End-of-Life Care Decisions Need to Be Made Sooner Than Later

Generally, most of us prefer not to think of depressing things. That makes sense. Better to think about sunshine, puppy dogs, children, vacations, and a good meal, not anything painful like death, dying, disability, and long-term care.

However, there is tremendous peace-of-mind for both you and your family when you take a few minutes and plan for some of life's more unpleasant things. A medical power of attorney and a living will is essential in giving peace-of-mind to the family, so they understand your wishes.

With advances in medical science, longevity has become a problem. Yes, we live longer, leading to financial concerns, and the impact aging has on our health and well-being. More of us require long-term care services than ever before. The U.S. Department of Health and Human Services suggests that many of us will need some long-term care service before we pass … if we reach the age of 65. While this doesn't mean we will all need long-term care services, many of us will.

Preparing for the financial costs and burdens associated with longevity is essential for yourself, your family, and your legacy.

Longevity Creates Planning Challenges

Health events and accidents that used to kill us no longer do. This longevity means either additional health issues and long-term care, or we just continue to get older. Getting older means a high risk of health issues and long-term care. Ugh!

If you cannot speak for yourself, what family member do you want to be in control of making decisions on your behalf? Will they know what your preferences happen to be?

Health events like a stroke or even early-onset dementia may make you unable to make your own decisions. Carol Bradley Bursack, a veteran family caregiver, author, and columnist, writes in HeathCentral.com that everyone over the age of 18 should have appropriate health care and financial documents in place if they are unable to speak for themselves.

"For those who die young, or are disabled because of an unexpected event such as a car accident or ill-fated dive into an unfamiliar lake, it's too late. Their families may have to fight in the courts and in hospital wards to carry through with the decisions that they believe this young person would have wanted them to make." Carol Bradley Bursack, a veteran family caregiver, author, and columnist, writes in Health Central

Bursack says many people who live to middle age and beyond see the wisdom of advance planning, but many fail to do so. Despite life experience, they put off this planning, including powers of attorney.

She gives the example of a person who is suffering from the early onset of Alzheimer's disease.

Medical Power-of-Attorney

So, are you prepared for the challenges of health and aging? Let's start with a medical power-of-attorney and a living will.

A medical power of attorney, or what is sometimes referred to as a health care power of attorney, is different from a living will.

Heather Frances J.D. writes in LegalZoom.com that a living will provide written directions to your health care providers. These directions will communicate your exact preferences for end-of-life care, including artificial hydration and nutrition.

With a medical power of attorney, it will apply in all cases that you specify in the document, although the most common cause is mental incapacity; a living will only apply when you are in the latter stages of a terminal condition.

In some states, you can combine the functions of a medical power of attorney and a living will into one document called an advance medical directive.

Living Will

The purpose of a Living Will is to communicate your wishes for care in the case of a terminal condition.

In its most common form, the living will provide that if:

- you are terminally ill,

- with no hope of recovery, and

- death is imminent.

It will direct medical professionals to remove death delaying medical procedures (e.g., artificial means of life support). The “Living Will” will apply only if you have a qualified terminal condition as certified by two physicians.

The “Living Will” is recognized in all 50 states and is useful for making your wishes clear when you are terminally ill. However, it is not a broad health care declaration and should generally be used only in conjunction with the Durable Power of Attorney for Health Care and never as a substitute.

You can choose not to have your life prolonged, nor do you want life-sustaining treatment to be provided if the agent you named believes the “burdens of the treatment outweigh the expected benefits.” This consideration would include the relief of suffering, expenses involved, and your quality of life.

You could choose to have your life prolonged unless you are in a coma that your attending physician believes to be irreversible, in accordance with reasonable medical standards at the time of reference. This would allow life-sustaining treatment to be withheld or discontinued.

You could also choose to prolong your life to the greatest extent possible without regard to your condition.

There are many resources available to you in order to set-up these documents.

How About Long-Term Care Expenses?

Are you depressed yet? Perhaps. The fact the subject is depressing is why many people delay making decisions. However, if you are still reading, we are not finished. How will you pay for the very expensive costs of long-term care services? Remember, most long-term care situations are not terminal initially.

In some cases, you could still lead a quality life while receiving help with normal daily living activities or supervision due to cognitive decline.

This extended care is not cheap. Your family will not be the best choice for being caregivers and are often not in a position to easily do so. They will have their own careers, families, and responsibilities to take care of … not just you. Paid care can wipe out even significant savings. Plus, if you have a spouse or partner, the cost of care services can adversely impact that person's income and lifestyle.

Since health insurance, including Medicare and supplements, will not pay for the majority of these costs, you need to plan well ahead of the time you will need care. Otherwise, you will pay for these costs yourself, or your family will become caregiver … or both.

For many, an affordable Long-Term Care Insurance policy is the best solution. Many experts suggest putting a plan in place in your 40s or 50s. However, if you have good health, you can still find affordable plans. A Long-Term Care Insurance specialist can help find you appropriate coverage.

Many of these Long-Term Care Insurance policies offer “case management.” Case management is a service where a nurse or licensed social worker will help you and your family develop an appropriate plan-of-care that fits your needs and preferences and help you find quality caregivers and facilities. The case management allows time for your family to be family reducing the burden that is otherwise placed on your family.

Many of these Long-Term Care Insurance policies offer “case management.” Case management is a service where a nurse or licensed social worker will help you and your family develop an appropriate plan-of-care that fits your needs and preferences and help you find quality caregivers and facilities. The case management allows time for your family to be family reducing the burden that is otherwise placed on your family.

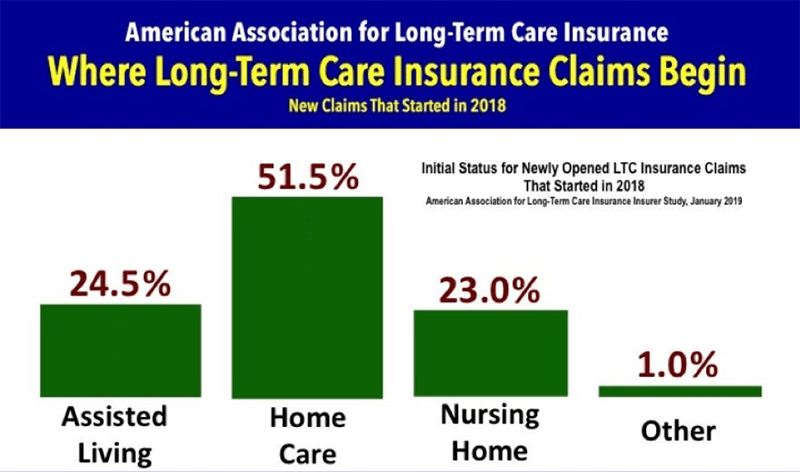

Long-Term Care Insurance usually pays for all types and levels of care, including care at home, adult day care centers, assisted living facilities, memory care facilities, and nursing homes. Most Long-Term Care Insurance claims start at home.

LTC Insurance Allows You to Stay at Home

A study completed by the American Association for Long-Term Care Insurance (AALTCI), a national consumer advocacy and education group, says the vast majority of Long-Term Care insurance claims begin and end where they first start. Most of the time that is at home.

"Just over half of all new claims began with care in the policyholder's home, and that's where 43 percent of claims ended."

Jesse Slome, director of AALTCI

In 2019, the AALTCI reported that the major insurance companies paid American families $11 Billion in benefits from Long-Term Care Insurance policies. This money is helping American families address the financial costs and burdens that come from aging.

He says this is essential data for consumers to know as they consider Long-Term Care Insurance protection.

What action can you take? For powers-of-attorney, there are several resources, including your lawyer, doctor's office or clinic, hospital, and online resources as well. For planning for long-term care services, most experts suggest you start planning before you retire, usually in your 40s or 50s, when you still enjoy good health.