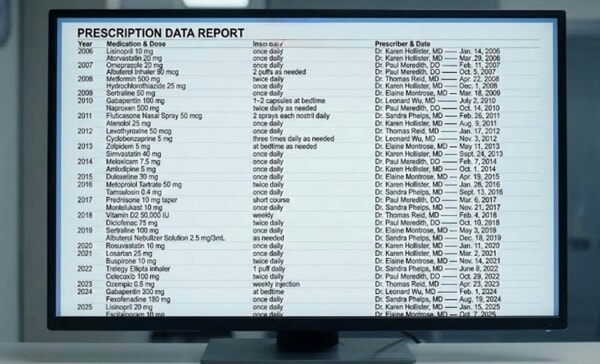

Milliman IntelliScript collects prescription data from pharmacies and pharmacy benefit managers. The report often includes:

- Medication names

- Dosages

- Dates filled

- Refill patterns

- Pharmacy information

IntelliScript data is used by insurers offering:

- Life insurance

- Health insurance

- Disability insurance

- Long-Term Care Insurance

Insurers analyze the information to estimate your risk, assess how chronic conditions are managed, and determine whether additional records are needed.

Regulators, including the Federal Trade Commission (FTC), treat IntelliScript as a consumer report under the Fair Credit Reporting Act (FCRA). That means Milliman is legally required to maintain reasonable accuracy, give you access to your file, and correct errors when you dispute them.

Why Adults Over 60 are Most Affected

Prescription histories become more complicated as you age. According to the Centers for Disease Control and Prevention, about 83 to 84 percent of adults aged 60 to 79 took at least one prescription drug in the past 30 days.

KFF reports:

- 54 percent of adults 65+ take four or more medications

- 32 percent of adults aged 50 to 64 take four or more

Every prescription is a data point. More medications mean more chances for:

- Incorrect matches

- Old prescriptions appearing active

- Misinterpreted drug use

- Mixed-up records with family members who have similar names

For many older adults, these mistakes can create an inaccurate picture of their health, affecting insurance eligibility.

FCRA is One of Your Strongest Protections

Under the FCRA, IntelliScript must provide you with access to your report upon request, meaning you can see exactly what data an insurer relied on, instead of guessing why your application was denied or why your premium increased.

The FCRA requires consumer reporting agencies to use “reasonable procedures” to ensure that the information they collect and distribute is as accurate as possible.

For IntelliScript, this includes:

- Correctly matching prescriptions to the right person

- Avoiding confusion with relatives who have similar names

- Updating discontinued medications

- Ensuring that old prescriptions are not shown as current

If Milliman fails to take these steps, the law considers that a violation of your rights.

If a reporting company fails to fix errors, refuses to investigate, or continues to publish inaccurate data, the FCRA gives you the right to pursue:

- Damages

- Attorney’s fees

- Court-ordered corrections

This legal framework is one reason lawsuits such as Healy v. Milliman and Morris v. Milliman exist. Without the FCRA, consumers would have little recourse.

Healy v. Milliman, Inc. (2020)

A life insurance applicant claimed IntelliScript mixed his records with someone else’s, causing his application to be denied.

Morris et al. v. Milliman, Inc.

In this IntelliScript errors lawsuit, the plaintiffs alleged Milliman:

- Failed to ensure accurate matching

- Distributed inaccurate histories

- Made it difficult to understand data sources

- Did not conduct proper reinvestigations when errors were disputed

Milliman denies the allegations, but the lawsuits highlight one truth: older adults can be judged by a report they never created, cannot see without asking, and often do not know exists.

How These Errors Show Up in Real Life

Many older adults notice something is wrong only after a confusing decision from an insurer:

- A Long-Term Care Insurance policy is declined without a clear medical explanation or something that does not match your current health history.

- An insurance quote is far higher than expected.

- An insurer asks for medical records related to conditions you never had.

- An underwriter mentions “high-risk medications” you have never taken.

Because IntelliScript operates behind the scenes, applicants often never realize the issue lies in a prescription-history file rather than in their actual health.

Your Rights Under the FCRA

Since IntelliScript is a consumer reporting agency, you have the right to:

1. Access Your File

You can request a copy of your IntelliScript report directly from Milliman.

2. Expect Accuracy

Milliman must follow reasonable procedures to ensure “maximum possible accuracy.”

3. Dispute Errors

If something is wrong in your IntelliScript report , you can dispute it. Milliman must reinvestigate the information, usually within 30 days, and correct or delete anything it cannot verify.

Milliman provides online and telephone options for requesting a report or filing a dispute.

How to Check and Correct Your IntelliScript Report

If you have been denied coverage or quoted an unusually high premium, follow these steps:

1. Ask the Insurer if IntelliScript Was Used

Request confirmation in writing if a prescription-history report affected your application, pricing, or underwriting.

2. Request Your IntelliScript Report

Use Milliman’s consumer contact information to obtain your file. You may need to confirm your identity.

3. Check Every Medication

Look for:

- Drugs you never took

- Prescriptions belonging to a spouse or relative

- Medications that ended long ago

- Incorrect dosages or refill dates

4. Compare with Your Own Records

Use:

- Pharmacy printouts

- Medicare Part D summaries

- Medication lists from healthcare providers

5. Dispute Errors in Writing

Document:

- What is inaccurate

- Why it is wrong

- Copies of supporting records

Send your dispute directly to Milliman.

6. Notify the Insurer

Tell the insurer and the agent that you filed a dispute and ask that they reconsider your application once corrections are made.

7. Watch for Identity or Medical Record Errors

If the report contains unfamiliar providers or unrelated conditions, review the FTC’s medical identity theft steps.

Why This Matters for Retirement and Long-Term Care Planning

Long-Term Care Insurance is at the heart of retirement security. A denial for LTC Insurance can alter your entire plan for:

- Protecting income for your lifestyle

- Easing the burden on loved ones

- Funding future long-term care costs

- Preserving assets for your family

Many people assume underwriting decisions reflect only what they wrote on the application. In reality, IntelliScript and similar systems generate an algorithmic profile that may not match your lived medical history. There is more medical history for those over 40, and more of it can lead to more errors.

Correcting errors is now part of routine financial self-defense.

Where Long-Term Care Insurance Fits

LTC Insurance underwriting is especially sensitive to prescription histories. One incorrect medication entry may suggest:

- Cognitive impairment

- Poorly controlled diabetes or other chronic health issues

- High fall risk

- Neurological conditions

- Medication noncompliance

These indicators can lead to declines or higher premiums, even when the information is wrong.

Always use an experienced Long-Term Care Insurance specialist when shopping and applying for an LTC policy. These experienced agents understand underwriting and can help facilitate an underwriting appeal.

Use LTC News tools when planning:

- LTC News Cost of Care Calculator

- LTC News Caregiver Directory (to search for quality caregivers and facilities for older family members)

- LTC News Education Center

The Bottom Line

You are not required to accept an insurance decision based on a report you never saw.

You can:

- Request your IntelliScript file

- Correct inaccuracies

- Challenge underwriting decisions that rely on incorrect prescription histories

These systems are technical. Your rights are not. With the correct information, you can protect your ability to secure coverage that supports your long-term independence and financial security.

- Request your IntelliScript report,

- Correct errors,

- Keep your own medication records organized,

If you discover that these background reports are driving denials or sharply higher premiums, you can seek legal help for insurance background check errors can explain how the FCRA applies and what options may exist if a reporting company or insurer does not correct problems after a dispute.

Most of the time, applying for Long-Term Care Insurance, or other types of life and health policies, goes smoothly, especially when you work with a qualified specialist.

The younger you are when you apply, the less likely you are to have an issue. However, don't allow the possibility of problems getting in the way of obtaining this critical coverage for you and your family.