Celebrity Health Events Remind Us of Our Frailties

About This Article

Celebrities suffer from the same frailties as the rest of us do. But when things happen to those in the public view, it allows us the opportunity to plan in advance. This can give our families peace of mind.

Linda Maxwell

Former journalist who now enjoys writing about topics she is interested in.

When you or a loved one has a health event, you usually don't read about it online or hear the story on the radio or TV. However, when a celebrity does, we all hear about it.

One good thing about knowing is that illnesses, accidents, or even aging inflict the rich and famous. This knowledge shows we are all human. It allows us to think about how we can plan in advance to make these health events easier for our families. Nobody gets to avoid the frailties of life on Earth.

There have been several celebrity deaths in 2022 already, including Betty White (who actually died on the final day of 2021), Sidney Poitier, Peter Bogdanovich, Marilyn Bergman, Bob Saget, and Ronnie Spector.

In 2021 some of the notable deaths included Larry King, Hal Holbrook, Cloris Leachman, Ed Asner, Peter Scolari, Cicely Tyson, Jessica Walter, Olympia Dukakis, Christopher Plummer, and Stephen Sondheim.

In 2020 we remembered stars like Robert Conrad, Claudette Nevins, and James Lipton.

We all face illnesses, accidents, and the consequences of aging.

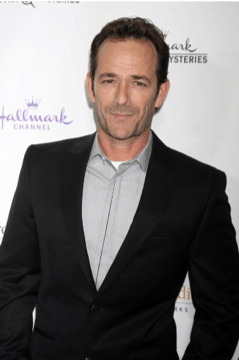

Many Generation Xers were shocked by the 2019 death of Luke Perry. The former star of TV's "90210" died following a massive stroke. He was 52, but it showed that strokes are not limited to those who are older.

Suffering a severe stroke, he was hospitalized under heavy sedation. After five days later, his family removed the life support after it was apparent that he would not recover, following a reported second stroke.

Stroke is a leading cause of long-term care. Every year, about 140,000 Americans die of a stroke, and while the risk increases with age, about one-third happen to those younger than age 65.

Many of us will remember actress Katherine Helmond. She died on February 23, 2019, at her home in Los Angeles at the age of 89.

Like too many people, she had Alzheimer's disease. About 6 million Americans of all ages are living with Alzheimer's dementia. People with cognitive decline require supervision and other help with normal living activities. If you grew up watching TV in the '70s, '80s, and '90s, you were touched by the impact of this news.

Helmond made her big splash on the TV show "Soap" from 1977 to 1981, playing the role of Jessica Tate. She won a Golden Globe and was nominated four times for an Emmy Award for Outstanding Lead Actress in a Comedy Series.

Later she played Mona Robinson in 1984 to 1992 on "Who's the Boss?" where she also won a Golden Globe and was nominated for two Emmy Awards.

Helmond also appeared on "Coach" and "Everyone Loves Raymond." Despite helping all of us laugh, in the end, she fell to the impact of memory loss and long-term care.

Social media remembered.

For those who remember the miracle New York Mets from 1969 or just fans of baseball, you were sad to hear that Tom Seaver has dementia. The Hall of Fame pitcher, regarded by many as the greatest New York Met of all time, is now retired from public life. Social media shared the news.

If you, or your children, watched "Bozo" on cable's superstation WGN throughout the '80s, Marshall Brodien, who played "Wizzo the Wizard," recently passed away after suffering from Alzheimer's.

Cost of Long-Term Care Can Devastate Savings Even for Wealthy

The financial costs of cognitive decline can be substantial, even for those of wealth. Many caregivers are family members who must take time away from their careers, families, and other responsibilities. Paid care is expensive and can drain assets. Unless a person has Long-Term Care Insurance, the burden is placed on your family and your bank account.

Growing up in the '70s, you heard many massive hits from Peter Frampton. Songs like "Show Me the Way" and "I'm in You" dominated the radio. He stopped touring as he suffers from the disease that causes his muscles to weaken and waste.

Frampton, now age 71, was diagnosed with inclusion body myositis (IBM) over five years ago; however, he just went public in the past few years as his disease progressed.

Impact of Long-Term Care is More Than Just About Money

If you are like most people, you know people, probably family members, who suffer from chronic illnesses, accidents, or just the frailty of aging. Your stories may not get media attention, but you can read the stories if you search social media.

These stories express the sadness, burdens, and costs that affect them and their loved ones. Being a caregiver places tremendous responsibility on family members. The challenges are many.

Longevity Brings Higher Risk of Needing Long-Term Care

The U.S. Department of Health and Human Services reports if you reach the age of 65, you have about a 50/50 chance of needing long-term health care services.

How would your retirement be impacted if you had to pay the expensive costs of care services? If your family had to be caregivers, how would their life change? How would it affect their family and career?

Take time to learn about how Long-Term Care Insurance can safeguard your 401(k), IRA, 403(b), SEP, and other savings from these high costs. However, perhaps the most significant benefit these policies offer is the gift of time it gives them.

Planning for Long-Term Care is All About Family

Your adult children will have the time to be family instead of caregivers. Everyone can enjoy peace of mind knowing a plan is in place.

The world might not know you have Long-Term Care Insurance, but your family will know. In the end, your biggest concern is your family. That small premium gives your family a great gift. On the other hand, you will have the tax-free funds to pay for your choice of quality care services, including in-home care.

Research Starts with Finding Current and Future Cost of Care

Start your research before you retire. Find the current and future cost of long-term care services with the LTC NEWS Cost of Care Calculator. You will also find the availability of special partnership plans which provide additional asset protection. Some states also have tax incentives in addition to the federal tax incentives available for some people.

Click here to find your state.

Be sure to get the help of a qualified Long-Term Care Insurance specialist. Most general insurance agents and financial advisors are not prepared to understand all the aspects of these policies. You can find a specialist who can help you design an appropriate and affordable plan. Click here to find a specialist.

None of us are immune to the impact aging has on us. While you might not be a celebrity, you do have a family you love. Long-Term Care Insurance may make you a star in the eyes of your family, perhaps not today but years from now.

Go ahead, tweet about it, and let the world know.