Family Caregiving Soars — 63 Million Americans Now Providing Unpaid Care

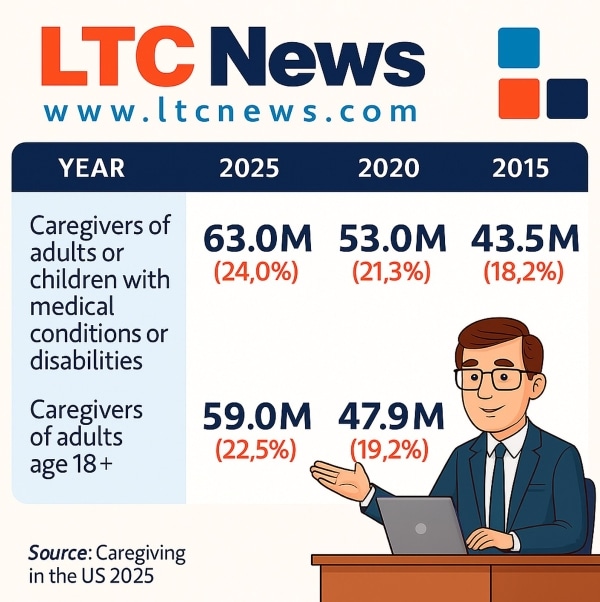

If you’re caring for an aging parent, a spouse with a chronic illness, or even a disabled adult child, you’re not alone. According to the 2025 Caregiving in the U.S. report from AARP and the National Alliance for Caregiving (NAC), 63 million Americans are providing unpaid care to an adult or child with health or functional needs. That’s 1 in 4 adults—and a 45% increase since 2015.

This new data confirms what many of us already feel: caregiving is no longer just a personal responsibility—it’s a national crisis.

“We’ve crossed a threshold,” said Jason Resendez, president and CEO of NAC.

Family caregivers are doing more for longer, often with little training and almost no support.

Caregiving is Getting Harder—and More Complex

Today’s caregivers are not just preparing meals or helping with transportation. Many are performing complex medical tasks once reserved for nurses.

- 84% help with three or more IADLs, instrumental activities of daily living, such as managing finances, transportation, and household chores.

- Nearly 50% assist with ADLs, activities of daily living, including bathing, dressing, and eating.

- 40% perform “high-intensity” medical tasks, such as wound care, administering injections, or operating medical devices.

Most receive no formal training. Only 11% say they’ve been trained to handle these responsibilities.

You may be doing this kind of care right now—without realizing just how much you’ve taken on.

Burnout Is the New Normal

Caregivers are stretched thin—and paying the price emotionally, physically, and financially.

- 61% work full- or part-time while caregiving

- 53% report mental health challenges, including anxiety, depression, and exhaustion

- 1 in 3 say caregiving has caused them to feel isolated or overwhelmed

Women, people of color, and members of the “sandwich generation”—those caring for both children and aging parents—are especially at risk.

Most Caregivers Are Unpaid—and Unprotected

According to the AARP/NAC report:

- Only 18% of caregivers receive any financial compensation.

- Most unpaid caregivers don’t qualify for job protections or paid leave.

- Fewer than half know where to turn for help or guidance.

Often, the caregiver is simply the one who happens to be closest—typically a daughter or spouse—regardless of time, training, or readiness.

What Medicare and Medicaid Really Cover

One of the most common mistakes families make is assuming Medicare will cover long-term care. It doesn’t.

- Medicare pays only for short-term skilled care, typically after a hospital stay—and usually no more than 100 days.

- It does not cover custodial care, like help with dressing, bathing, or supervision for dementia.

- Medicaid does cover long-term care—but only for people with limited income and assets.

This gap in coverage forces millions of families to become unpaid caregivers or pay out of pocket—unless they qualify for Medicaid or have Long-Term Care Insurance.

Why Long-Term Care Insurance Belongs in Every Retirement Plan

If you’re planning for retirement, Long-Term Care Insurance should be part of your strategy. This isn’t just about protecting your nest egg. It’s about preserving your independence—and your relationships.

With a properly designed policy, you get:

- Choice of quality care providers, including home care, assisted living, memory care, and nursing homes.

- Quality professional care services reduce the burden on your family, giving them the time to be family instead of caregivers.

- Greater control over how and where you receive extended care

Premiums for Long-Term Care Insurance are based on your age and health at the time of application, so the earlier you plan, the more affordable it will be.

Use the LTC News Cost of Care Calculator to understand the real current and future cost of care where you live, based on zip code.

Finding the Right Caregiver or Facility

Whether you’re planning or need immediate help for a loved one, finding reliable care is critical—especially if your loved one wants to remain at home.

Use the LTC News Caregiver Directory to search the nation’s largest and most comprehensive database of:

- Home care agencies and private caregivers

- Assisted living and memory care facilities

- Nursing homes

- Respite care and short-term support services

You can search by ZIP code and filter by service type. Whether you need daily support or you're a family caregiver looking for a weekend break, the directory connects you with experienced, vetted providers.

You can share your thoughts and experiences about aging, caregiving, health, and long-term care with LTC News —Contact LTC News.

If a Loved One Has a Policy—Ask Now, Use it Right Away

Many families forget to check: your loved one might already own a Long-Term Care Insurance policy—and never told you.

If so, you may be able to use it today to cover:

- In-home care

- Adult day care

- Assisted living or memory care

- Nursing homes and rehab

- Hospice and palliative services

Need help filing a claim? LTC News partners with Amada Senior Care to provide free claim support with no cost or obligation. Their trained experts can walk you through the entire process and help you access benefits quickly and correctly — File a Long-Term Care Insurance Claim.

What You Can Do Right Now

Whether you’re a caregiver, planning ahead, or supporting aging parents, here are key steps:

- Talk to your family now about long-term care preferences and policies

- Check for existing LTC Insurance coverage

- Use the LTC News Cost of Care Calculator to understand future care expenses

- Search the Caregiver Directory to find professional support near you

- Explore your own LTC Insurance options to avoid becoming a burden on loved ones.

Most people acquire Long-Term Care Insurance between the ages of 47 and 67, but work with a qualified LTC Insurance specialist, no matter your age, and they will help find the best coverage and the lowest cost based on your age, health, and other factors.

Final Thoughts: A Crisis in Motion, a Call to Prepare

The 2025 Caregiving in the U.S. report makes one thing clear: we are living in the age of the family caregiver.

Caregivers are doing critical work—without pay, training, or recognition. As long-term care costs continue to rise and public programs fall short, families must take steps now to protect themselves and their loved ones.

Don’t wait for a crisis. Build a plan. Look into your options. And remember—you’re not alone.