State Filial Responsibility Laws Getting Kid’s Attention

Filial responsibility laws have been around for a while. But now that Americans are living longer than ever and more require long-term care services, could they become another problem impacting families in the future?

Filial responsibility laws have been around for a while. But now that American's are living longer than ever and more require long-term health care services and supports, these laws are getting a fresh look by cash-strapped states.

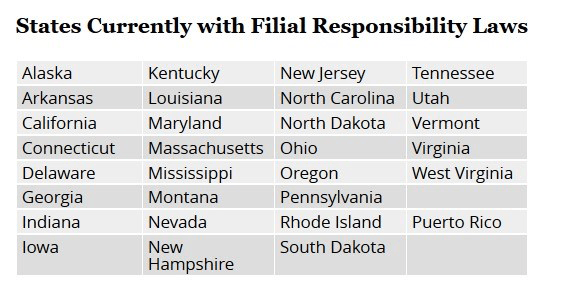

These filial responsibility laws impose a duty upon third parties, usually adult children, for the support of their impoverished parents or other relatives. Currently, 29 states and Puerto Rico have these laws in place.

Generally, family members usually are not responsible for a dead relative's debts, including long-term health care costs, unless they have co-signed a loan that is still unpaid. Assets given to a family member during the five-year lookback period for Medicaid qualification would still be considered the care recipient's asset and could be recovered by the state.

But could filial responsibility make adult children responsible for their parents' long-term health care costs? Perhaps.

This filial responsibility is going even further as a North Dakota nursing home recently sued the adult children for more than $43,000 in unpaid bills relating to their father's seven-month stay in the facility. They are not alone. Some facilities are seeking legal action to recover unpaid costs citing North Dakota's "filial support" law. The statute was adopted in 1877, a decade before North Dakota became a state. Filial statutes are modeled after England's Elizabethan Poor Laws of 1601.

Read the story here: Little-known law forces adult children to pay for nursing home care for parents

Will Your Kids Be Legally Responsible for Your Future Long-Term Care Costs?

Do you want your children decades from now held legally responsible for your future long-term health care costs if you no longer have sufficient financial resources to pay for it yourself? Until recently, these statutes have been largely ignored.

In addition to the actions in North Dakota, several recent court decisions around the country indicate that there might be renewed interest in enforcing them. Since most state budgets are under a severe financial strain, a lack of a long-term care plan might be placed on your loved ones.

If the legal action taken by these facilities in North Dakota becomes successful, you will see other nursing homes, assisted living facilities, and even home health agencies do the same thing.

Increasing Number of People Need Long-Term Health Care

Many of us will need help with activities of daily living or supervision due to memory issues like Alzheimer's. Unless you have an advance plan in place, your savings will pay the costs, for your adult children can become caregivers, something they are untrained and unprepared to provide.

If you have little or no assets, Medicaid will pay. Health insurance and Medicare, including Medicare supplements, will only pay for 100 days of skilled services. Otherwise, you will be responsible for these costs unless you own Long-Term Care Insurance. If you exhaust assets and don't pay all the bills, your adult children may end up being responsible. Certainly, your legacy will be adversely impacted by the expensive costs of long-term care services.

Most people obtain Long-Term Care Insurance in their 50s. Most states offer Partnership Long-Term Care Insurance plans that offer additional dollar-for-dollar asset protection, something many financial advisors are unaware of and don't talk about with their clients.

Keep in mind that the problem of declining health and aging is more than just a financial problem. Yes, be concerned about the cash flow issue that long-term health care costs create. But long-term care is also a family problem creating stress, anxiety, and burden for everyone.

There is an easy and affordable solution. Before you retire, add a Long-Term Care policy to your pre-retirement plan. Now you will have the resources to pay for your choice of quality care while protecting your savings. You won't have to ask your children to be caregivers (that won't work), and someone won't be seeking legal action against them to recover costs of care you were not able to pay.

Even if you live in a state that does not have filial responsibility laws, you probably still want to avoid sending hundreds of thousands of dollars on long-term care. You probably understand that caregiving is hard on family members as well.

LTC NEWS Cost of Care Calculator Great Tool

Planning in advance will give you and your family extra peace of mind. Start your research by finding the cost of long-term care in your state and the availability of tax incentives and state partnership programs - Cost of Care Calculator - Choose Your State | LTC News.

Be sure to plan before retirement so you can take advantage of low premiums and even preferred health discounts. Long-Term Care Insurance might be your answer to keep your kids out of the courtroom after you're gone.

About the Author

An LTC News author focusing on long-term care and aging.

James Kelly

Contributor since August 21st, 2017

Editor's Note

Aging happens whether the virus remains or goes away. As we get older, we experience a decline in our health, body, and mind, leading many people to need help with daily living activities or supervision due to memory loss.

Being prepared for these changes that happen due to an illness, accident, or the impact of aging is a vital part of retirement planning. Health insurance and Medicare (including supplements) will not pay for most of these costs.

Family caregivers find it hard to juggle their careers and family responsibilities with that of a caregiver for an older parent. The burden is something most people have said in surveys that they don't want to place on their family.

The solution is affordable Long-Term Care Insurance. LTC Insurance provides guaranteed tax-free benefits to access your choice of quality care options, including care at home. You will be able to protect income and assets and reduce the stress and anxiety otherwise placed on loved ones.

Planning Tools and Resources on LTC NEWS

You can find many tools and resources on LTC NEWS to assist you in your research for a planning solution or help your family find the appropriate care for a loved one at the time of crisis.

To help you plan the costs and burdens of changing health and aging, LTC NEWS has put in place several resources, including:

- The LTC NEWS Cost of Care Calculator will show you the current and future cost of long-term health care services where you live. Plus, each state has vital state-specific information you should know - Cost of Care Calculator - Choose Your State | LTC News

- The Ultimate Long-Term Care Guide is an outstanding read to help you get a good overview of the topic area.

- Compare the major insurance companies that offer Long-Term Care Insurance products here - Top Insurers for Long-Term Care Insurance | LTC News.

- A detailed tax guide that includes available tax incentives can be found by reviewing the Long-Term Care Tax Benefits Guide.

Find all the resources on LTC NEWS - Resources for Long-Term Care Planning | LTC News.

Seek Professional Guidance

Insurance rates are regulated, so no insurance agent, agency, or financial advisor can give you special deals. However, premiums vary over 100% between insurance companies for the same coverage.

Experts suggest using a qualified Long-Term Care Insurance specialist to help you navigate the many options available to you and your family.

A specialist who works with the top companies can match your age, health, family history, and other factors and find you the best coverage at the best value. A specialist will save you money, and you will have peace of mind knowing they are making the appropriate recommendations - Work With a Specialist | LTC News.

Get Expert Help Filing an LTC Insurance Claim

LTC NEWS provides free assistance with no obligation to help you or a loved one complete the claims process with your Long-Term Care Insurance policy.

You can also get support in finding quality caregivers and get recommendations for a proper care plan, whether a person has a policy or not. - Filing a Long-Term Care Insurance Claim | LTC News.

Benefits of Reverse Mortgages

Today's reverse mortgages for those aged 62 and older could be an ideal resource to fund a Long-Term Care Insurance policy OR even provide money to pay for care if you, or a loved one, already needs help and assistance.

Some people have much of their savings invested in their homes. With today's reverse mortgages, you can find ways to fund care solutions, care itself, even help with cash flow during your retirement.

Learn more by asking questions to an expert. LTC NEWS columnist and host of the TV Show "62 Who Knew" will answer your questions regarding caregiving, aging, health, retirement planning, long-term care, and reverse mortgages.

- Just "Ask Mike." - Reverse Mortgages | LTC News.

Share Your Knowledge - Be A Guest Contributor for LTC NEWS

LTC NEWS is open to contributors to share their stories with the world.

You can write a story or ongoing column for LTC NEWS. You can write about many topics, including aging, caregiving, health, lifestyle, retirement planning, and long-term care, to name a few.

Be sure to write for our core target audience of adults aged 40 and older. Our audience is worldwide; however, our primary target is the United States, Canada, the United Kingdom, and other English-speaking nations.

Improve your website or blog's SEO and gain exposure and traffic at the same time by being a contributor to LTC NEWS.

You can even promote yourself, your business, and your website or blog. However, it must have editorial content exclusive to LTC NEWS and cannot be just an advertisement. It can include links to other sites, and you can share the article link once published on your website or social media.

Email your story idea or article: newsroom@ltcnews.com - LTC News Contributors | LTC News

Your Marketing and Advertising Partner – LTC NEWS

Use LTC NEWS to drive traffic to your website and help you attract people interested in your products and services. Plus, you can improve your website's SEO so more consumers can find you when they search for your products and services.

There are various marketing options available with LTC NEWS. Traditional advertising, sponsored content articles, strategic alliances, and more are available.

Learn more about how LTC NEWS can help you market your business, drive traffic, and improve SEO - Advertise With Us | LTC News.

Shared Links

LTC NEWS offers a 'helpful links' page so readers looking for additional information can find them easily. You can get a dofollow link to your website on LTC NEWS in exchange for a dofollow link on your site.

Let's work together and help consumers who search for us on the web - Site Request | LTC News.

You can also affordably purchase a dofollow link to your website or blog on LTC NEWS. Just contact the advertising department.