Prescription Drug Use Increases with Age Presenting Potential Problems for Caregivers

The number of medications, potential drug interactions, and managing proper use is just a few of the problems of getting older. Care recipients, caregivers, and families face challenges ensuring proper drug use.

As you stroll through the aisles of your local pharmacy, take a moment to observe the clientele. Notice the number of senior citizens patiently waiting in line and the collection of prescription bottles they carry away. It's no secret that our reliance on medications increases as we age.

A staggering 131 million individuals, or nearly 70% of adults in the United States, rely on prescription drugs to manage their health. This figure is particularly pronounced among older adults and those suffering from chronic conditions.

Research from the Mayo Clinic and Olmsted Medical Center conducted a few years ago revealed that over half of the population takes at least two medications. Furthermore, the Centers for Disease Control and Prevention (CDC) reported that 24% of people used three or more prescription drugs in the past 30 days.

The growing reliance on pharmaceutical interventions underscores the importance of understanding and addressing the unique health challenges our aging population faces. As our society continues to grapple with the complexities of healthcare, the role of medications in maintaining and enhancing quality of life becomes increasingly critical.

Older You Get – The More Meds You Take

CDC data shows that those aged 60 and older take more medications than the rest of the population.

As we get older, we suffer from more chronic health problems. The Georgetown University Health Institute reports that three-quarters of those aged 50 to 64 use prescription drugs. However, prescription drug use increases with age as 91 percent of those age 80 and older with prescriptions. The average number of medications filled increases with age, from 13 for 50 to 64 to 22 for 80 and older.

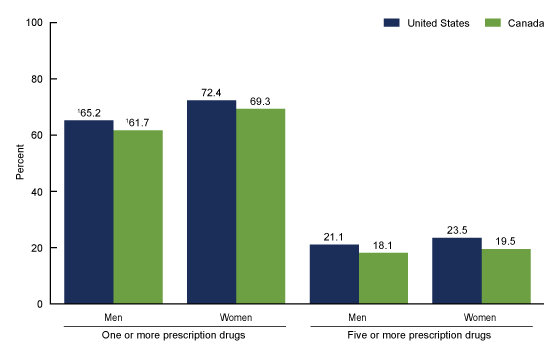

Use of one or more and five or more prescription drugs in the past 30 days among adults aged 40–79: United States, 2015–2016, and Canada, 2016–2017 - SOURCES: NCHS, National Health and Nutrition Examination Survey, 2015–2016, and Statistics Canada, Canadian Health Measures Survey, 2016–2017.

Older adults are the largest users of prescription medications. While seniors want to avoid being dependent on others as they get older, their lack of ability to manage their medications properly is often one of the reasons an individual needs in-home care or care in a long-term care facility.

Women Given More Meds Than Men

As older adults experience declining health, their multiple medications to manage their conditions present a significant challenge for caregivers and family members responsible for their care. Ensuring that seniors receive the appropriate medications at the right times becomes an overwhelming responsibility, particularly when cognitive impairments like dementia come into play. One of the challenges associated with medication management for older adults is the sheer number of prescriptions they often receive. This issue is particularly prevalent among women, who tend to be prescribed more medications than men. Navigating the complexities of multiple medications can be daunting for older adults, their caregivers, and family members. Balancing the dosage, timing, and potential side effects or interactions of various drugs requires careful attention and a coordinated effort to ensure the health and well-being of the individual.

Use of one or more and five or more prescription drugs in the past 30 days among adults aged 40–79, by sex: United States, 2015–2016, and Canada, 2016–2017. SOURCES: NCHS, National Health and Nutrition Examination Survey, 2015–2016, and Statistics Canada, Canadian Health Measures Survey, 2016–2017.

Nonadherence to Medication Management Often Reason for Nursing Home Use

Nonadherence to medication management is frequently a significant factor in nursing home placement. An estimated 3 million older adults are admitted to nursing homes due to drug-related issues.

Moreover, the likelihood of experiencing an adverse reaction to medications increases with age. A significant concern arises from the large number of drugs an older person may be prescribed, particularly when multiple doctors are involved, and prescriptions are filled at different pharmacies. This can lead to an increased risk of adverse drug reactions.

Medical professionals typically screen medication use for individuals aged 65 and older, as some drugs may pose a higher risk of side effects or be less effective for this age group. Depending on the diagnosis, doctors and pharmacists may recommend safer or more effective medications or even non-medication alternatives.

It is also worth noting that older adults often have reduced kidney function, which can affect their response to certain medications. This underscores the importance of careful medication management for this population.

Avoiding Missed or Incorrect Doses

Effective medication management is crucial for seniors to prevent missed or incorrect doses. Medications are designed to treat health conditions and manage symptoms; incorrect usage can negatively impact overall health.

Family caregivers may also lack proper education in medication management. Given the number of medications that individuals take, keeping track of them can be challenging for family members.

Michael Banner, Host of the 62WhoKnew Television Show and columnist for LTC NEWS, said there is no doubt, the older we get, the more prescriptions we are given by our various doctors. When he was a caregiver for his father, he saw this firsthand.

At 81 years old, with multiple serious illnesses that included Congestive Heart Failure and Diabetes, managing his more than 20 medications per day, which included testing his sugar and giving him an injection of insulin, was virtually impossible.

Families Need Professional Help

Banner said without professional help, he could have never made sure his father was given the correct dosages seven days a week at the right times.

Having professional caregivers will help reduce the stress on families and ensure the correct medications are being given to the care recipient. The medicines are expensive, but the proper caregivers are also costly.

Quality care takes money, either from Long-Term Care Insurance or self-funding.

He says one source of funding for those over age 62 is a reverse mortgage. A reverse mortgage can fund the purchase of a Long-Term Care Insurance policy to pay for badly needed in-home care if an individual's health does not allow for purchasing an LTC policy.

Who knew living longer would be so complicated and so expensive.

Aging Happens and We Decline with Age

As we age, our bodies undergo changes, and our health declines. Preparing for these inevitable consequences of aging should be an integral part of retirement planning to prevent the crisis many families currently face with their older loved ones.

Taking on the role of a caregiver is an immense responsibility. Family caregivers are often untrained and ill-prepared for the stress and burden associated with caregiving. The task of a caregiver goes beyond simply providing care; it involves managing various responsibilities to ensure the best possible quality of life for an individual facing challenges due to illness or aging.

Proactively planning for these challenges can alleviate the stress placed on adult children. For those without children, the situation can be even more complex. Most Long-Term Care Insurance policies include case management services that assist families in ensuring appropriate care is provided. Case managers can also serve as advocates in the absence of close family members.

Preparing for Aging Vital for Retirement Planning

Experts say the ideal time to obtain coverage is when you are in your 40s or 50s, as the ability to qualify for a policy is dependent on your health. Premiums are based on several factors, including age, health, and family history, in addition to the total amount of benefits being purchased.

Banner recommends speaking with an expert when shopping for coverage and deciding on options. You can find a qualified specialist here - Work With a Specialist | LTC News.

Meanwhile, be involved with your older family members, understand their health problems, know the doctors they see and get a list of medications they take.

When a doctor prescribes a new medication, make sure it is necessary and ask how the new med interacts with the existing drugs.

About the Author

Linda is a freelance writer interested in retirement planning, health and aging.

Linda Kople

Contributor since October 31st, 2017

Editor's Note

Long-Term Care Insurance is key to safeguarding your savings and ensuring quality care and asset protection. The time to get a policy is before you retire, ideally in your 40s or 50s. There are several types of policies you can select from; one will be appropriate and affordable.

You can choose a single premium hybrid policy that offers both a death benefit and tax-free long-term care benefits. You can also select a traditional plan with partnership benefits that offer additional dollar-for-dollar asset protection.

There are tax incentives available when you own an LTC policy. Learn about the available long-term care solutions and start planning.

Types Of Long-Term Care Insurance Policies & Which Is Best For You

Most people obtain coverage in their 50s when better health qualifies them for even lower premiums.

How Much Does Long-Term Care Insurance Cost?

Seek Help from a Specialist

Be sure to work with a qualified Long-Term Care Insurance specialist when planning for long-term health care. A specialist will help you navigate all the available options. They will help you understand underwriting and provide accurate quotes from all the top companies, along with professional recommendations. Be sure the specialist works with the top companies and will match your age, health, and family history with the most affordable option.

Available Resources on LTC NEWS

LTC NEWS has many tools and resources to help you research aging, caregiving, health, long-term care, and retirement planning. Here are some of those tools:

- The Ultimate Long-Term Care Insurance Guide - If you like details, you will enjoy this comprehensive guide to LTC Insurance.

- Long-Term Care Guides - LTC NEWS has several other guides that can help you plan or find quality care.

- Frequently Asked Questions - Get the answers to the most often asked questions about long-term health care planning and LTC Insurance.

- Filing a Long-Term Care Insurance Claim - Does a loved one - like your Mom or Dad - have a Long-Term Care Insurance policy and need to file a claim to get benefits? LTC NEWS will help. If they don't have a policy, but you need help getting a care plan and finding caregivers, LTC NEWS can also assist.

- Reverse Mortgages - Learn about reverse mortgages and ask questions about how they work and if you or a loved one would benefit from one.

Marketing and Advertising Options on LTC NEWS

Advertise your website, blog, or business on LTC NEWS to reach customers searching for your products and services. You can increase your website's visibility and improve its SEO by taking advantage of our various marketing options, such as traditional advertising, sponsored content, and strategic partnerships. With LTC NEWS, you can ensure potential customers easily find your products and services.

Please learn more about how LTC NEWS can promote your company, increase traffic, and enhance SEO by visiting the Advertise with Us page on LTC NEWS.

Remember, sponsored content advertising options can cover any topic or service.

Contribute Content to LTC NEWS

Improve your visibility and make sure your website, blog, or business is seen by potential customers worldwide by contributing content to LTC NEWS. Our core target audience is adults aged 40 and above, including those from the United States, Canada, the United Kingdom, and other English-speaking nations.

When you write about topics such as aging, caregiving, health, lifestyle, retirement planning, or long-term care, you will gain exposure, traffic, and SEO benefits from your editorial contributions. Be sure that when contributing, you're providing exclusive content that is not just an advertisement; however, you can include links to other sites and share your article link once published on your website or social media.

Sharing News with LTC NEWS

Include LTC NEWS in your press release distribution. If your group, organization, business, political committee, etc., have news to share, send it to LTC NEWS. Email - newsroom@ltcnews.com