2025 Milliman Long-Term Care Index Shows the True Cost of Aging

Table of Contents

- What the Milliman Long-Term Care Index Measures

- Why Women Face Higher Long-Term Care Costs

- Duration of Care Drives the Real Financial Risk

- Where You Live Matters More Than You Think

- Investment Returns and Timing Change the Equation

- What the Index Means for Your Long-Term Care Plan

- Planning Before a Crisis Protects More Than Money

You probably spend time planning for retirement income, investments, and taxes. But long-term care planning is often left out until a family crisis hits. When a health crisis forces decisions under pressure, the consequences can be life-changing for families and finances.

New data from Milliman puts real numbers around that risk and helps you understand what future care could actually cost. Milliman is not a think tank or advocacy group. It is one of the world’s largest independent actuarial and consulting firms, with decades of experience analyzing health care costs, insurance risk, longevity trends, and long-term care utilization. Its work is widely used by insurers, governments, and financial institutions to price risk and project future obligations.

When Milliman publishes a long-term care benchmark, it is based on real claims data, population modeling, and actuarial assumptions drawn from the insurance and health care systems themselves. That makes the Milliman Long-Term Care Index a credible planning tool—not a guess or a sales pitch, but a data-driven snapshot of the financial risk aging adults face if they need long-term care.

The 2025 Milliman Long-Term Care Index estimates the lifetime cost of paid long-term care services for a 65-year-old today. It offers a practical benchmark you can use to evaluate your own risk, your savings strategy, and whether you have a realistic plan in place.

What the Milliman Long-Term Care Index Measures

Long-term care includes help with everyday activities such as bathing, dressing, eating, and supervision for cognitive impairment. Medicare and health insurance do not cover ongoing long-term care. Medicaid only helps after you meet strict income and asset limits.

Milliman created its Long-Term Care Index to answer a basic but critical question:

How much should a 65-year-old reasonably expect to spend on paid long-term care over a lifetime?

Using commercial market rates, insurance claims data, and actuarial modeling, the index estimates the expected lifetime cost of paid long-term care services.

Long-term care is one of the few major retirement risks that lacks a built-in safety net. Unlike housing, food, or medical expenses, long-term care costs are unpredictable, potentially long-lasting, and largely unfunded by Medicare or health insurance outside short-term skilled care.

The index gives you a realistic baseline for a risk that can quietly erode savings, force family members into caregiving roles, or limit access to quality care. By providing a credible dollar range for lifetime care needs, the index helps families design a long-term care plan before a crisis rather than react after options are already limited.

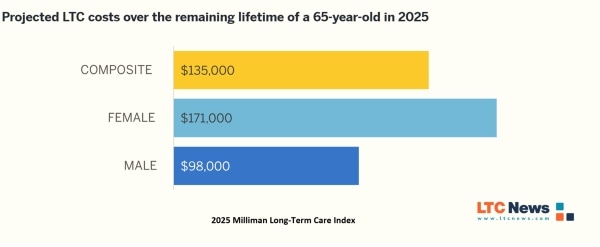

The 2025 Benchmark: $135,000 in Lifetime Costs

According to Milliman, the 2025 Long-Term Care Index is $135,000. That figure represents the average lifetime cost of paid long-term care for a 65-year-old, stated in today’s dollars and assuming a 4.35 percent investment return.

This is not a worst-case scenario. It is a midpoint estimate across millions of possible outcomes. Some people will need little or no care. Others will face costs far beyond this benchmark.

The index exists to help you plan for risk, not to predict a single outcome. The $135,000 figure is an average, not a ceiling. Long-term care costs vary widely based on how long care is needed, the type of care required, and where that care is delivered.

Search for the current and projected cost of long-term care services where you live with the LTC News Cost of Long-Term Care Services Calculator.

Some people will never require paid care at all, or families will try to be caregivers. Others may need only short-term help after an illness or injury. But for those who need care for several years, especially due to dementia, mobility loss, or chronic illness, the cost of long-term care services can climb into the hundreds of thousands of dollars or more in today's dollars.

Longevity plays a major role in this risk. As people live longer, the likelihood of experiencing a period of disability or cognitive decline increases. Advances in medical science are helping people survive conditions that once shortened life, but those same advances often extend the years lived with chronic health issues that require ongoing care.

Longer life spans and rising extended care costs mean the financial risk reflected in today’s index is likely to grow in the decades ahead, making early planning more important than ever. Of course, the financial impact of long-term care is only one part of the story, as the burden on loved ones can change their lives.

Why Women Face Higher Long-Term Care Costs

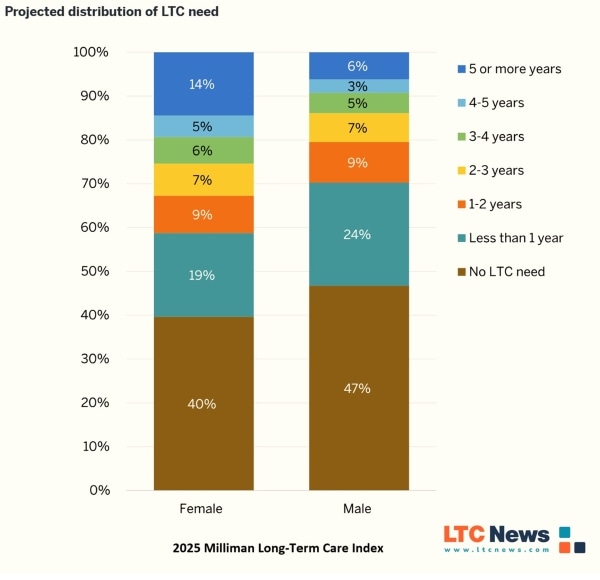

One of the most consequential findings in the 2025 Milliman Long-Term Care Index is the gender gap. According to Milliman, women face lifetime long-term care costs that are about 75 percent higher than men. This difference is not driven by a single factor but by a combination of longevity, health patterns, and caregiving dynamics that compound over time.

Several realities contribute to higher long-term care risk for women:

- Longer life expectancy: Women live longer on average, increasing the likelihood that they will experience a period of disability, frailty, or cognitive decline that requires care.

- Greater likelihood of needing paid care: Women are more likely than men to require formal, paid long-term care at some point, rather than relying solely on informal family support.

- Longer durations of care: When women do need care, they are more likely to need it for extended periods, including five years or more, particularly in cases involving dementia or chronic conditions.

There is also a social dimension to this risk. Women are more likely to outlive spouses or partners, reducing the availability of informal caregiving at home. At the same time, women often earn less over their lifetimes and are more likely to step out of the workforce to care for family members, leaving them with fewer financial resources to cover long-term care costs later in life.

For many families, this means the financial and emotional impact of long-term care falls disproportionately on women—both as care recipients and as unpaid caregivers. Understanding this imbalance is critical for realistic planning, especially for single women, widows, and families relying on one income in retirement.

Duration of Care Drives the Real Financial Risk

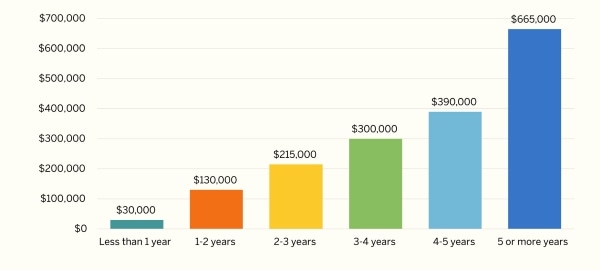

Not everyone who needs long-term care will face overwhelming costs. The length of time care is required matters more than any other factor. Short-term care following surgery, an illness, or an injury may be manageable for many families. Extended care, however, can quickly overwhelm even well-prepared retirement plans.

Milliman’s data highlights just how wide this gap can be:

- About half of the people who need long-term care require it for less than one year

- Short-duration care often totals around $30,000

- People who need care for five years or longer face average costs exceeding $665,000

This wide range explains why long-term care planning cannot rely on averages alone. A single fall, stroke, or dementia diagnosis can turn a temporary need into a long-term financial commitment.

Planning for duration, not just the possibility of care, is what separates manageable risk from financial crisis.

An individual’s plan of care also plays an important role in overall costs. Experts tell LTC News that some individuals may need only limited in-home care, such as four or five hours a day, a few days a week. How long care remains at that level before expanding to daily or more intensive support can significantly affect the total cost over time.

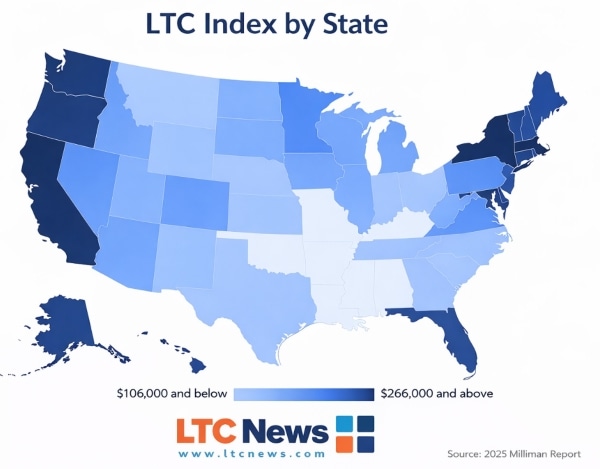

Where You Live Matters More Than You Think

Long-term care costs vary widely by state, and Milliman’s index reflects that reality.

The higher-cost states tend to share common traits:

- Higher wages for caregivers

- Longer life expectancy

- Higher likelihood of extended care needs

States such as Alaska and Connecticut sit at the high end of lifetime cost projections. States like Texas and Mississippi fall lower, though costs continue to rise everywhere.

To understand what care actually costs where you live, tools such as the LTC News Cost of Care Calculator provide current, location-specific data that the national index cannot capture.

Investment Returns and Timing Change the Equation

The index also highlights how timing and assumptions affect planning outcomes.

Milliman shows that:

- Assuming a higher investment return can significantly reduce the amount you need to set aside today

- Starting earlier allows compounding to shoulder more of the burden

- Waiting until retirement concentrates risk at the worst possible time

For many households, relying solely on investments to self-fund care means risking forced asset sales during market downturns or health crises.

What the Index Means for Your Long-Term Care Plan

The Milliman Long-Term Care Index delivers a clear message: long-term care is not a remote possibility. It is a measurable financial risk.

If you are planning for retirement, this data should prompt important questions:

- How would a multi-year care need affect your income and assets?

- Would your family be forced into caregiving roles by default?

- Do you have a plan that protects choice, independence, and dignity?

Many people use this benchmark alongside Long-Term Care Insurance, personal savings, or a combination of strategies to avoid crisis-driven decisions.

Long-Term Care Insurance provides guaranteed, tax-free benefits that can be used to pay for in-home care, assisted living, memory care, or nursing home services when extended care is needed.

Those benefits are designed to replace income that would otherwise be spent on care, helping protect lifestyle and retirement savings, preserve cash flow, and reduce the risk of selling investments or assets at the wrong time.

Beyond paying for care, Long-Term Care Insurance often supports care coordination, caregiver support, and flexibility in choosing where and how care is delivered. For many families, it is not about predicting whether care will be needed, but about creating certainty in an uncertain situation.

When paired with benchmarks like the Milliman Long-Term Care Index, insurance helps turn a theoretical risk into a manageable, planned-for expense rather than a financial shock.

Planning Before a Crisis Protects More Than Money

Long-term care planning is not just about dollars. It is about control, family impact, and access to quality care when it matters most.

The 2025 Milliman Long-Term Care Index provides a credible starting point. The next step is translating that data into a plan that fits your life, your health, and your family.

Use the following resources on LTC News to help you in our long-term care planning journey: